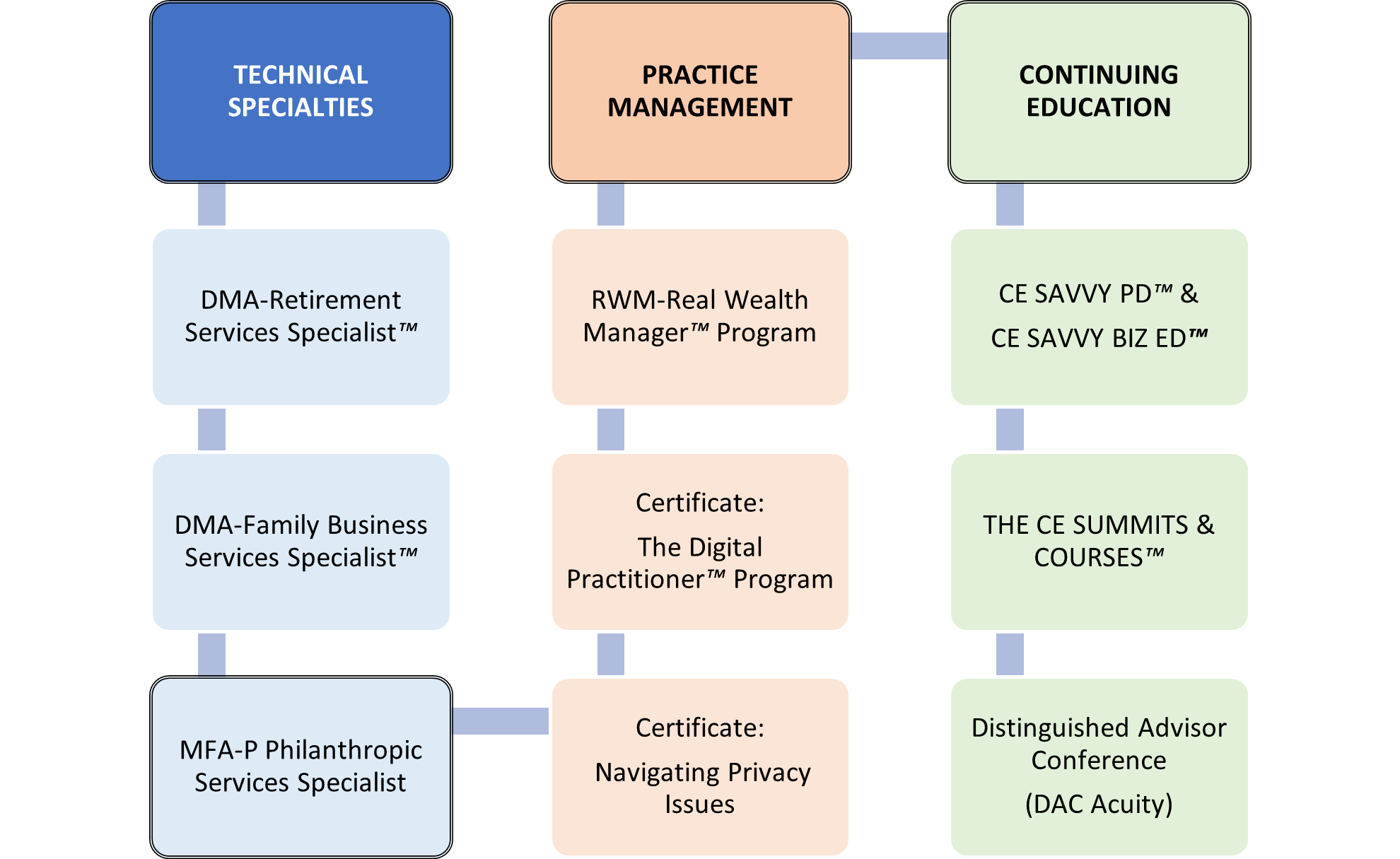

Earn New Credentials: The DMA™, RWM™, MFA-P™ Designations

Or Up Your CE Value Proposition

Is it Time to Differentiate Your Financial Practice?

- Take an academic path leading to Specialized Designations

- Certify new skills in Digital Practice Management

- Enhance your value proposition with Savvy CE/CPD

- Strengthen your client relationships

- Safeguard your practice from attrition

Earn Specialized Credentials

DMATM - Retirement Income Services Specialist

DMATM - Family Business Services Specialist

Improve Practice Management

Certificate: Navigating Privacy Issues

Certificate: Digital Practitioner Program

Take Continuing Education

Distinguished Advisor Conference

Learn more. Earn more. Share more.

Enter your pathway to success with every course you take and move along the continuum from Technician to Practitioner to Specialist.

Technical Specialties: Up to 180 hours of study, 30 course hours at a time

Practice Management Programs: 40 to 60 hours of study

Continuing Education: 5 - 1 hour modules or add live or virtual events

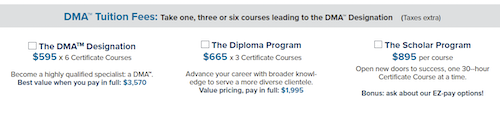

Tuition Fee Structure

Regular Fees: These are the fees for the program, before reductions for Early Registration, Volume Enrolments, VIP Graduate and Designation Status.

Early Registration: Enrol in advance of online session or event start dates and receive Early Bird Tuition Reductions and save on tuition.

Volume Enrolments: Save on tuition by taking multiple courses in a collection or series. Also applies to multiple course selections for team members (2 or more).

VIP Grads and Designates: At Knowledge Bureau we reward our graduates! Receive tuition reductions on your next course. To find your VIP Status login to your Virtual Campus and check your Official Transcript.

Accreditation

Knowledge Bureau confers CE Credits, Certificates, Diplomas and Designations on its graduates and also accredits certain courses with third party accreditors.

Tax Deductibility

Tuition fees paid qualify for a tuition fee credit or can be used as a workplace training deduction. You may also qualify for a Canada Training Credit or government funding.

E-Z Instalment Plan. Ask us about it!

This practice management course is for specialists who wish to offer family wealth management services. This program teaches a framework for the accumulation, growth, transition and preservation of wealth from one generation to the next.

Advisors who truly want to offer a new value proposition and build strong, inter-generational, multi-advisory relationships throughout personal and financial lifecycles, will want to use a new approach: Real Wealth Management.

- 30 KB CE

- 30 CE IDM

- 20 PD IIROC (cycle 9)

The strategic philanthropy program for those who wish to specialize in helping families with investment, retirement and estate planning that includes charitable giving.

This is an emerging investment trend increasingly important to investors of all ages, but few advisors are delivering what HNW clients want: the integration of values-based decisions when discussing tax and financial plans.

- 30 KB CE

- 90 CAGP

- 20 ICM

- 14 IAFE PD and 1 Ethics

- 20 IIROC PD and 3 Compliance with IIROC (cycle 9)

Included in both programs:

- Knowledge Bureau Calculators - Designed to provide you with answers to trigger questions your clients have about tax efficiency and the important financial decisions they need to make.

- EverGreen Explanatory Notes - This will be your go-to reference for answers to your personal and corporate tax questions

This course will introduce you to your obligations towards management of personal information in your possession. This includes identifying what is personal information and sensitive personal information, best practices in relation management of collection, use, storage, retention, and destruction of personal information so as to build credibility and reputation in your business.

- 30 KB CE

- 10 Compliance CE with IIROC (cycle 9)

Any service-based professional will have had to pivot and reconfigure their practice during the pandemic. Now we can bring systems and processes, order, consistency, concepts and tactics to a defined strategy in growing our future practices.

In short, it’s time to throw off the “bandaid ” approach, get some real “stitches” into your new “hybrid” practice and thrive in the digital world.

- 30 KB CE

- 30 ICM CE

Option 1: The Collection Series

Tuition Fee | $ 295 + tax

Complete up to 5 courses in 90 days. Pass them, get your certificates, then add them to your permanent Scholar’s Library.

CE credits for the CE Savvy Collections are follows:

• 10 CE Knowledge Bureau • 5 CE ICM • 5 PD FP Canada • 5 PD IAFE • 5 PD MFDA

Option 2: Entire Collection Series

Annual Tuition Fee | $ 995 + tax

Complete 30 courses in 12 months. Pass them, get your certificates, then add them to your permanent Scholar’s Library

CE Summits Live Virtual Events

Join Knowledge Bureau President, Evelyn Jacks and Special Guest Instructors for live virtual events each featuring a comprehensive online course and after the event, the recorded presentations. Exponentially increase your learning experience and meet fellow learners from coast-to-coast by attending these fun and informative peer-to-peer events, which tens-of-thousands of practitioners have relied on for their CE/CPD since 2003.

Navigate your academic pathway to continuing professional development

IMAGINE!

You can raise the bar of your practice, elevate your client experience and increase your remuneration. Many successful financial advisory firms have incorporated the The DMATM Distinguished Master Advisor program into their team with great results.

Don’t be left behind.

Don’t Just Take Our Word For It…

“What surprised me about the courses was the outcome. My new understanding of the mechanics made it significantly easier for other advisors to implement my advice because I was confident I know how to explain it.”

Ian Wood, MB