Knowledge Bureau’s suite of calculators is your Client Relationship Toolkit. Designed to provide you with answers to trigger questions your clients have about tax efficiency and the important financial decisions they need to make.

The calculators follow the four elements of Real Wealth Management™—Accumulation, Growth, Preservation, and Transition—but can also be used to fill random knowledge gaps. Used in order, they will support consistent client interview processes throughout the year.

Student Experience

“When I first used the Knowledge Bureau Calculators, I was so impressed. They did a much better job than my long form, plus it was very clear cut, the time to calculate incomes and taxes to almost nothing. These calculators are great. I give them an A+!”

—Marc O., ON

Free Trial

You may use any or all of the calculators for a period of 24 hours. After your free trial period has expired, you must purchase a license to continue to use the calculators.

Accumulation

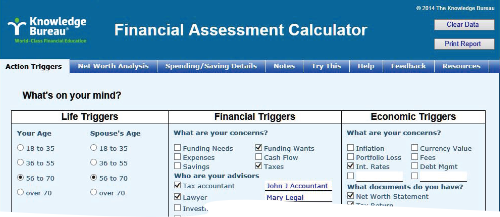

Financial Assessment Calculator

A powerful calculator that links your client’s trigger questions about life, financial, and economic events to the changes required to get the best financial results now and in the future. Begin by analyzing the use of money in four stages—basic spending needs for food, clothing, shelter (non-discretionary spending), emergency savings for now and in retirement (discretionary spending), foundational savings (capital used as a tool to build financial resources) and finally, transition of savings (building of sustainable family legacies). The process then moves from thinking in the present to a future—how to use “redundant income” as a tool to build income-producing capital (often called “don’t see it, don’t need it” money). You can make decisions about spending and saving to meet goals, such as what is personal net worth today and what can be done to increase and sustain it, after tax?

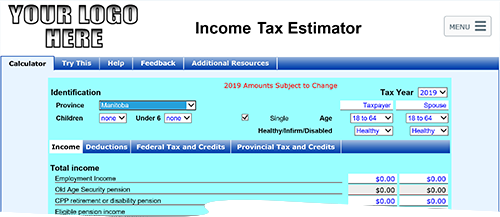

Income Tax Estimator

A straight-forward calculator that helps to determine total taxes paid for individuals and/or couples based on different combinations of income sources. It is also a critical tool for every advisor who wants to show clients the benefits of an RRSP contribution, the effect of dividends on net income, how to pension income split, and how to structure income to avoid a clawback of Old Age Security or other income-tested government benefits like the Child Tax Benefit for families.

With the Toolkit version of this calculator you can include your own logo, name, and disclaimer. It also allows you to save and retrieve scenarios.

Growth

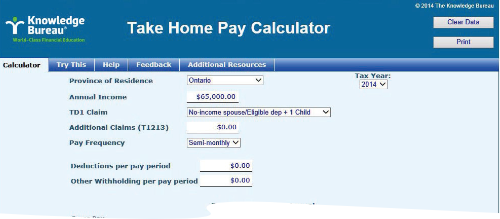

Take Home Pay Calculator

One key issue for employees considering a new job is their take-home pay, especially if the job is in a different province. This calculator provides an estimate of the take-home pay based on salary, exemptions, deductions and province of residence.

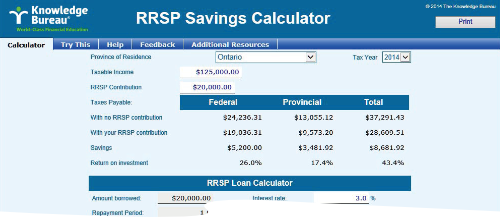

RRSP Savings Calculator

The first section of this calculator gives you a quick answer to how much tax savings are available by making an RRSP contribution. The second section determines the costs of a proposed RRSP loan and compares the loan costs to the earnings within the RRSP during the loan repayment period.

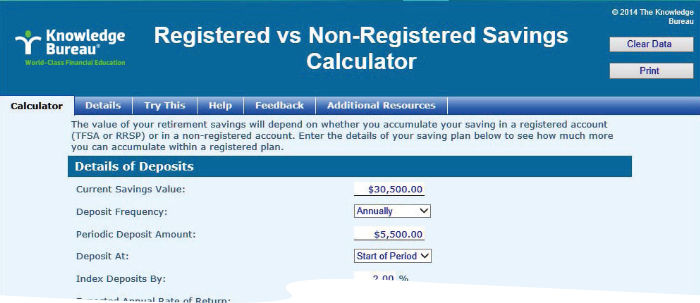

Registered vs non-Registered Calculator

This calculator shows you how making the right choice—registered or non-registered account—makes all the difference in building wealth on time for your client’s retirement schedule.

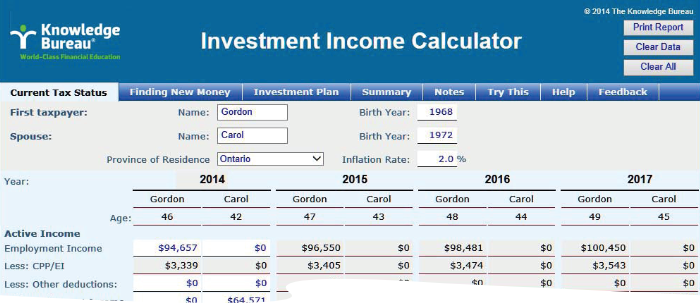

Investment Income Calculator

This calculator helps you project investment income into the future, based on a four-year forecast. Use this calculator to put in detailed figures of all the different types of investment income the client may have in the future, based on their current savings pattern. This planner quickly determines the tax impact on investment income and helps you reconfigure solutions when alternative saving strategies are required. Then match new product selects to the outcomes required.

Preservation

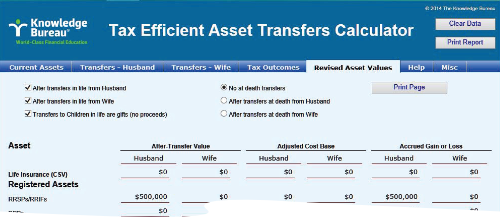

Tax Efficient Asset Transfers

The average retirement is 20 years and this calculator lets you look at the duration, financially speaking, after tax. It helps layer income over a period of years to determine what tax brackets your clients will be in, how income sources affect net and taxable income, and what is left, after tax, if anything.

It also identifies return of capital required over the period to meet needs and wants, or, if there is plenty of money, the redundant amounts that can be reinvested on a safe, tax-efficient basis.

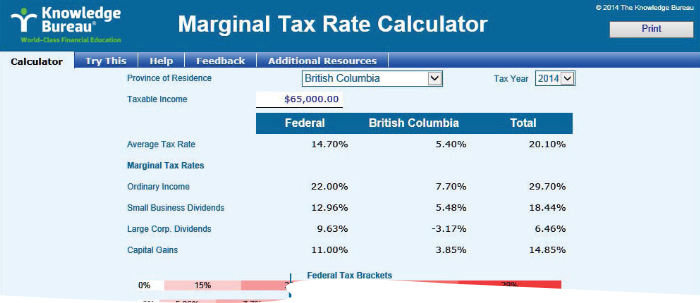

Marginal Tax Rate Calculator

Use this tool to quickly determine the average tax rate, marginal tax rate and tax bracket your client is in today, based on their income levels. This will help to determine your client’s current tax picture so that you can structure future income sources with tax efficiency.

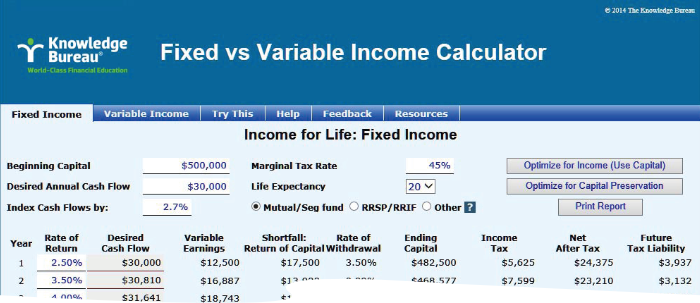

Fixed vs. Variable Income Calculator

Planning for consistent, reliable income is the best way to protect capital in retirement, but this is more difficult when the retirement period coincides with a period of low or negative returns in the marketplace. Retirement income planning seeks to optimize fixed and variable income sources, but when the client relies on sources that fluctuate in value or in producing income, retirement income is unpredictable, causing the client stress.

By zeroing in on the retirement withdrawal equation and how to supplement cash flow gaps without eroding capital away in the process, this calculator will help advisors and clients make decisions about the return of capital options.

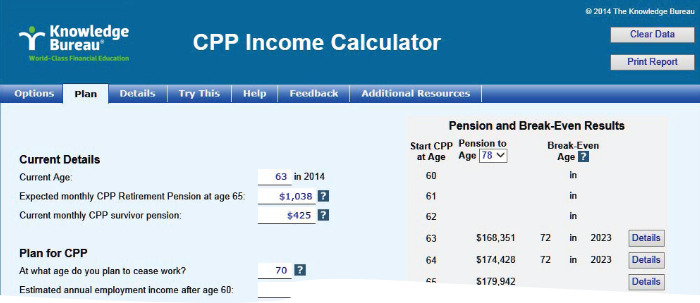

CPP Income Calculator

Should your client draw from the CPP early? This calculator helps you answer that question by determining break-even points along the way while explaining the rule and criteria changes that take place in current and subsequent years.

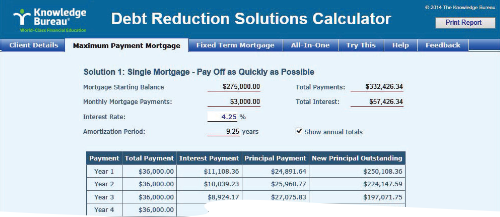

Debt Reduction Calculator

This calculator assists in determining the amount of income available to service debt and then provides opportunities to calculate maximum mortgage payments, fixed-term mortgages, and all-in-one solutions.

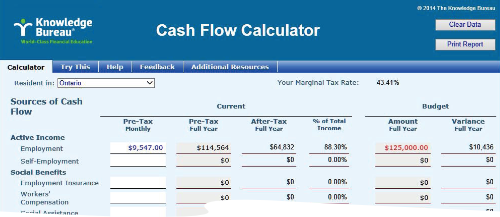

Cash Flow Calculator

Cash flow and income are two different things, but your client may only see it as how much do they have to spend each month. The difference is the real money they get to keep after taxes. Calculate all the income sources—taxable, non- taxable, a return of capital, and windfall—to better understand where the money comes from for different purposes.

Transition

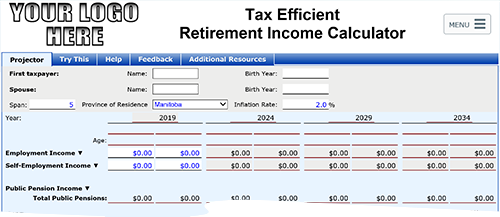

Tax Efficient Retirement Income Calculator

The average retirement is 20 years. Take a look at what that looks like, financially speaking, after tax, for both you and your spouse, retiring at different times. When will income sources start and stop for each of you? This calculator helps layer income over a period of years to determine what tax brackets you and your spouse will be in, how income sources affect net and taxable income and what is left, after tax, if anything. It also identifies return of capital required over the period to meet needs and wants, or, if there is plenty of money, the redundant amounts that can be reinvested on a safe, tax efficient basis.

With the Toolkit version of this calculator you can include your own logo, name, and disclaimer. It also allows you to save and retrieve scenarios.

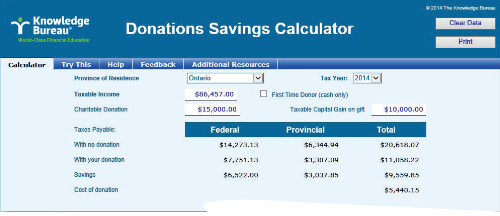

Donation Savings Calculator

Canadians are becoming more philanthropic—giving more every year to causes that are important to them. This calculator helps in determining the tax savings, and therefore the after-tax cost, of charitable donations.

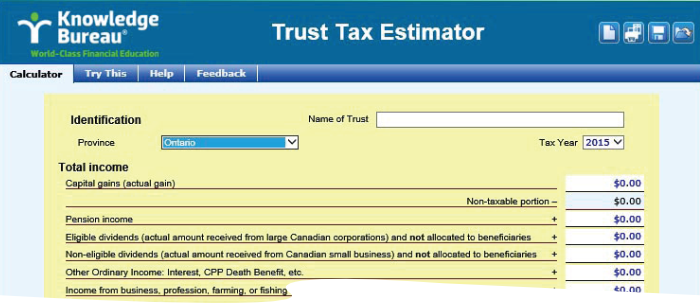

Trust Tax Estimator Calculator

In order to plan for succession using testamentary trusts, you’ll need to know how much tax will be payable by the trust. Use this calculator to estimate the taxes on income earned in trust either as a graduated rate estate or a regular trust.

Calculator License Options & Fee Structure

1-Year Single User Subscription

All 15 Calculators

Cost:

- $795/yearly payments

Single User Subscription

The single user subscription is for a single user (the Subscriber) only. The Knowledge Bureau does not permit the sharing of an account or access through a single user subscription being made available to multiple users within an organization or to other third parties. The Knowledge Bureau reserves the right to cancel the access of any Subscriber who allows the use of his/her account by a third party. If access is required by more than one user, a branch office subscription is required.

For branch office and countrywide corporate subscriptions, call 1-866-953-4768 .