Real Wealth Management

Unique Value Proposition

What Is Real Wealth Management™?

The Real Wealth Management Framework:

Take a multi-stakeholder approach to Real Wealth Management: a long-term, multi-generational strategy, designed to keep all stakeholders on the same page under one holistic and unified plan.

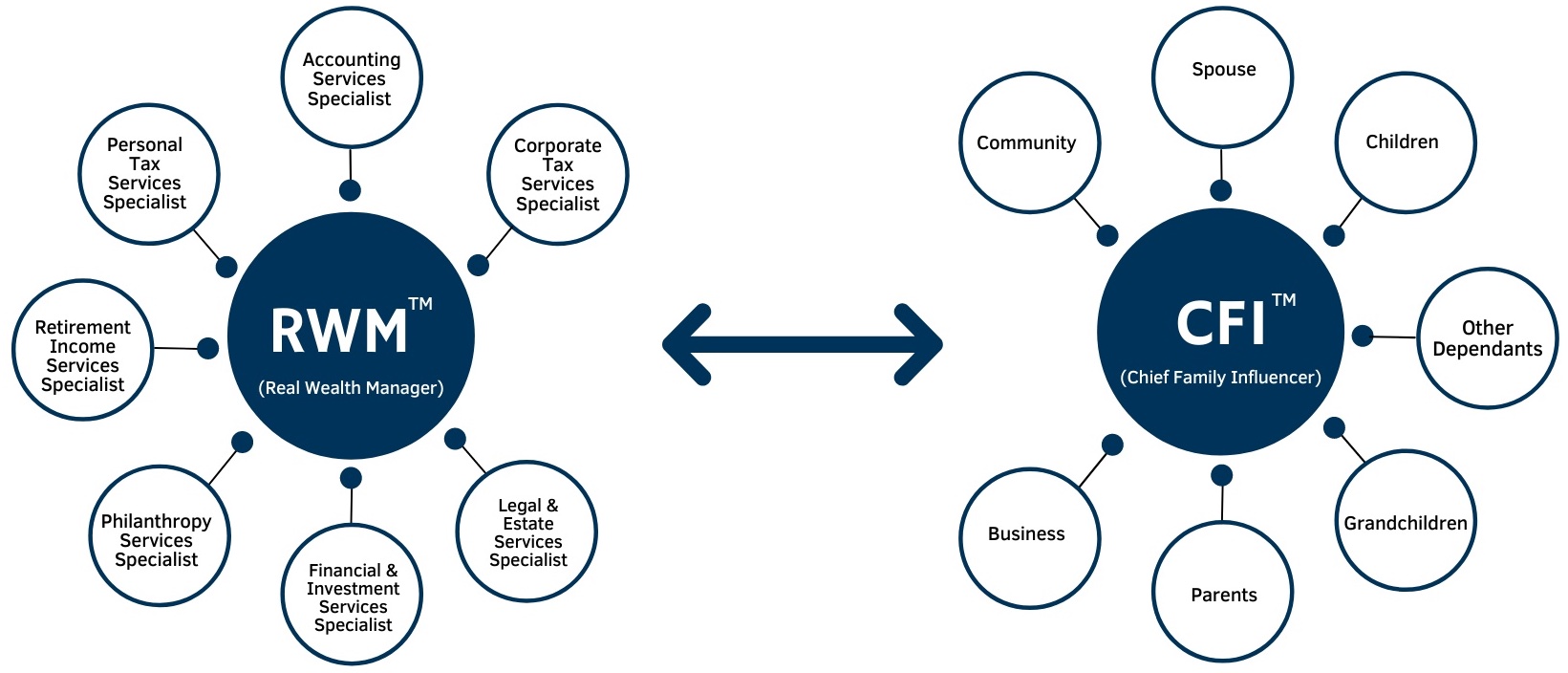

The RWM™- Real Wealth Manager™ - orchestrates the client’s unique plan by leading a team of financial professionals required to accomplish the client’s goals, through direct communication and partnership with the family’s delegated Chief Financial Influencer (CFI). The CFI who acts on behalf of the household unit with the common goal of wealth accumulation, growth, preservation, and transition - with sustainability after taxes, fees and inflation.

Why Should You Add Real Wealth Management™

to Your Practice?

Differentiate your practice with new credentials that introduce an integrated approach to growing your business, while building a natural referral network.

The RWM™ approach enables you to take your conversations further and deeper with your clients, following a compliant framework that goes beyond KYC and KYP to enable financial piece of mind.

It’s time for a change in the financial services industry. This is a new designation in line with the trend as it shifts towards building collaborative financial leadership.

Ready to Bring Real Wealth Management to Your Practice?

Included In

The Real Wealth Management™

Program:

Newly updated 18-module online course

Access to the RWM™ Calculators and Tools

Earn CE/CPD Credits

Receive an exclusive invitation to join the Society of Real Wealth Managers™ (complimentary to undergraduates of the program)

Education for the Next Level of Holistic Professional Wealth Advisory Services

The RWM™ approach focuses on wealth planning throughout all financial stages in delivering the next level of professional holistic wealth advisory:

Accumulation

Growth

Preservation Transition Sustainable Wealth

Connect

Connect with a like minded group of financial leaders through cross-referral and networking opportunities.

Members of the Society of Real Wealth Managers™ commit to an annual membership that qualifies for 15 CE/CPD credits to keep your RWM™ credentials in good standing with Knowledge Bureau. IIROC credits available, too.

Contribute

Contribute to building a collaborative network of Real Wealth Managers™.

Be a keynote speaker at Society of RWM™ Meetings of the Minds.

Participate in the development and discussion of true-to-life RWM™ cases for CE Credit.

Collaborate

Collaborate and engage with other like-minded financial leaders within the financial services industry.

Join us for virtual classroom sessions to introduce you to the RWM™ program.

Members of the Society of RWM™ are listed on the member directory: share your professional value proposition.

Apply Your RWM™ Tools in Practice

Knowledge Bureau’s suite of calculators is your Client Relationship Toolkit. Designed to provide you with answers to trigger questions your clients have about tax efficiency and the important financial decisions they need to make.

The calculators follow the four elements of Real Wealth Management™—Accumulation, Growth, Preservation, and Transition—but can also be used to fill random knowledge gaps. Used in order, they will support consistent client interview processes throughout the year.

Harness the Power of Your RWM™ Referral Network

Benefit from ease of collaboration in practice with trusted like-minded individuals you can partner with professionally to the benefit of your clients, in a timely fashion.

Create New Intergenerational Planning Opportunities

Your new value proposition will create a natural referral to the next generation that will help you grow your practice