Last updated: September 27 2023

Year End Planning: CCA Tax Breaks Phasing Out Soon

Evelyn Jacks

It seems like a long time ago. On November 21, 2018, the federal government introduced an Accelerated Investment Incentive (AII) to enhance first-year Capital Cost Allowance (CCA) claims and allow for businesses to fully expense new asset acquisitions, certain machinery and equipment, including clean energy equipment. Some of these tax incentives will start phasing out after 2023, making this year end an important one for new investments. Here’s an overview. Be sure to book time to have these important discussions with your business owner clients soon.

The Accelerated Investment Incentive (AII). This general provision had two elements for most capital acquisitions:

- Claim one and a half times the prescribed CCA rate to a net addition of a class (note, this incentive can only be claimed in the first year in which the asset is acquired) and

- Do not use the half year rule in the first year of acquisition.This incentive includes CCA claims for Class 13 (leasehold improvements) and the cost of Canadian vessels.

Full Expensing. In addition, three types of properties can be fully expensed if acquired after November 20, 2018: Class 53 (machinery and equipment used for manufacturing and processing) and Class 43.1 and Class 43.2 (specified clean energy equipment). The property must be available for use before 2028 to qualify. Also, when property qualifies for full  expensing, the two general rules above will not apply.

expensing, the two general rules above will not apply.

CCA Methodology – Straight line or declining balance. The incentive applies to property on which CCA is calculated on a declining-balance basis (such as intangible property in Class 14) as well as leasehold improvements, patents, and limited period licences, for which CCA is calculated on a straight line basis. In the latter case, 1.5 times the CCA deduction allowed in the first year is claimed, the usual amounts during the depreciation period, and a reduced amount reflecting the remaining value in the final year. Essentially, the same amount of CCA is claimed over the lifetime of the asset; just more in the first year.

Short Tax Years. When there is a short tax-year, the maximum amount of CCA claimable must be prorated.

Here’s what’s phasing out. For most eligible property that qualified for the AII:

- First-year claims tripled for purchases between November 20, and December 31, 2023. Rather than restricting the claim to 50% of the normal Capital Cost Allowance (CCA) claim under the half-year rules, the deduction claimable will be 150% of the normal CCA claim.

- For purchases 2024 to 2027, the half-year rule will be suspended (full CCA claims will be allowed) and where the half-year rule does not apply, the claim will be 125% of the normal claim.

- For purchase after 2027 the usual CCA rules will apply (the half year rules are back again).

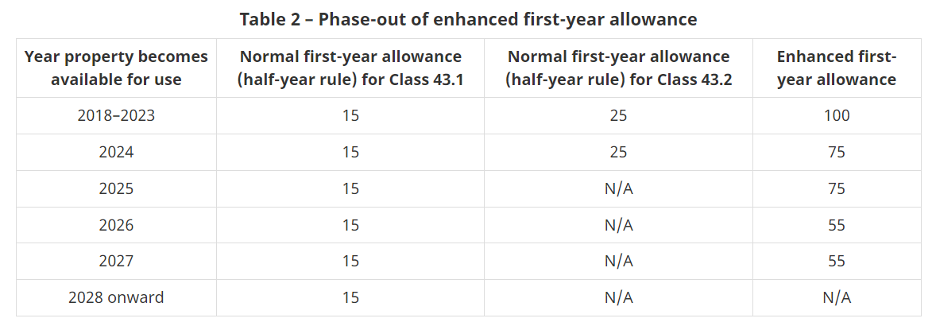

For the fully expensed properties, the rules are different. CRA has developed two charts as a synopsis (see below).

For specified clean energy equipment, accelerated write-offs have been available for some time. Many of these assets would have normally been depreciated at lower rates of 4%, 8% or 20%. But if acquired after February 21, 1994, they were recorded into Class 43.1 which featured an accelerated CCA rate of 30%. If the equipment was acquired after February 22, 2005, and before 2025, it was eligible for inclusion in Class 43.2 and a CCA rate of 50%. To bring things up to date, here’s a chart to summarize the phase-outs:

For class 53 - manufacturing and processing machinery and equipment):

- The CCA rate will be 100 % for purchases between November 20, and the end of 2023.

- For purchases in 2024 and 2025, the rate will be 75%

- For purchases in 2026 and 2027, the rate will be 55%.

- For purchases after 2027, the rate will return to 30% subject to the half-year rule.

The government footnotes that for Class 43 properties acquired after 2025, full expensing will apply if they would otherwise be included in Class 53.

Warch out for recapture. As is currently the case, when assets are disposed of for more than their undepreciated capital cost, the excess claims will have to be recaptured (except for passenger vehicles). That means part of the year end tax planning consultation should include a spreadsheet that anticipates what that cost might be on disposition due to death, transfer or actual sale.

Make a Difference. Taxpayers in the market to purchase new assets for their business before year end need to know about these rules. Tax and financial advisors will add significant value letting them know about their potential tax savings.