When Can Canada Administer a Proposed Tax Change?

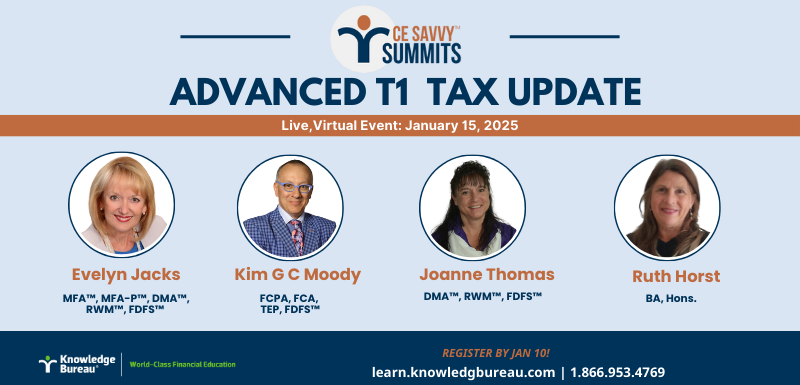

Evelyn Jacks

With Parliament prorogued with the resignation of the Prime Minister, and CRA’s announcement that it will administer the proposed changes to the capital gains inclusion rates, the capital gains deduction and other provisions of the April 16, 2024 budget, many have questioned how this is possible given that the proposals, and the related Notices of Ways and Means Motions (NWMM) have not been passed into law.

It turns out that governments can in fact do so under what is known as the Provisional Implementation of Taxation. In an excellent article entitled, Tax Bills and the Ways and Means Process, author Michael Lukyniuk, a writer for the Canadian Parliamentary Review, explains how this process has developed.

Specifically, a “. . .unique characteristic of the legislative process relating to taxation is that any change in taxation is effective the moment a Minister tables a notice of a ways and means motion. The implementing legislation may only be adopted months (or years) later, but the taxes are collected from the date of the notice. This practice is not supported by any statutory authority, but is simply a convention known as the “provisional implementation of taxation”.

The rationale for such a system, he notes, is to prevent commercial disruptions, and to prevent people who might be so tempted, to take advantage of changes. It also allows the government to have some clarity and certainty in its fiscal planning, including the annual development of tax returns and tax collection processes.

So, when does a proposed tax law under a NWMM take effect? Commonly, the author says, the day when a Finance Minister presents a Budget. If that budget and the related NWMM is adopted, the taxation changes can be implemented, even if a Bill is introduced much later. Not that this has sat well over the years.

Mr. Lukyniuk writes: “In its report, Policy Resolutions 2008-2009, the Canadian Chamber of Commerce voiced its frustration in this manner. “The announcement of tax rule changes with no legislation makes it difficult for individuals and businesses to plan their affairs when they have no assurance as to what form the law will take, whether it will be implemented and how it will apply.”

Mr. Lukyniuk writes: “In its report, Policy Resolutions 2008-2009, the Canadian Chamber of Commerce voiced its frustration in this manner. “The announcement of tax rule changes with no legislation makes it difficult for individuals and businesses to plan their affairs when they have no assurance as to what form the law will take, whether it will be implemented and how it will apply.”

Was the NWMM Adopted? The problem we currently have in Canada with regard to the capital gains provisions is that the NWMM tabled on September 23, 2024 (an amended document to the motion tabled on June 10, 2024), to introduce a bill entitled An Act to amend the Income Tax Act and the Income Tax Regulations, was not adopted before parliament was prorogued.

The Bottom Line: CRA can move forward with proposed tax increases based on the provisional implementation of taxation precedent, and is relying on this in taking their position to tax without the approval of a Bill. However, if the NWMM to introduce the Bill is not reintroduced and approved after Parliament resumes, then CRA will need to support requests for adjustments of tax returns filed according to the proposals. This will require proactivity on the part of taxpayers and their advisors, however, while money is tied up with the CRA in the meantime.

Don’t forget, these provisions come with other consequences: for example, the implementation of a more expensive Alternative Minimum Tax for those with large capital gains, and new Intergenerational Business Transfer Rules.

Unfortunately, this all brings with it, tax complexity and uncertainty.

Canadian Chamber of Commerce, Policy Resolutions 2008-2009, p. 32.