Tip Sheet: New Criteria for Employees Claiming Home Office Expenses

Evelyn Jacks

The CRA has introduced several new rules for filing employment expenses in 2020 which in reality, have complicated rather than simplified, employment deduction claims. Four employment filing profiles have emerged, as well as a new little-known calculation for home office space common area use. Details and a tip sheet follow.

For professional advisors assisting their clients it is first important to communicate that there may be two prorations required for people who use any detailed filing method to claim home workspace expenses on the 2020 tax return.

Next, be aware that for employees claiming home office expenses only, there are two new methods for claiming them – simplified or detailed – and the eligibility criteria is the same. The employee must have worked more than 50% of time from home for at least 4 consecutive weeks due to the pandemic.

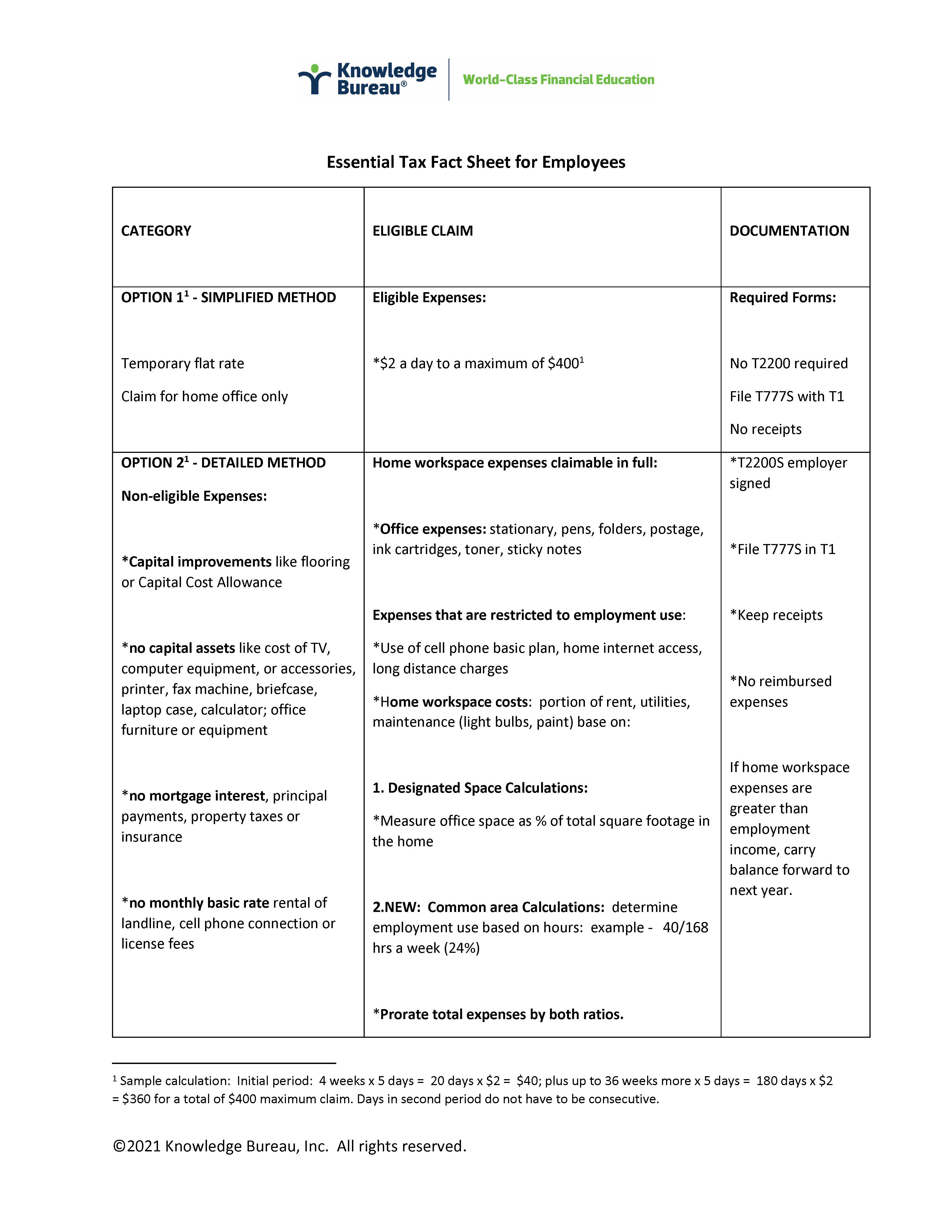

Using the simplified method, no receipts are required to claim the flat rate of $2 a day. But most employees using the detailed method will first of all be restricted to certain itemized expenditures only, as per the tip sheet below.

In the case of employees on commission there are more rules, but also more expenses that can be claimed. For example, sales and promotion, costs, costs of an assistant you employ, travel and home office expenses. The home office be where work duties were principally performed or the space must be used regularly and continuously to meet clients or others.

Unfortunately, there are further complications if expenses exceeded commissions earned in the year. With the exception of interest and Capital Cost Allowance (CCA) on a vehicle used for employment purposes, employment expenses cannot exceed commissions. However, if the commissioned salesperson abandons the claim for sales and promotion expenses, it is possible to claim travel expenses in excess of employment income. Note that in order to claim meals in this case, the employee must be away from the home base for at least 12 hours.

When it comes to claiming home office expenses in this case, per CRA’s Employment Guide T4044: “The amount you can deduct for work-space-in-the-home expenses is limited to the amount of employment income remaining after all other employment expenses have been deducted.” A carry forward of the unclaimed home office amounts is possible in that case.

The following Essential Tax Fact Sheet for employees claiming expenses summarizes the new rules.

Download the PDF