Last updated: September 16 2021

Thought Leadership on Canada’s Tax Competitiveness

Beth Graddon

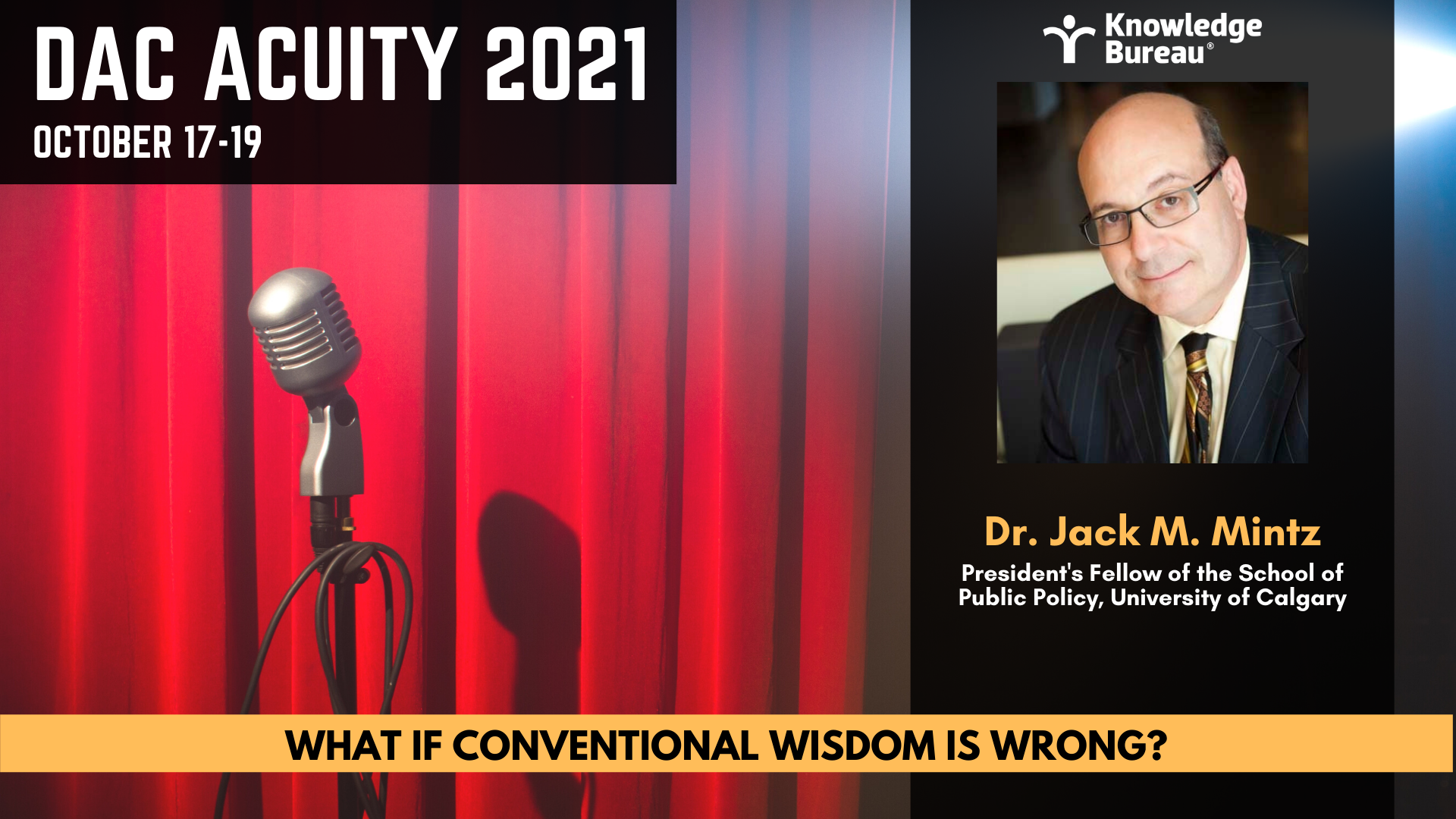

While it may be politically popular to consider raising corporate tax rates, it is the opposite that may be needed to get back to economic health in Canada. At least according to the authors of a new report on tax competitiveness, Philip Bazel and Dr. Jack Mintz who will share wisdoms on October 18 at DAC Acuity 2021. The report, entitled “2020 Tax Competitiveness Report: Canada's Investment Challenge” share some startling facts about Canada’s current economic malaise and offers solutions:

- Canada’s average five-year GDP per-capita growth rate from 2016 to 2020 has turned negative for the first time since the Great Depression.

- Canada’s pre-pandemic investment performance has been quite disappointing since 2015. Overall, business investment lags that of most countries.

- Among OECD countries, Canada had the fourth-worst growth in gross fixed capital formation since 2015, even worse than other economies with similar corporate income tax

rates. Among the countries where investment is growing fastest, we see low-tax countries, including Ireland, Hungary and Estonia.

rates. Among the countries where investment is growing fastest, we see low-tax countries, including Ireland, Hungary and Estonia. - In 2016, Canada had a tax advantage of almost five points, compared to the OECD weighted average tax rate.Now, Canada has a relatively high corporate income tax rate compared to many countries.

- In general, industry sectors with higher labour productivity tend to pay higher compensation to attract more highly skilled workers.

The authors urge broad corporate tax reform to encourage investment and help the nation recover to good economic health after the pandemic. They point out that Canada’s tax competitiveness may greatly depend on government priorities in a post-pandemic world.

Specifically, whether the focus will be on growth, investment and getting people back to work or on damaged government balance sheets will determine whether corporate tax levies will rise. Each option will have repercussions tax and financial professionals need to be aware of in advising corporate clients, in particular.

Check out the full report for further insights from these thought leaders who address what Canada’s corporate tax system should look like, based on where we are now, in order to remain competitive and recover economically post-pandemic.

Then, enrol by September 30 to attend DAC Acuity 2021 where Dr. Mintz will be lending even more insights to this important conversation, during his session: Investment Planning Tax Reforms in a New Economy. Get a sneak peek by checking out his speaker video!