Last updated: April 05 2023

The Federal Budget: More Taxes to Come

Evelyn Jacks

Managing the economy is a complex challenge for government and Canada's near-term economic outlook remains uncertain, according to the March 28, 2023 Federal Budget. For taxpayers, however, there is certainty: the impact of increasing carbon taxes and with that, higher GST costs. This perhaps is the bigger story, based on new information from the Parliamentary Budget Officer, released on March 30.

Challenges for Government. Aside from managing the domestic challenges of inflation and higher interest rates, the budget notes that “a rapidly changing global economy is accelerating the global race to attract investment in clean economies and the growing industries of tomorrow.”

For these reasons, the budget focused on providing Investment Tax Credits for companies investing in Geothermal Energy, Clean Technology Manufacturing, Zero-Emission Technology Manufacturing and Carbon Capture, Utilization and Flow-through shares and Critical Mineral Exploration Tax Credits. At the same time, qualifying for the credits will include specific labor and wage requirements.

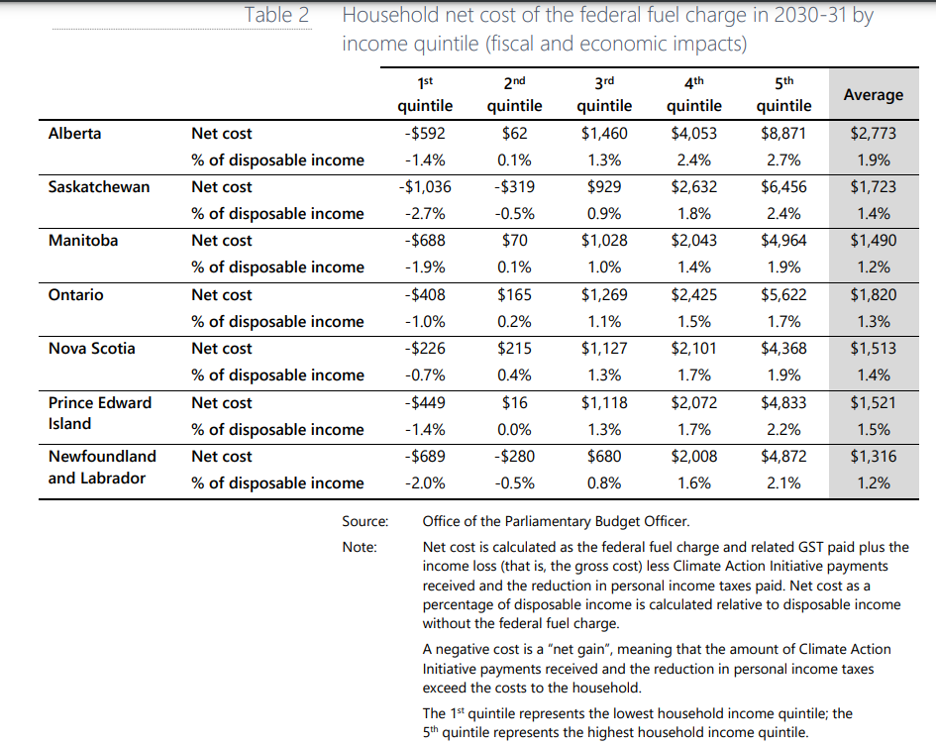

Challenges for Taxpayers. The PBO references the 2030 Emissions Reduction Plan, under which the federal fuel charge will rise “from $65 per tonne of carbon dioxide equivalent in 2023-24 to $170 per tonne in 2030-31”, seven years from now. Further, “when both fiscal and economic impacts of the federal fuel charge are considered, we estimate that most households will see a net loss, paying more in fuel charges and GST, as well as receiving lower incomes, compared to the Climate Action Incentive payments they receive and lower personal income taxes they pay.”

The average net costs appear below, from the PBO document, A Distributional Analysis of the Federal Fuel Charge under the 2030 Emissions Reduction Plan.

According to the March Budget, GST revenues are scheduled to rise over the budget forecast period, from $45.4 billion in 2022-23 to $59.5 billion in 2027-28. The PBO analysis confirms that the fuel charge will contribute billions to this revenue line item:

In 2023-24, with the federal fuel charge set at $65 per tonne, we estimate that the Government will collect $11.8 billion in fuel charges from the seven provinces where the charge applies. With the charge rising to $170 per tonne in 2030-31, we project that the Government will collect $25.0 billion in fuel charges under the 2030 Emissions Reduction Plan. With the return of fuel charge proceeds to households and provincial governments through higher program spending, there is no direct impact on the budgetary balance. However, the Government will also collect revenue from the GST on its fuel charge. We estimate that $429 million in GST from the fuel charge will be collected in 2023-24, rising to $924 million in 2030-31.

There was no commitment to address the real net cost of these tax measures in the March Budget. In fact, the March 28 budget did not introduce any new personal tax deductions or credits, and only enhanced two of them; the one-time income-tested Grocery Rebate and the very targeted maximum deduction claimable under the Tradespeople’s Tool Expenses from $500 to $1000.

The budget did however warn of continued uncertainty due to higher interest rates on the global economy. Further disruptions in the global financial system could emerge, it stated, and an “abrupt repricing of risk could trigger a broader tightening of lending standards.” This would be bad news for borrowers here in Canada.

Bottom Line: There was little good news in the March 2023 budget. Higher taxes and the risk of even higher interest rates loom. It is time for planning. High earn ers, investors and business owners need to pay attention to managing capital dispositions, in light of the new Alterative Minimum Tax beginning in 2024.

ers, investors and business owners need to pay attention to managing capital dispositions, in light of the new Alterative Minimum Tax beginning in 2024.

For average Canadians that issue is cash flow management: some will need to think about changing spending habits and pay down debt, as fuel taxes and the GST they will pay in the future will both grow. Smart investors will top up TFSAs, RRSPs and RESPs because after-tax dollars will certainly shrink.

For a detailed analysis of the Federal Budget, subscribe to receive KBR in your email and you’ll receive access to download your copy of the Special Report.

PLUS join us at the May 24 CE Summit which will feature presentations and analysis from an investment, retirement and estate planning view by expert instructors.

*In 2023-24, the federal fuel charge will be expanded to include Nova Scotia, Prince Edward Island, and Newfoundland and Labrador and continue to apply to Alberta, Saskatchewan, Manitoba and Ontario.