Last updated: July 20 2023

The Age Pyramid: How Well Do You Know Your Next Clients?

Evelyn Jacks

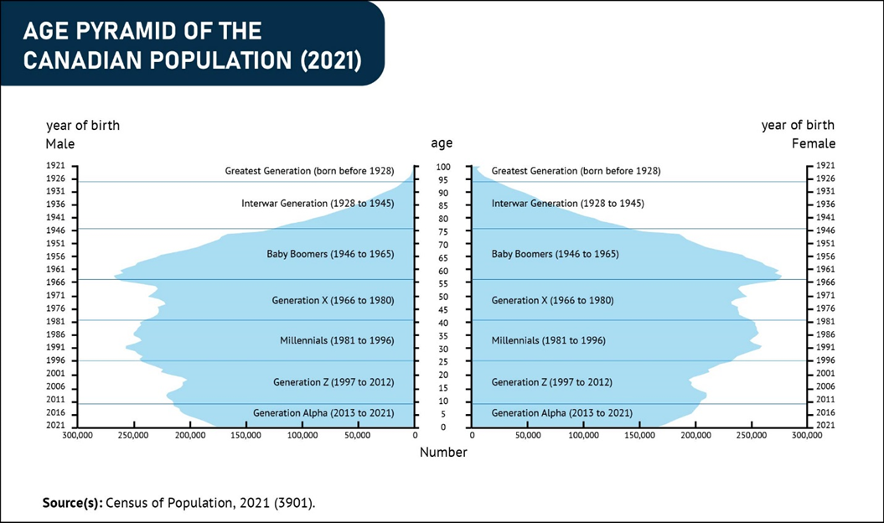

Demographics are changing rapidly in Canada. Statistics Canada recently released an interesting study of demographics in Canada and a visual that depicts how the generations stack up, numbers wise, and most important, what their age-related tax and financial issues are. The professional who gets this right is truly well positioned as an “advisor for the future”.

The Age Pyramid breaks down as follows:

Some observations:

- All the Baby Boomers will have reached age 65 by the year 2030.The Great De-accumulation Period is in full swing and it’s complex.There is much out of the retirees’ control:inflation, interest rates, market performance, the valuation of non-financial assets like real estate and business ventures and of course, health and longevity. It requires astute tax, investment and estate planning segments that, by necessity speaks to the need of a multi-stakeholder approach. This topic is under discussion by the Society of Real Wealth Managers’ Meeting of the Minds on August 16 at noon CT.Be sure to register for this free Knowledge Bureau event now

- The millennials could account for 34.6% of the population aged 15 to 64 by 2031 and would still make up the majority of the working-age population, ahead of Generation Z (31.5%).This demographics is in the accumulation phase, and if their parents manage their finances well, they could receive a significant inheritance down the line to help back fill inflation fuelledconsumption periods due to child rearing, home acquisition and other costs.However, if both demographics are indebted – often because Baby Boomers are already helping their Millennial children – the future may look bleaker.That makes the prediction of future wealth patterns more difficult and requires a more disciplined tax and financial planning process.

Bottom Line: Family wealth management for Boomers, Millennials and Gen Z is key to financial peace of mind across all three generations. Advisors who have re-engineered their practices to focus on this important strategy are already reaping the rewards of building trusted, lasting relationships in their communities. Find out more about how to do this with the RWM™ (Real Wealth Management) Designation Program.

The word “Real” in this program refers to sustainable wealth across the generations, after taxes, inflation and fees such as interest, management expenses and professional costs. Many of those wealth eroders are controllable, with a big enough time horizon. That’s part of the strategy: to work with families who have accumulated wealth today and find ways to earn more and share more for the future

Evelyn Jacks is a bestselling tax and financial author, an award-winning educational entrepreneur and President of Knowledge Bureau. She is the founder of the Real Wealth Manager programs. Follow her on twitter @evelynjacks.