Last updated: February 14 2023

Tax Tip: Deductions for Commissioned Salespeople

Did you know that employed commissioned salespeople can write off more tax deductions than other employees? In fact, expense deductibility differs only slightly from that of the self employed. Yet, to get past a tax auditor, there are special nuances: employers must be prepared to verify unreimbursed, out-of-pocket costs were required and there are some specific restrictions. Details follow.

The Employer’s Role. In order for a commissioned employee to deduct expenses incurred out of pocket for the purpose of earning the income, employers must declare on form T2200 the commissioned employee was:

- Employed in the year to sell goods or property or negotiate contracts for the employer;

- The employment contract requires the employee to pay for their own expenses;

- The employee is ordinarily required to carry on the duties away from the employer’s place of business; and,

- The commissioned employee is remunerated in whole or part by commissions or similar amounts fixed by reference to the volume of sales made or contracts negotiated.

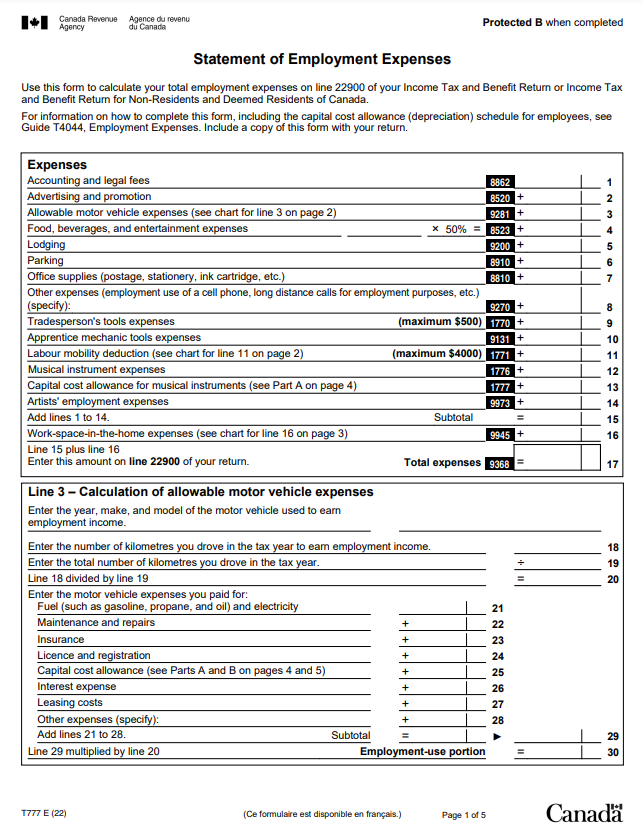

What’s Deductible? Employment expenses are deducted on Form T777, Statement of Employment Expenses, and include accounting and legal expenses, sales and promotion expenses, office supplies, travel, home workspace costs and auto expenses.

Another useful deduction is the ability to hire an assistant, who can be an employee of the commissioned salesperson, as long as that person’s services are required for the purpose of earning the commissioned employment income. This can be a spouse, providing for an income splitting opportunity. Similar to rules for the self-employed, the salary paid to the assistant must be reasonable for the duties performed, there must be a written employment agreement, and that statutory deductions, including for the Canada Pension Plan and Employment Insurance must be remitted.

What’s Not Deductible. The commissioned employee must actually earn commissions from employment in order to deduct certain expenses, such as sales and promotional expenses. In addition, home workspace costs cannot create or increase an employment loss.

However, commissioned salespeople may claim interest and capital cost allowance on vehicles or other travel costs in excess of commissions earned according to specific rules.

Tax Tip. Many commissioned employees forget to claim the GST/HST rebate, especially if they are preparing their own tax return. The employer must be a GST/HST registrant in order for the employee to make this claim. If you missed it, you only have 4 calendar years in which to recover the rights to receive it; that’s different from the normal 10 year adjustment period. Rebates must be reported as income in the tax year received; unless they are claimed for a depreciable asset, in which case they will affect the undepreciated cost of the vehicle.

Bottom Line: Be sure to work with a qualified tax specialist who can ensure you – and your employees who may earn commissions - are paying only the correct amount of tax and no more and can help themselves to all the tax credits they are entitled to.

Additional Educational Resources: Check out the 2023 T1 Advanced Tax Update Course for more details or purchase the Knowledge Bureau’s “Tax Bible” - the hard copy of the Knowledge Journal that accompanies this course – an invaluable reference throughout tax season!

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

©Knowledge Bureau, Inc. All rights Reserved