Last updated: September 11 2024

Tax Specialists: The Right Time to Make an Impact

Evelyn Jacks

Filing tax returns is for millions of households, the most important financial transaction of the year. While helping with this task is often challenging, with unprecedented complexity in tax law and a highly digitized environment at CRA, specialized tax accounting skills have helped professionals evolve into a highly rewarding career with an extremely bright future. That makes this the right time to step up, meet the demand for more services and scale up the industry, too. Consider the following statistics and trends:

The Market is Growing. Canadians so appreciate astute help in managing their relationship with the CRA, in complying with their tax system, which is based on self-assessment, and for which they bear the burden of proof.

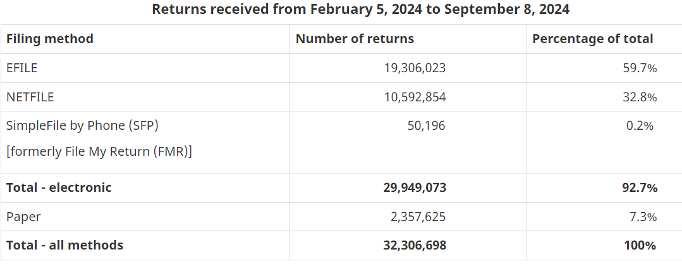

Income tax filing statistics at the CRA for the current tax year (2023) bear this out: 60% of all tax returns filed in Canada are now filed by EFILERs – those who prepare more than 5 returns for other Canadians for a fee. Interesting also is that 93% of all tax returns in Canada are now filed electronically.

Further the tax filing statistics confirm a growing market for EFILE Services:

The Backdrop for Heightened Demand. Recent proposed tax legislation is so complex (hotlink to government August 12 draft legislative releases) and related penalties for both advisors and clients so expensive, that it is causing experienced tax practitioners to consider retirement or in the case of younger practitioners, other forms of practice, as reported by Kim Moody in a recent Financial Post Article.

In Knowledge Bureau’s September poll, advisors have also expressed concern about this trend. (Please do weigh in). Notes David Weinstein:

“Compliance has already become excessively complicated and expensive and it is unfair to penalize for non-compliance when the rules keep changing and have become incomprehensible in many cases. In addition, the government has begun issuing new rules without thinking them through, causing massive confusion. Trust reporting in 2023 is a perfect example. Accounting firms are already over-burdened with compliance issues and this will add to their load as more taxpayers will require more in depth levels of service out .png) of fear. They can barely keep up now.”

of fear. They can barely keep up now.”

This is a disturbing trend at a time when staffing at CRA has grown to 60,000 in a largely digital response setting that is both frustrating and time consuming for taxpayers and their advisors.

But that also makes this the perfect environment for new highly trained graduates of specialized tax accounting courses to step up.

Bottom Line: Especially if you are an entrepreneurial thinker, getting your credentials in tax accounting services including expertise in filing personal, corporate, trust, cross-border and retirement services is a great way to make a social impact. Remember, filing tax returns is for millions of households, the most important financial transaction of the year.

How to come up to Speed Quickly. We are passionate about encouraging more professionals from across the financial services industries to consider adding tax expertise to their career development. To that end, we are working hard at Knowledge Bureau to make tax training more accessible, diverse, comprehensive and affordable, and to connect professionals from multiple sides of the industry (tax accountancy, financial planning and legal work) in a strong community.

CE Savvy Summits. Join us on September 18, November 6, January 15, and May 21 in a technical day of learning and collaboration on tax news and planning opportunities.

Developing Leaders, Mentors and Teachers. Most important, we are delighted to celebrate and congratulate those advisors entering or working in practices that are making a big difference in their community. They are the dedicated practitioners and the mentors committed to teaching and sharing knowledge.

We will honor new role models who are graduates of our certificate, diploma and designation programs, and our Faculty members who have achieved the FDFS™ designation - to be formally feted at the Acuity Conference for Distinguished Advisors in Montreal Nov 10 - 12. Please join us as a testament to your commitment to strengthening our community of tax and financial services industries!