Tax Refunds Take Big Bite Out of Retirement Savings

This year’s average tax refund of $1641 takes a big bite out of retirement savings for Canadian families.

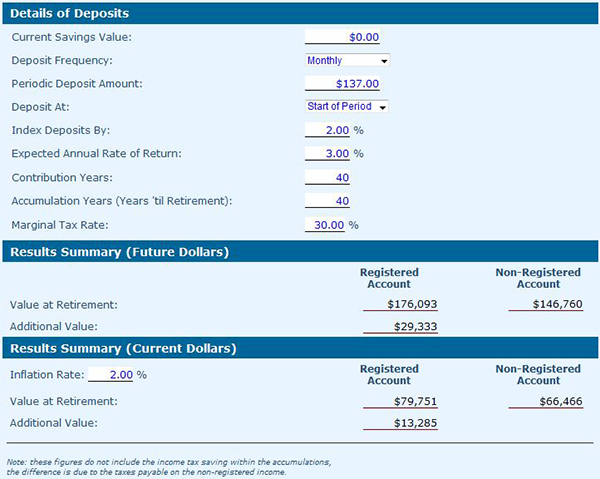

If you do the math, that amounts to $137 a month. It’s serious money especially if you multiply the savings gap forward: over an average working life of 40 years, you’re giving the government an interest free loan of over $65,000.

Imagine, arranging your affairs to reduce your tax withholdings by putting the money into an RRSP instead. Here’s the math using an average return of 3%. The Knowledge Bureau’s Registered vs Non-Registered Calculator makes the illustration obvious:

It’s Your Money. Your Life. You’re on to something big when your tax pro recommends reducing withholding taxes by filing Form T1213 with CRA. For many average Canadian families, getting your tax refund with every paycheck can make a big difference in the worry about retirement savings.

To see more of the Registered vs. Non-Registered Savings Calculator in action, view this week's feature article here.

Evelyn Jacks is President of Knowledge Bureau and author of 50 books on tax and personal wealth management. She is also the founder and director of the Distinguished Advisor Conference (DAC). The theme of this year’s three day think tank in Ojai, CA Nov 10-13 will be “Back to the Future – Collaborative Wealth Management.” Follow Evelyn on Twitter at @EvelynJacks.