Last updated: February 05 2025

Tax Planning Tips: Families Having Children, Later

Joanne Thomas

Statistics Canada data shows that Canadian parents are starting families later in life than previous years. This trend not only affects housing markets but also influences social services, healthcare needs, and community planning.

What tax planning strategies should be discussed with older parents of young children? Check out the details and tax planning considerations:

The Statistics. In 2021, Canada was home to 10.3 million census families—that is, couples with or without children and one-parent families.

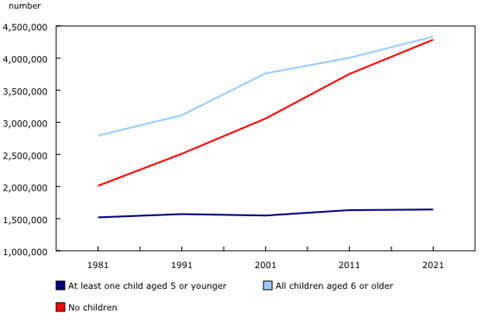

Among these census families, only 1.6 million had at least one child aged 5 years or younger, while the majority had either older children or no children at home. The share of families with young children decreased steadily from 24.0% in 1981 to 16.0% in 2021, as the number of families with older children or no children grew much faster over this period.

Chart 1 Number of census families by presence and age of children, Canada, 1981 to 2021

The declining share of families with young children has been driven by three key factors:

- population aging,

- decreasing fertility rates and

- changing norms around living arrangements.

The planning impact. The growing number of older adults living as couples without children means there's a shift in resource allocation and support systems. There's also a significant impact on social networks and community engagement, as these older couples may have different needs and contributions compared to previous generations. This includes housing and medical needs.

Parents today not only have fewer children but also have them at older ages, on average, compared with parents in previous generations. Three investments are key in tax planning for these people:

- RRSP contributions

- FHSA contributions (for those who are aspiring to buy a home) and

- RESP contributions

From a tax viewpoint, the RRSP becomes increasingly important, as the income of these taxpayers is normally higher than their younger counterparts. That means, they may receive less or no Canada Child Benefit. The RRSP and FGSA will reduce family net income, the figure upon which the CCB is calculated. See chart below.

|

Claw back Rates (2025 – based on 2024 tax year) Family Net Income |

|||

|

Number of Children

|

Under $37,488

|

$37,489 to $81,222

|

Over $81,222

|

|

1

|

0%

|

7.0%

|

$3,061 + 3.2%

|

|

2

|

0%

|

13.5%

|

$5,627 + 5.7%

|

|

3

|

0%

|

19.0%

|

$8,309 + 8.0%

|

|

4+

|

0%

|

23.0%

|

$10,059 + 9.5%

|

The other planning factor for multi-generational households is the RESP; that’s because, once these taxpayers, who are older parents, are in retirement, they quite likely will also have tuition costs to consider for their children. Contributing to RESPs will allow them to retire with more peace of mind, knowing that the RESP can reduce tuition costs in the future.

However, because the Millennials as well as their Boomer/Gen X parents may be retired at the same time as their children enter post-secondary school, multiple generations may be required to contribute to the costs of both retirement and education for a family unit.

The Bottom Line: It’s fascinating how demographic shifts shape societal structure, and investment strategies, isn't it? As Canada's population ages, and family dynamics will evolve, planning may evolve quite differently for the grandchildren of the Boomers and Gen X.

By the time the children of the Gen Y and Gen Z grow up and move out, the older adults, 2 or even 3 generations of them, may be living longer and more often with a partner. In fact, we may not see an increase in the traditional "empty nesters," until much later in life, if at all, and quite possibly, with fewer tax supports along the way.

Has this been discussed as a possibility between advisors and their clients? If not, it’s a great conversation opener this tax season.

Additional Educational Resources: