Last updated: February 01 2023

Tax Literacy Tip: What’s Earned Income for RRSP Purposes?

What matters is what you keep – after taxes! That’s critical in the current high inflation, high interest rate environment. It helps to take a hard look at how well you are using your “tax efficiency potential,” starting with maximizing your RRSP contribution by March 1. That will help you get a bigger tax refund and more tax benefits when you file your T1. As important, are you making just enough of the qualifying earned income to maximize RRSP advantages in the 2023 tax year? Here’s how to do it, well in advance:

First, understand the RRSP earned income formula. The maximum contribution is the lesser of:

- 18% of last year’s earned income (2021) or

- The dollar maximum ($29,210 for 2022), resulting from 2021 earned income of $162,278.

Note, if you are planning ahead for 2023, the maximum dollar contribution is $30,780, which is reached when 2022 earned income is $171,000.

There may be other adjustments: contributions to an employer sponsored plan, for example, will reduce the RRSP contribution room. Check out the Notice of Assessment or Reassessment to find what CRA has on record for your allowable contribution, but know that this balance may or may not be up to date. Plus, if you have missed filing a tax return, it will be understated.

Don’t limit your potential for retirement savings – catch up on your filings and make sure you at least have access to all of your RRSP tax efficiency potential. It’s part of a sound wealth management plan your tax and financial pros can help you with.

Next calculate RRSP Earned Income: Review this checklist carefully. Notice, dividends from a small business corporation don’t appear here. If your only remuneration is dividend income, you’ll miss out on making any RRSP contributions. That’s not a good idea if all your retirement eggs are in your company; diversifying your financial options for the future is an important strategy. Here’s the list of qualifying earned income sources:

- Add the total of Employment income (T4 slip and casual earnings)

- Add the following amounts:

- royalties for a work or invention that you authored or invented plus

- net research grants received plus

- retroactive to tax year 2011 – post-doctoral income plus

- unemployment benefit plan payments plus

- wage earner protection plan payments.

- royalties for a work or invention that you authored or invented plus

- Subtract

- annual union, professional, or like dues that relate to the employment earnings plus

- employment expenses like home office or allowable auto expenses

- Add net income from an unincorporated business (excluding distributions from an amateur athletic trust (ATT))

- Add disability payments you received from the Canada Pension Plan or Quebec Pension Plan

- Add net rental income from real property

- Add total taxable support payments received.

- Add support payments previously paid and deducted but that were later repaid and included as income

- Add the qualifying performance income contributed to an ATT.

- Reduce the above by the following amounts:

- Current-year loss from a proprietorship you carried on alone or as an active partner

- the taxable portion of gains on the disposition of eligible capital property

- current-year rental loss from real property

- total deductible support payments

- support payments received and included as income for the year that were later repaid within the current or immediately prior years.

Earn enough to maximize your RRSP contribution. To maximize your 2024 RRSP contribution, you’ll need to make $175,333 in 2023 to contribute $31,560. Investors or business owners who are earning dividends or capital gains can then supplement their tax efficient income needs with these sources.

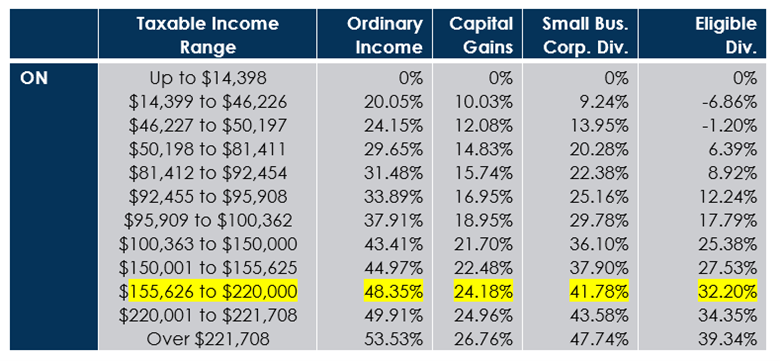

Here’s how this works in tandem: consider marginal tax rate in Ontario is 48.35% for employment income; that means an RRSP contribution of $31,560 will bring tax savings of $15,259.26 – money you can now invest in your TFSA, next year’s RRSP or to pay down debt. Beyond this, earning dividends from a small business corporation will result in tax savings of 6.57%. (48.35 – 41.78).

Also note, dividends provide a better after-tax result for lower earners; you’ll want to discuss family business remuneration strategies with a keen eye to the best results for the entire household.

Bottom Line: These numbers tell an important story of tax savings potential. But, there is a downside. Your tax deferred earnings within the RRSP will be taxable when they are withdrawn and so will the principle contributed on a pre-tax basis (remember, the RRSP deduction that produced a significant tax saving). The trick to future tax efficiency, is to draw down taxable retirement in combination with other income sources and income splitting opportunities, to average down the taxes payable over time. That’s where your and financial pros comes in.

In short, your tax efficiency potential can be maximized with this to-do list:

- Always file a tax return for each family member to report qualifying earned income

- Consider how to create the RRSP contribution room with qualifying RRSP earned income.

- Try to earn other tax efficient income sources beyond this.

- Make the RRSP contribution to create tax savings and qualify for social benefits available through the tax system.

- Discuss whether a spousal RRSP can be a good solution for minimizing tax in retirement in your household.

- Once you have built your large retirement fund, maximize your opportunity to build wealth by planning to withdraw those funds over a longer period of time, using income splitting and tax averaging techniques to keep more down the line.

Additional Educational Resources: DFA - Personal Tax Services Specialist Program™. Learn to earn and help people in your community as a highly qualified personal tax specialist. Check it out today.

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

©Knowledge Bureau, Inc. All rights Reserved