Last updated: May 19 2015

Tax Efficient Transition Planning with RRIF Withdrawals

What should you do with your RRIF withdrawals once you’ve generated the tax with the funds?

Some obvious new strategies have emerged thanks to the April 21 federal budget:

• Step 1: Invest the RRIF withdrawals in a Tax-Free Savings Account to earn tax-free income at the contribution maximum level of 10,000 in 2015 and subsequent years; making sure, that if it makes sense from a tax point of view, enough money is generated to catch up on any unused contribution room available for prior years.

• Step 2: If the taxpayer is still insurable, use the funds to pay life-insurance premiums on a policy that will provide tax-free income to the beneficiaries.

• Step 3: Consider making a gift to adult children. Transfer the tax-paid amounts to the taxpayer’s beneficiaries before death, so that future income is taxed in their hands. The first-line of defence in a tax – efficient family wealth management strategy, however, involves funding their TFSA accounts first.

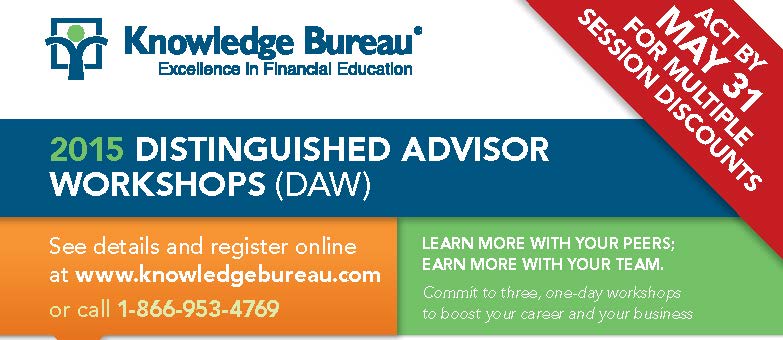

A peer-to-peer discussion of these and other potential new strategies will be held at the Distinguished Advisor Workshops this June. Pre-planning and inter-advisor collaboration is important in working with clients, particularly seniors. Balances left in the account at the time of the RRIF holder’s death may be transferred tax-free to a surviving spouse, but after this, balances are taxed in the survivor’s terminal return. With so many new taxes at provincial levels, estate planning will be affected.

As a result, for single or widowed taxpayers, it becomes important to average out the taxable income sources from the RRIF over the longest possible time frame to avoid heavy taxes on the terminal return. What this means is that advisors and their clients must have these conversations much sooner to get the best tax benefits for the family.

Also important to note from a technical point of view is that when the account holder dies, the T4RIF slip issued will include the fair market value of the RRIF assets at death. But this is unfair if the value of RRSP or RRIF assets have decreased between the time of death and the time those assets are distributed to the beneficiaries.

For these reasons, a deduction was introduced in 2009 for the amount of the decrease in the value of the assets, which can be claimed on the final return of the deceased (at line 232).

To compute the effect of RRIF planning on taxable income using pension income splitting, Knowledge Bureau has developed two specific tax calculators to help: The Income Tax Estimator and the Tax Efficient Retirement Income Calculator, available at a 15% discount throughout the month of May for a one year subscription. Click the links for the discounted calculator.