Last updated: November 19 2013

Structure a Tax-Efficient Family Income

Modern families that are successful in accumulating wealth over time use the power of their economic unit to get the best after-tax results during their lifetimes and with a tax-efficient, intergenerational wealth transfer in mind.

It’s not unusual for everyone in the family to participate in the economy in a significant way: the money the kids earn at babysitting, doing lawn care, or working at the local hamburger joint, mom and dad at employment or self-employment activities, in the case of stay-at-home parents, the raising of children, caring for the vulnerable, studying for self-improvement or the home-based entrepreneurial activities which all grow into enormous economic contributions.

Have you ever tracked the value of those activities? It’s a worthwhile exercise that helps you optimize family filing provisions on all the tax returns and in making investment decisions.

Your Tax Time Focus. Your focus at tax filing time needs to be on two things: reducing taxes on income earned by each family member as a starting point; then in making sure you gather all the refundable tax credits your family is entitled to.

Your Family Management Focus. While discussions about money are often difficult for families, the reality is that at some point, family life events demand a joint financial accounting: at tax filing time, at marriage, divorce, incapacity, retirement and at death.

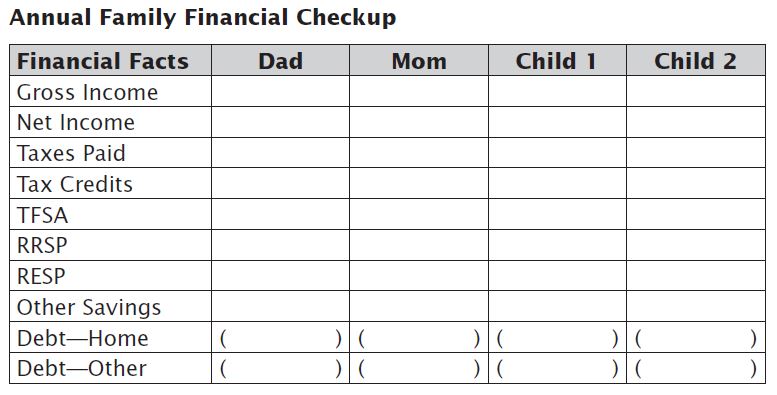

In anticipation of those events, it’s important to think more strategically: how can you build and protect from tax the asset pools each member in the family unit is building? Is money being saved at all? Is it in the right accounts? Which accounts should be funded first? At year end, consider gathering the family for a simple financial check-up, which may include a high level review of income, expenses, assets and liabilities.

This is a very simple accounting of income and net worth for the family as a whole that may help you think about the kinds of financial decisions you should be making at year end, at tax time and throughout the rest of the year. It will instill the knowledge and skills your family needs about money management as a whole and then help your family unit make confident decisions about tax strategies and investment outcomes together with your professional financial and tax advisors.

When it comes to smart family tax filing, know that it’s possible to transfer various tax credits on the tax return, as well as to split and shift certain income sources from higher to lower-taxed individuals to get better overall results. Your goal is to structure a “tax-efficient family income” and this may involve the transfer of assets into the right hands throughout various life stages and at the end of life, too. Be sure to seek professional help to minimize tax erosion.

Excerpted from Essential Tax Facts: 2013 Edition. © Knowledge Bureau, Inc. All rights reserved.