Last updated: April 06 2020

Special CERB Report: How to Apply Now

Evelyn Jacks & Beth Graddon

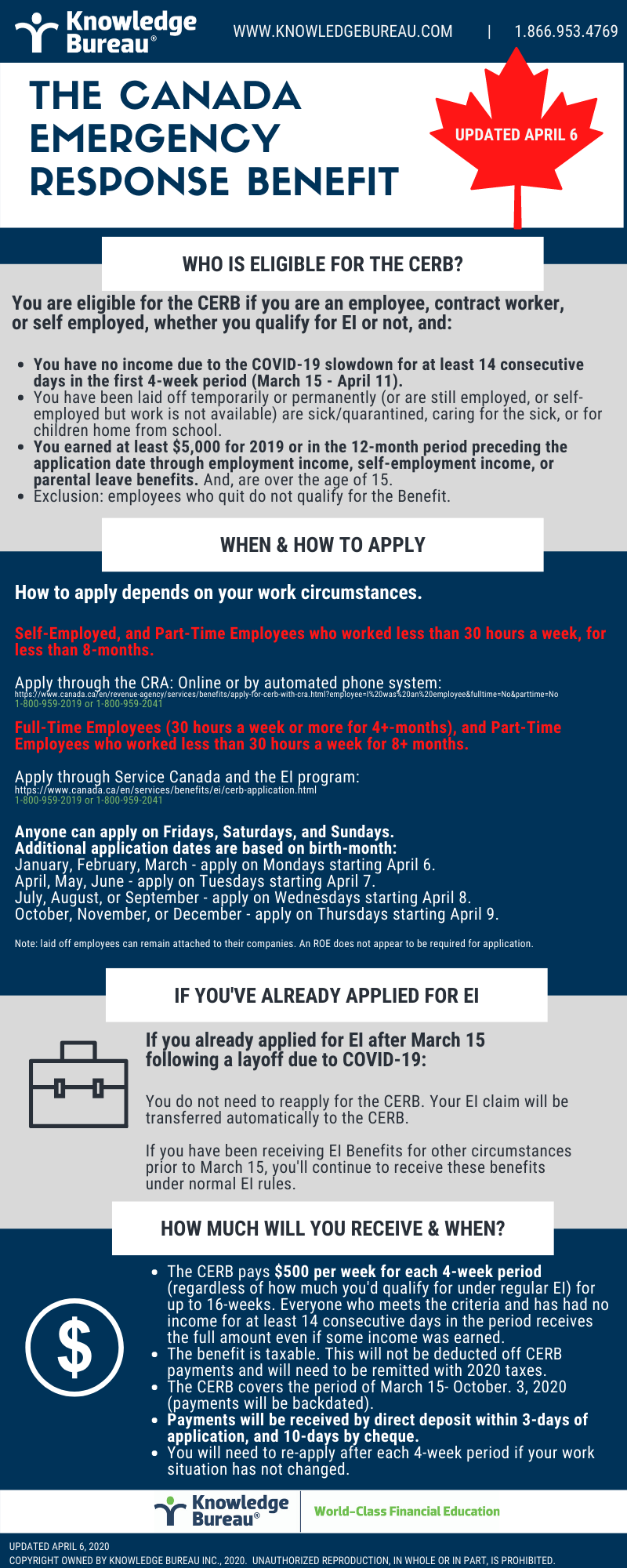

Canadians can start to apply for the Canada Emergency Response Benefit (CERB) this week and there are some new details to be aware of. Here’s how it will work:

What is it? The CERB is available from March 15, 2020, to October 3, 2020 for a maximum 16-week period. You can apply for it no later than December 2, 2020. It is a $500 a week amount. The application process begins this week and you should be sure to apply by birth month:

|

If you were born in the month of |

Apply for CERB on |

Your best day to apply |

|---|---|---|

|

January, February or March |

Mondays |

April 6 |

|

April, May, or June |

Tuesdays |

April 7 |

|

July, August, or September |

Wednesdays |

April 8 |

|

October, November, or December |

Thursdays |

April 9 |

|

Any month |

Fridays, Saturdays and Sundays |

How to apply depends on your work circumstances:

- If you were self-employed, you will apply through the CRA My Account.

- If you worked part time (less than 30 hours a week) but for less than 8 months, you will also apply through CRA.Here is the link: https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html?employee=I%20was%20an%20employee&fulltime=No&parttime=No

- If you were an employee and worked full time (at least 30 hours or more for four months), you will apply through Service Canada and the Employment Insurance program.

- If you were a part time employee (who worked less than 30 hours a week, but for at least 8 months, you too will apply through Service Canada and the Employment Insurance program. Here is the link: https://www.canada.ca/en/services/benefits/ei/cerb-application.html

The government has also released the phone numbers for the automated phone application process. 1-1-800-959-2019 or 1-800-959-2041

Laid Off Employees: You can still remain attached to your company (an ROE does not appear to be required to apply) and receive the CERB if you had to stop working and expect to be without employment or self-employment income for at least 14 consecutive days in a 4-week period. After this, you can continue to receive the benefit if you meet the other criteria and have no employment. Note: there is no waiting period for the CERB and the money will be back-dated to the start of your eligibility period.

Not eligible. The Benefit is only available to individuals who stopped work and are not earning employment or self-employment income as a result of reasons related to COVID-19. If you have not stopped working because of COVID-19, you are not eligible for the Benefit.

Note that If you became eligible for EI regular or sickness benefits prior to March 15th, your claim will be processed under the pre-existing Employment Insurance rules.

CERB First; EI second. The government notes on its updated website that when you apply for the CERB, you will receive a flat $500 a week regardless of how much you would have been eligible to receive as regular EI. The government notes that if you became eligible for EI prior to March 15, your claim will be processed under the pre-existing EI rules. After March 15, your claim is automatically processed through the CERB. It is also noted that you will retain your eligibility to receive EI after you stop receiving the CERB. That is, the period you receive your CERB does not impact your EI entitlement.

Apply more than once. Those who qualify will receive the $500 a week payment for each 4-week period, backdated to the period beginning March 15, 2020. You will receive the full benefit amount of $2,000 regardless of if you earned some income, provided you meet the rest of the criteria and had no income for at least 14-days within the 4-week period. You will need to keep applying if income situation doesn’t change as each application is for payment over a single 4-week period. The first period covered is March 15-April 11. If your income situation continues, apply again for an additional 4-week period, up to a maximum of 16 weeks (4 periods in total).

How fast will the money be in your hands? Here’s what the government advises:

- When you select direct deposit: within 3 business days from the day you submitted your application.

- Cheque payments: expect your cheque within 10 business days from the day you submitted your application.

Who qualifies? Here is the criteria. You must be:

- Residing in Canada, and at least 15 years old

- Stopped working because of COVID-19 or are eligible for Employment Insurance regular or sickness benefits

- Had income of at least $5,000 in 2019 or in the 12 months prior to the date of application; this may be from any or a combination of the following sources:

- Those in receipt of non-eligible dividends (dividends out of corporate income taxed at the small business rate).Eligible dividends (those paid from public corporations or those taxed at higher general rates won’t count for these purposes.)

- Maternity and parental benefits under the Employment Insurance program and/or similar benefits paid in Quebec under the Quebec Parental Insurance Plan.If work is not available as a result of reasons related to COVID-19 upon conclusion of the maternity/parental leave, it is possible to apply for the CERB if other eligibility criteria is met.

- Note that the $5000 does not need to have been earned in Canada

- You need to have resided in Canada at the time you became eligible

- You must have a valid Social Insurance Number

- Workers who are not Canadian citizens or permanent residents including temporary foreign workers and international students may also be eligible if the other criteria listed here is met.

- You are or are expecting to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period

No tax withholding but CERB is taxable. The CERB will be taxable on 2020 tax returns filed next year but there will be no tax withholding at source. That means recipients will have to come up with all the taxes payable on this source a year from now. Best to tuck some of it away in an RRSP to reduce the taxes, if you have RRSP room and can afford to do this. The amount of taxes payable will depend on your tax bracket and province or residence but at least 25% should be saved based on taxes paid on the lowest federal tax bracket in 2020 (taxable income up to $48,535).

COPYRIGHT OWNED BY KNOWLEDGE BUREAU INC., 2020. UNAUTHORIZED REPRODUCTION, IN WHOLE OR IN PART, IS PROHIBITED. FOR REPRODUCTION PERMISSION CONTACT RECEPTION@KNOWLEDGEBUREAU.COM