SMES: Carbon Tax Rebates on the Way?

Evelyn Jacks

July 15 was an important day for carbon-tax weary taxpayers. A Canada Carbon Rebate payment was made to individuals who have filed their 2023 personal tax returns. What about the long-awaited $2.5 billion Carbon Tax Rebate For Small Businesses? The delivery date and amounts to be received remain elusive, but one thing is clear: many businesses will have disqualified themselves by missing the July 15 date for filing 2023 T2 returns. Here’s what you need to know.

Which Businesses Qualify? To be eligible for the Canada Carbon Rebate for Small Business for one or more of the fuel charge years (which run from April 1 to March 31), a CCPC must:

- have employed one or more persons in a designated province in the calendar year in which the fuel charge year begins;

- have had 499 or fewer employees throughout Canada in that calendar year; and

- have filed their corporate income tax return for the tax year ending in 2023 no later than July 15, 2024.

How to apply? There is no further application form required; just the filing of that tax return. CRA will then calculate and automatically issue the refunds.

How Much Is The Rebate? Altogether it is $2.5 Billion but the amounts to be paid to individuals has not been announced yet. However, the government says it depend on:

- the number of persons employed by the eligible CCPC in a designated province in a calendar year, and then this number is

- multiplied by a payment rate specified by the Minister of Finance for the designated province for the corresponding calendar year.

When is the money coming? Again, the government has said nothing except that they will announce this in the coming months.

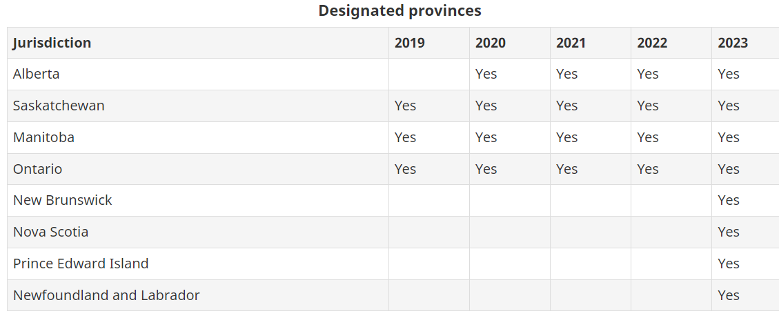

What are the designated provinces? Companies and individuals resident in Saskatchewan, Manitoba and Ontario have been on the designated list since 2019; Alberta since 2020 and the Maritime provinces since 2023. The other provinces have their own carbon tax regimes. The following chart provides detail: