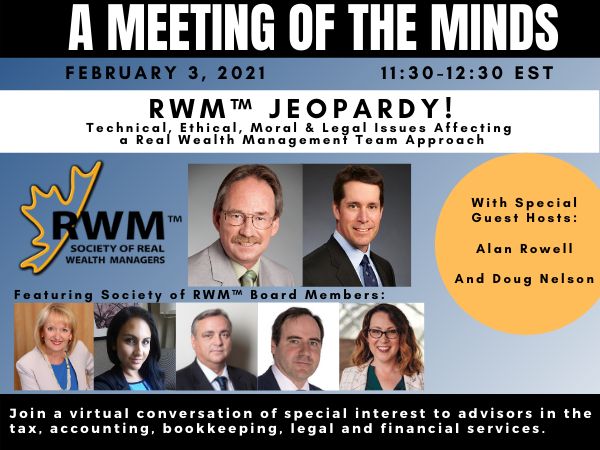

Free Event! Feb 3, Meeting of the Minds with the Society of RWM™

Join the Society of Real Wealth Managers™ on February 3rd at 11:30 EST to discuss how to interact and adapt to challenges working with your clients and other financial professionals. The focus is on how to overcome the technical, ethical, moral and legal issues that can arise when multiple advisors are involved.

The theme is RWM™ Jeopardy and this is a fun way to learn more about the Real Wealth Management™ team approach. This free event is open to any professional in the tax, bookkeeping and financial services with interest in learning more about the RWM™ methodology. RWM™ Designates who have completed the program are also invited to join the Society of Real Wealth Managers™.

RSVP now!

Real Wealth Management™ requires the interaction of various financial specialties to help clients make financial decisions that are outlined in a cohesive financial plan, all for the benefit of the client. Easier said than done!

Alan Rowell, host of the event tells us why this is such an important topic this year:

“More than any other year, clients will need the combined strengths of multiple advisors with multiple specialties to decipher the effects of COVID on their tax and financial outcomes. This session helps to identify some of the difficulties Real Wealth Managers face when dealing with other advisors and how to overcome the issues that arise.”

Who should attend?

Financial advisors and tax professionals who are interested in knowing more about how to benefit from the interactions of multiple advisors in order to provide a smooth and efficient RWM™ Framework for their clients should consider attending.

It’s an approach that enables inter-advisory professionalism through the collaboration of financial specialists aligned to help their clients achieve financial peace of mind.

The members of The Society of Real Wealth Managers™ (RWM™) are financial specialists trained to align the work they do within four financial goals using a common framework for decision-making and tax compliance, Real Wealth Management™ structures these financial goals into four purposeful elements: the accumulation, growth, preservation and transition of sustainable wealth after taxes, inflation and fees.

RWMs engage stakeholders to an RWM™ strategy in a common process for meeting these goals by ensuring accountability to three financial documents: the family tax returns, the net worth statement and the financial plans created to meet their clients' financial objectives and responsibilities.

The common and most important financial document of the year for most Canadians in meeting those responsibilities is the tax return. Taxpayers must arrange their affairs within the framework and intent of the law to pay the least amount of taxes legally possible while building their net worth to enable future consumption. This requires joint decision-making with family members as well as various members of the professional financial community.

While the process of Real Wealth Management™ generally begins here, with a discussion of the life events, financial events and economic events a client needs to make financial decisions about. Real Wealth Managers™ work together to help clients achieve the best after-tax results for their family's income and capital across multi-generations, through education, advocacy and stewardship that enables financial peace of mind.

How can people join this free event?

Register for this free event on-line

How Do You Become a Member of the Society of RWM™?

Complete the application for membership and submit to Registrar@KnowledgeBureau.com

Note: New students who enrol in the RWM™ program receive a free membership for the year included with their $1,495 tuition fee. Click here to learn more and submit your membership application.

When is the renewal deadline for existing members to remain in good standing?

2020 members of the Society of RWM™ must renew to continue receiving 2021 program benefits for $195 until January 31 only. This includes access to the Real Wealth Management Calculators and listing on the national directory.

Please contact Knowledge Bureau’s educational consultants at 1.866.953.4769 for personal assistance.