Revealed: Canada Carbon Rebate for Small Businesses

Evelyn Jacks

Approximately 600,000 Canadian Controlled Private Corporations (CCPCs) which filed their 2023 corporate tax returns by July 15, 2024, and who have fewer than 499 employees, will receive a Carbon Tax Rebate by the end of the year. The federal government held up payment of $2.5 billion for the past 5 years, and so for some, the payments can be significant. The President of the CFIB, Dan Kelly, who is a keynote speaker at the Acuity Conference for Distinguished Advisors (DAC) in Montreal, November 10-12, welcomed this news.

“While I don’t think it will change the negative view small business owners have of the carbon tax, it is good news that Ottawa is finally making good on its promise to deliver the $2.5 billion promised to small firms.”

Dan goes on to explain the importance of the held up payments: “The rebates in the 8 affected provinces are significant, especially in Ontario and the Prairie provinces where the tax has been in place for up to 5 years.”

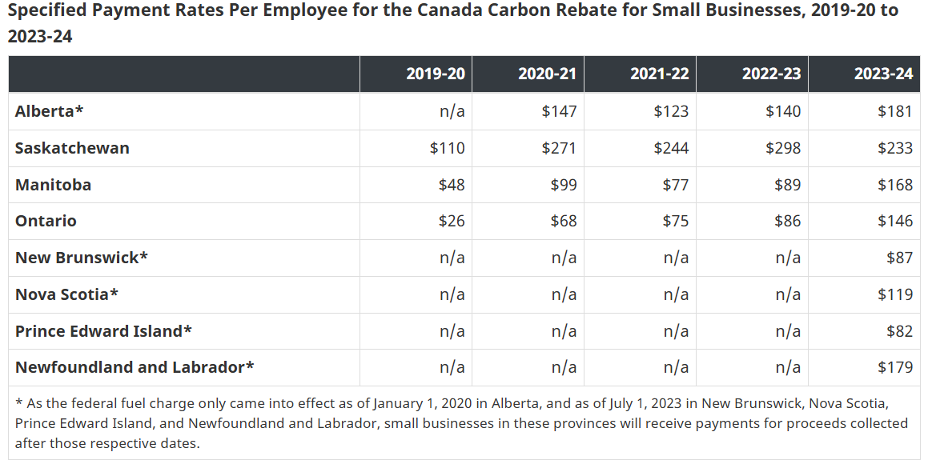

How are the amount calculated? Amounts received by individual businesses are calculated based on the number of persons employed for the previous calendar year. For 2022-23 payments for example, the government will look back at the 2022 calendar year. The number of employed persons multiple a specified payment rate will then be calculated. Here are the specified rates:

In the case of 15 employees, a Manitoba business would receive $7215 for the period 2019 to 2024; an Ontario business $6015 and a Saskatchewan business $17,340.

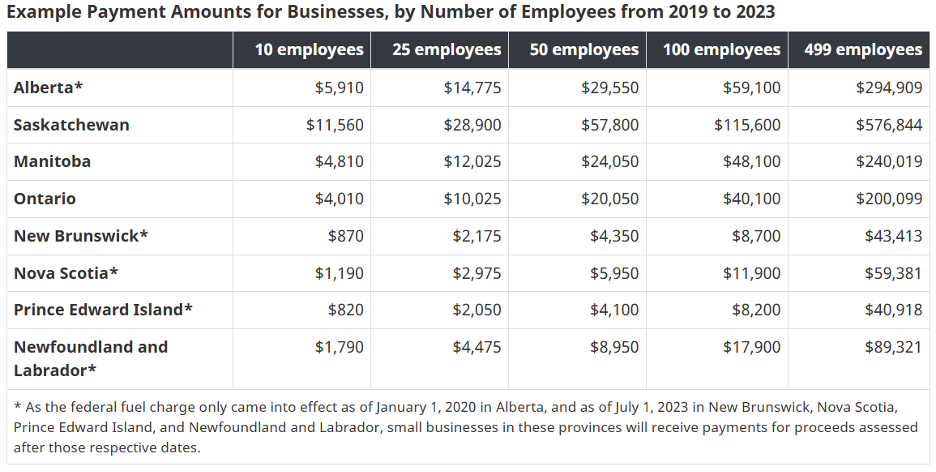

The government has provided an example with 10, 25, 50, 100 and 499 employees:

Tax Filing requirements. Corporations that filed their 2023 tax return by July 15, 2024, will receive their payment by December 16, 2024 from the CRA, if the corporation is registered for direct deposit. Otherwise, cheque payments will be made by December 31, 2024.

What if the 2023 tax return is not yet filed? Businesses may be in for a lengthy wait. For corporations that file the 2023 tax return after July 15, 2024, and on or before December 31, 2024, legislation will need to be enacted (Royal Assent required) before payments can be issued. Unfortunately, this could be held up if the government does not survive a non-confidence vote.

Going forward the plan is that for fiscal years including 2024-25 an annual payment will be made. According to Dan Kelly, however, that promise, while welcomed in the short term, could be step in the wrong direction in the long run. He notes, “This cash injection will be very helpful as small firms continue to deal with the rising cost of doing business. “Now that the cash is being delivered, it is time for government to scrap the entire carbon tax regime.”

Bottom Line. The Canada Carbon Rebate is just another reason for individuals and businesses to file their personal and corporate tax returns on time.