Emergency Response Benefit Complexity: New Info Released

Beth Graddon

In the midst of many provinces facing increased lockdown measures, the CRA has released new information, documentation and resources about Canada Emergency Response Benefit repayment and taxation. It has the potential to both aid and add to the complexity and confusion many are facing, particularly when it comes to the CERB. Here is what you need to know:

1. T4A slips are starting to be sent out

As of yesterday, the CRA began issuing T4A slips to those who received income from any of the Canada Emergency Response Benefit Programs including:

- The Canada Emergency Response Benefit (CERB) – not taxed at the source

- The Canada Emergency Student Benefit (CESB) – not taxed at the source

- The Canada Recovery Benefit (CRB) which replaced the CERB program – taxed at the source

- The Canada Recovery Sickness Benefit (CRSB) - taxed at the source

- The Canada Recovery Caregiving Benefit (CRCB) – taxed at the source

This information will need to be included on line 13000 outlining the total amount of received from these programs when 2020 taxes are filed this year. The CRA is currently stating that these slips should currently be considered statements of income, and not statements of repayment for those who may have received benefits they shouldn’t have been entitled to.

Despite tax being withheld at the source, some Canadians who received the CRB, CRSB, and CRCB may still have a tax balance owing upon filing.

CERB recipients who never had taxes withheld at the source should anticipate having to pay taxes on the income. Amounts are dependent upon other sources of income, deductions and credits included upon filing, and Canadians are encouraged to seek the services of a certified tax professional to help sort out this year’s complex filing requirements. An RRSP contribution  before March 1 will help, too.

before March 1 will help, too.

2. The CRA admitted to contributing to CERB eligibility confusion over the $5,000 income requirement – but will not be forgiving the debts

To date, 441,000 letters were sent out to individuals who may have received money through the CERB they weren’t eligible for. Many that have received these letters, as we previously reported, are small business owners who met the $5,000 prior year income requirement based on gross income, when in fact the CRA has since stated the eligibility should have been based on net – meaning many who received it should not have qualified.

In mid-December, the government issued a statement acknowledging that unclear instructions were provided, and the National President of the Union of Taxation Employees (which represents CRA employees) indicated that CRA agents and the CRA website have both incorrectly stated that the eligibility requirement was based on $5,000 gross income.

Unfortunately, the CRA has indicated that they will not be forgiving these “debts”, but that interest and penalties would not be applied to those who received the benefit in good faith.

They also indicated that they would work on repayment on a case-by-case basis and promised that more details on this will be provided.

However, it is important to note that those required to repay who did not do so by December 31, 2020 will need to pay tax on full CERB amounts received, which will then be adjusted after filing 2021 taxes.

3. The CRA released a repayment quiz to help Canadians understand whether or not they need to send back CERB amounts

With so much confusion still surrounding CRA repayments, the CRA has released a repayment quiz on the repayment page of their site to help Canadians determine if this applies to payments they’ve received.

It asks individuals to choose from the following situations that apply to their circumstances:

- Earned more income than expected during the time you received the CERB payment

- Applied for and got the CERB from both EI/Service Canada and from the CRA for the same eligibility period

- Applied for the CERB but later realized you’re not eligible

- None of the above

Since income criteria changed during the evolution of the CERB, those who select the first circumstance also need to choose the eligibility period that they may need to repay. It then asks about subsequent periods the CERB was received for and asks about earning amounts for those periods to determine if repayment applies. It is intended as a guide only, however, and does not automate the repayment process.

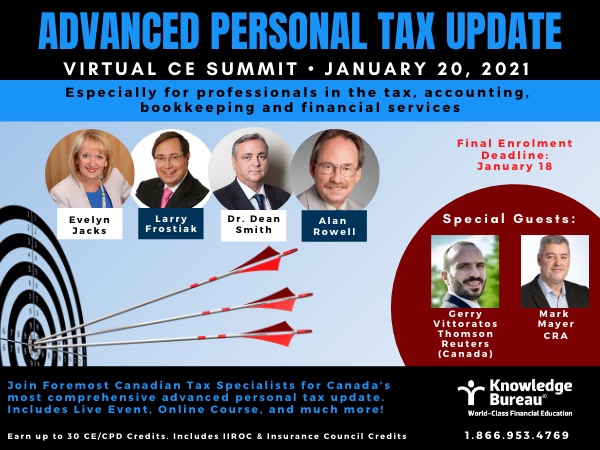

Additional educational resources: there’s no question that the upcoming tax season is going to be complex for many Canadians. Provide an essential service they need by enrolling in one of two educational options to enhance your tax training:

- The Advanced Personal Tax Update, Virtual CE Summit on January 20 which is accompanied by a comprehensive online course, and Knowledge Journal with line-by-line tax updates. Enrol by the January 15 early-bird deadline to save $100 on tuition.

- Get your credentials as a DFA-Tax Services Specialist™.