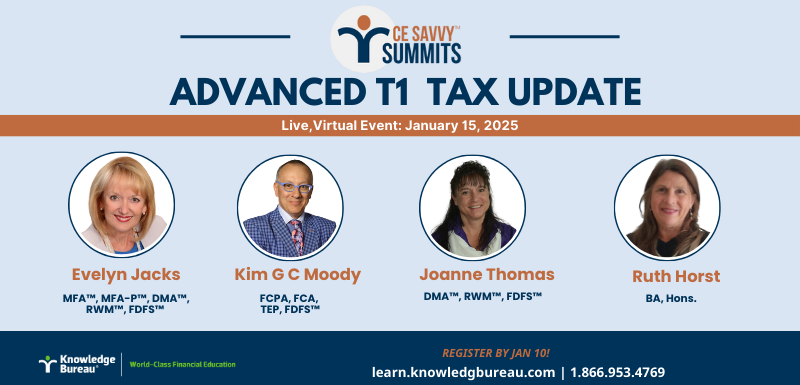

Register by Jan. 10: The 2025 Advanced T1 Tax Update on January 15

Learn with Peers from Coast-to-Coast at Canada’s renowned Advanced T1 Tax Update, plus receive the Knowledge Bureau ‘Tax Bible’. All Students Receive Our Comprehensive Line-By-Line Knowledge Journal, Online Tax Course, Evergreen Explanatory Notes Research Library, PLUS PowerPoint Presentations from Expert Presenters! This year’s lineup includes Evelyn Jacks, Kim G C Moody, Joanne Thomas, and Ruth Horst. We invite you to check out the detailed agenda, learn more about our illustrious speakers and register by Jan 10 for early-bird tuition savings!

Registration and details are available here!

Agenda Overview:

8:15: Grab a Coffee and Sign into the Virtual Auditorium, Follow the PPTs.

8:30: Evelyn Jack - Introduction to the Day: Your speakers, content overview, accreditation

8:45: Line-by-Line Tax Update: What’s New on the 2024 T1, Schedules and Forms

9:15: What’s New at CRA: Frameworks for Filing, Income Tested Benefits

9:30: What’s New at Finance Canada: Tax Theory Changes Behind the Lines

10:15: Communications and Refreshment Break

10:30: Ruth Horst - Focus on Income and Deductions for Employees

11:15: Ruth Horst - Focus on Retirement Income and Deductions

11:45: Lunch Break and Virtual Networking Showcase – What’s New?

12:15: Kim G C Moody - Focus on Capital Gains – Asset by Asset

2:30: Communications Break

2:45: Kim G C Moody - Focus on The Self Employed

3:30: Communications Break

3:40: Joanne Thomas - Real Wealth Management – Focus on Family Beginnings, Endings and Survivors

4:25: Closing Remarks and Grand Prize Winners

View the full detailed agenda online!

Meet the Speakers:

Evelyn Jacks, DMA™ MFA™, MFA-P™, RWM™, FDFS™

Twice named to the Top 25 Most Influential Women in Canada, Evelyn Jacks is one of Canada’s most prolific financial authors of 55 personal tax and finance books, many of them bestsellers.

She is a noted speaker on tax and financial issues and national commentator on federal/provincial budgets and elections, appearing regularly on regional and national media outlets including BNN, CBC, CTV and Global news. She is invited to write articles and blogs for national websites and media including the TMX Money site, Moneysense Magazine and the Globe and Mail’s Globe Advisor. She also appears regularly on national and province-wide radio to provide commentary and insights on federal and provincial elections, budgets, economic and financial issues of concern to Canadians.

Evelyn has been a catalyst and champion for tax and financial literacy through lifelong learning. As Founder and President of Knowledge Bureau, Evelyn has built the only multi-disciplinary educational institute to provide tax, accounting, bookkeeping and financial advisors a world class financial education leading to professional credentials and continuing professional development. By designing and developing online learning programs, publishing and learning platforms - 30 years before the 2020 pandemic - Evelyn has been a knowledge innovator throughout her career.

Kim G C Moody, FCPA, FCA, TEP, FDFS™

Kim G C Moody FCA, TEP, is a Chartered Accountant, Registered Trust and Estate Practitioner and a tax specialist practicing in Calgary. He is the Founder of Moodys Private Client Law LLP / Moodys Private Client LLP and Moodys Tax (a division of Moodys Private Client Law LLP). His main area of expertise is tax and estate planning for the owner-manager of private corporations, executives, professional athletes, and other high net worth individuals. Kim obtained his Bachelor of Management degree from The University of Lethbridge and his CA designation from The Institute of Chartered Accountants of Alberta in 1994.

Kim is driven to innovate new and better ways to do things for the clients he serves, the advancement of the firm, and other professionals in tax. His relentless obsession with getting to know everything in the Tax Act makes him a highly sought-out resource for peers and clients. Kim makes time to share his immense knowledge through writing, lecturing, teaching, and being an active, national leader in the tax profession. Today, he writes a weekly taxation column for the Financial Post.

Joanne Thomas, DMA™, RWM™, FDFS™

Joanne Thomas is the founder of Tax Link Canada. Joanne has been in the tax industry for over 25 years now. She is a DMA and an RWM and continues to update her education every year in order to better service her clients.

Joanne’s specialty is in advising and training businesses how to save on tax, streamline their operations to cut costs and increase sales. She is passionate about getting the best tax advantage possible for each client or business that she serves. Joanne also has extensive experience at “Tax Rescue”; which is helping business who have run into problems with their taxes or businesses that have not filed for years.

Ruth Horst, BA Hons

Ruth Horst is a former award-winning Liberty Tax Franchisee with over 26 years of success running multiple offices across Ontario with her business partner. Ruth attests that their greatest achievement by far was creating a culture within the organization where learning and excellence were valued. Staff were encouraged to increase their knowledge base with the ability to handle complex returns easily, and in turn increased their client base. Ruth enjoys learning and teaching, and the challenge of distilling complex tax concepts down to a level that anyone can understand.

Your Online Course – The Line-by-Line T1 Tax Filing Guide

Chapter 1 – What’s New on the T1

Chapter 2 – Changes to Tax Theory

Chapter 3 – Employment and Family Filing Profiles

Chapter 4 – Filing Returns for Retirees and Investors

Chapter 5 – Non-Financial Assets: Real Estate and Business

Did you know you can earn your Diploma in Advanced Family Tax Compliance when you achieve four CE Summit Certificates of Achievement? Jump in anytime; then learn the programs concurrently.

- January 15 :The Advanced Personal Tax Update Course

- May 21:The Advanced Retirement and Estate Planning Course

- Sept 17:The Audit Defence Course for Investors and Business Owners

- Nov 5:The Year End Tax Planning Course for Investors and Business

Get started today with Canada’s Tax School before the upcoming tax season!