Register by Feb 15 and Earn New Specialized Credentials as a Distinguished Master Advisor™!

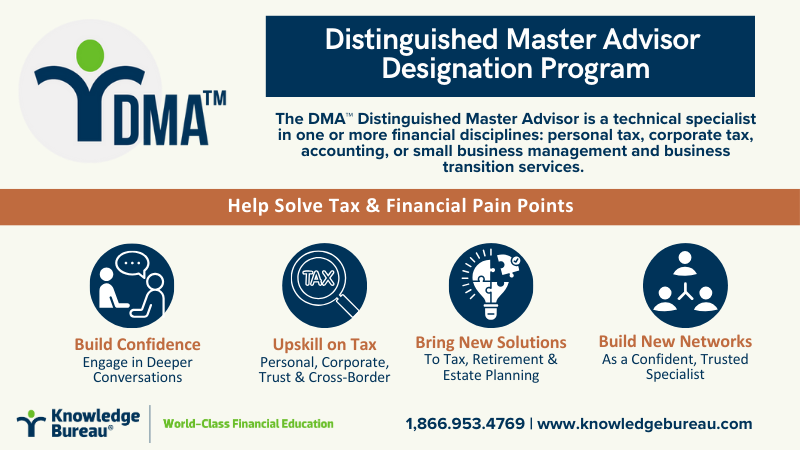

The DMA™ Distinguished Master Advisor is a technical specialist in one or more financial disciplines: personal tax, corporate tax, accounting, or small business management and business transition services. Register by February 15 to earn new specialized credentials that build confidence, bring new solutions and build new networks!

Our online certificate courses lead you down the educational pathway towards designation and new specialist skills. Ideal training for those new to the Canadian taxation system, or to give experienced professionals a refresher on the latest tax news and information. Looking to start a new career or upskill your team?

Register by Feb. 15 and save $100 off regular tuition in the DMA™ Program...Only $895 per single course (regularly $995) or $695 per course to take the full Designation Program. VIP Designates and Grads save even more! Tuition reductions will automatically be applied upon registration.

DMA™ Personal Tax Services Specialist

Learn all aspects of personal tax filing on a deep level for employees, investors, small business owners, seniors and families who experience life events including new births, new personal residences, snowbirding, disability and death. Offer confident, high value advice.

Course Curriculum

- Professional Income Tax Filing - Level 1

- Professional Income Tax Filing - Level 2

- Filing Proprietorship Returns

- Filing T3 Trust Returns

- Filing Final Returns at Death

- Cross Border Taxation

DMA™ Corporate Tax Services Specialist

Advance your career and guide clients through succession planning, valuations and transitions. You will be able to provide a superior level of service that will continue to pay off for your clients and your business.

Course Curriculum

- Corporate Tax Filing Fundamentals

- Tax Planning for Corporate Owner-Managers

- Tax Planning for Incorporated Professionals

- Investment Tax Strategies

- Succession Planning for Owner-Managers

- Tax in Asset Management