How Can You Help Canadians Recover from Financial Fallout?

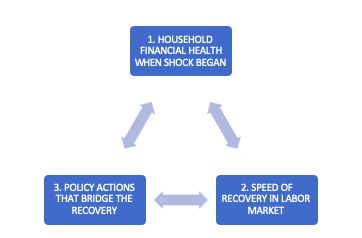

The true financial test on how well Canadians will weather the financial storm brought on by the pandemic will occur in the months to come. A glimpse into that future is well described in a June 2020 report from the Bank of Canada. It suggests three catalysts, working together, that can lead to successful financial recovery:

The three catalysts in the Bank of Canada report:

For financial intermediaries – the tax, bookkeeping and financial advisors that help clients with their financial affairs – there is a significant opportunity to proactively work on the “financial frontlines” clients who have been affected both positively and negatively by the pandemic lockdowns. In the process, it will be possible to deepen and expand relationships with other family members and strengthen referrals amongst the professionals working for the family.

These catalysts are now explained in The Financial Fallout Course now available to help tax, bookkeeping and financial advisors help clients recover from financial distress.

Get Access to the Financial Fallout Course

Throughout this course, we will discuss the financial fallout from the pandemic with these three points of view, zeroing in on the financial issues and trends that advisors and clients can focus on as this most unusual 2020 year comes to a close, and moving forward, what can be done to build financial bridges with the tools at our disposal to manage risks.

The New Comprehensive Knowledge Journal and Online Quizzes included with the Financial Fallout Course bring you up-to-the minute information you can use immediately to advise your clients. Access to EverGreen Explanatory Notes is included, too, with recommended topics to read. Students must complete the course by October 15, though it is recommended that you do so before the September 30 Virtual Event.

Learn more about the speakers and topics in the comprehensive online agenda.