Last updated: January 13 2021

Ear to the Ground: Financial Pros on Canada’s Economic Recovery

Beth Graddon

It turns out that the 74% of our December poll respondents who answered no to our question “Do you think that Canada is headed towards strong economic recovery in 2021?” were right: Canada is not yet poised for a strong economic recovery. We’ll report on some of their reasons why, but also take note of new economic data.

The Canadian economy lost 63,000 jobs in December; the first monthly decline since April 2020. Also in January, new lockdown rules and restrictions continue to affect companies nation-wide, especially small businesses But there may be some good news on the horizon.

This week’s more stringent restrictions in place in Ontario also mirror much of what’s been happening across the country during the second wave of the pandemic. The province’s second lockdown, which started on December 26, already had 1 in 3 small business owners stating that they would not survive, according to a CFIB report.

Now, under a new State of Emergency and Stay at Home Order announced yesterday for the province, which allows no small retailers to operate after 8pm (even for curbside pickup or delivery) there are even greater concerns, especially as big box stores appear to be exempt from this rule. It’s a situation that we will continue to monitor and report on in Knowledge Bureau Report.

In the meantime, here’s what you had to say about your expectations for Canada’s economic recovery heading into 2021. Specifically, when we asked, “Do you think that Canada is headed towards strong economic recovery in 2021, 74% of respondents in an audience made up of financial services professionals, said “no”. What were the reasons?

Here are some of the comments, and many of you voiced particular concern for small businesses and the important role that they play in Canada’s economy.

“Many small businesses (the ones that support the majority of the tax paying base) may not survive the new reality. Only those that are able to realign their business models may see growth but the national economy as a whole will take a lot more than one year to recover.” - Ron Y

“I don’t believe we will see any kind of recovery in 2021. So many small businesses, which are such an important part of our economy, are being prevented by lockdowns from doing what they need to do. When businesses can’t be open for extended periods of time, they will eventually be forced to close permanently. Then watch the economy fail! This all has the potential to be catastrophic for Canadians.” - Ron S

“Provided our biggest customer, the USA, can complete a transition to a new leader, and COVID subsides in both countries, Canada should be able to recover. There will need to be an appropriate balance between economic stimulus to specific industries including small businesses and financial prudence.” - Don & Marj Bieber

“Not likely. Government support programs has clearly masked the economic climate and we the taxpayer and our children cannot afford the spending” - Rick and Cindy Riffel

“The rest of us, with our children and grandchildren, will be picking up the pieces and paying for this so far into the future it is not possible to see where there might be an end to it.” - Mitzi-Lynne Morgan

“No hope of economic recovery when most of the country is in lockdown.” - Clint Wormsbecker

“Of course not! Economic recovery only happens when the citizens have confidence in the economy. Small business is suffering, badly, and is still the economic engine of the country. Businesses will fold, individuals will have reduced income, and a fear to spend.” – Alan Rowell

“How can a country that is spending so quickly see economic recovery? And if they continue to hold small businesses hostage while allowing large businesses and governments to continue without interruption they will decimate our economy once and for all. ” - Doris Woodman-McMillan

“I don’t believe that 2021 will bring much in economic recovery due to the fact that, at the time of writing this opinion, COVID-19 is still having a significant impact on our economy. I also believe that it will take some time for Canadians to regain confidence to resume to a pre-Covid life. I have a strong feeling that our government will make additional taxation demands (ie: increase GST/HST rate) that will further reduce the average Canadian’s buying power in 2021.” - Gaetan Arthur Ladouceur

“There will be some recovery, but “strong”, No! There is far too much uncertainty into the future to see that come about. It will take a couple of years just to properly assess what the implications are: medical, economic, social, political, and then move forward. Obviously, there will be some preliminary ongoing assessment, and this will spur some recovery. But in all, work in all these areas is a matter of art rather than science, to a greater or lesser degree. This pandemic is just too disruptive to expect a quick recovery. - David Prokopchuk

“Tax increases. Higher interest rates - as a result of defaults, not central bank policies. SME’s struggling and/or exiting businesses. More baby boomers drawing on retirement funds. What  could possibly go wrong?” - Gordon Wiebe

could possibly go wrong?” - Gordon Wiebe

“Economic recovery will be a long, long time. With all the federal spending and the ever-increasing deficit, it will be years if not decades to work our way out of this. Any recovery that might be achieved will likely be taxed back to the government to pay for the spending. This will leave Canadians in a worse financial state that before.” - Robert A Litschel

And, some comments that provide a little bit of optimism for these times:

“My first comment is that if the federal government doesn’t continue to spend the economy as a whole will certainly fail. There are aspects of our economy that haven’t skipped a beat through Covid-19, other than perhaps the slowing of delivered supplies, as well some are growing. Like after WW11 the government will need to be strategic in providing the plans and funding to launch our whole economy forward into a boom and I think this will happen. Providing we have a vaccine 2021 will be the start of something good.” - JoAnne Knapp

“Nothing has changed other than people are home with less opportunity to spend and more job loss. we are now at the lowest of spending by household, people are paying off debt. Those who are in debt and have lost their jobs, will suffer, it will be called an adjustment. Once everyone is out and participating, there will be new jobs, more spending and of course more revenue streams. This time in 2021 we will be back on track.” - Patrizia Cappelli

“The future looks bright.” - George L. Nate

Thank you to everyone who participated in our December poll. We would love to hear your thoughts about our January poll question: “Given the financial stress people are under during the second wave, should governments suspend audit activities and waive penalties and interest in 2021?”

Additional educational resources: The responses to our poll indicate that now more than ever, small business owners need support. Get the credentials you need to help in 2021 and beyond as an MFA™-Business Services Specialist.

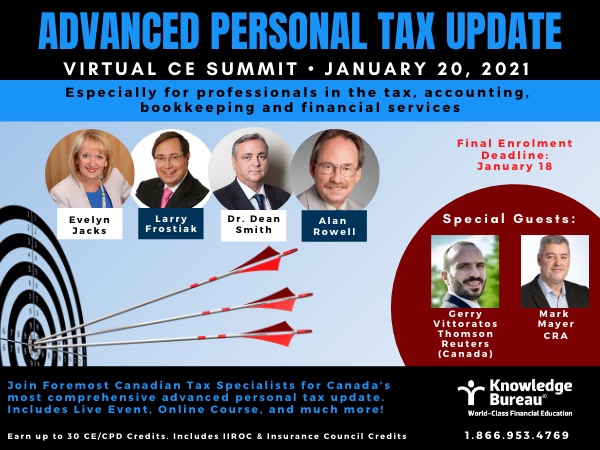

Tax services overall will also be an integral essential service this year, and our Advanced Tax Update, delivered both through a live CE Summit event on January 20 and a comprehensive online course will position you to help Canadians in need.