Preserving Income and Capital in Retirement

The Tax Efficient Retirement Income Calculator is a powerful tool that advisors can use virtually every day in almost any retirement scenario. The calculator provides an easy way to quickly see if a client is able to meet their after-tax retirement income goals based on any combination of income.

The calculator helps to determine the optimum combination of income sources for both today and in the future. The goal is to maximize after-tax income—the income you keep. If less tax is paid on income drawn in retirement, then less income is required to be withdrawn to meet the income goals. This allows the advisor to design a lower-risk portfolio and to preserve capital and purchasing power over time.

Client Scenario

Jack and Diane are 66 years old and live in BC. They have access to CPP, OAS, investment income, and income from their RRSP. They have not converted their RRSP to a RRIF as of yet.

-

$8,000 each per year in CPP.

-

$6,640 each per year in OAS.

-

Other Income

-

$50,000 per year in investment income (dividends or interest)

-

$50,000 per year from the RRIF

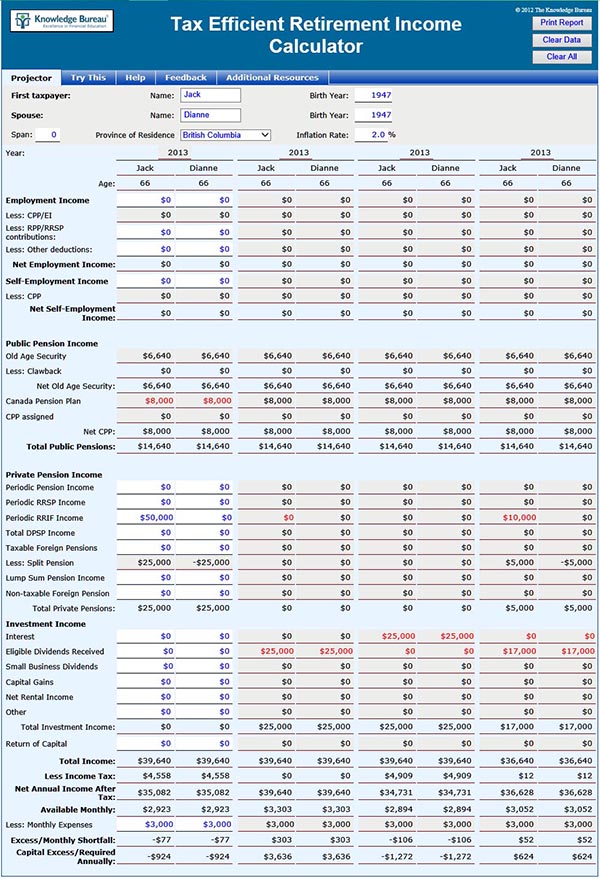

Let’s explore whether they should receive $50,000 in investment income or RRIF income. First, we’ll use a span of “0” giving us four current-year scenarios. Assume monthly expenses are $3,000 per month each.

Option 1

In the first set of columns, we’ve entered the CPP and defaulted OAS for the couple. We’ve also entered the first option: $50,000 RRIF income. The calculator automatically splits the RRIF income between the spouses (using the election to split pension income) and shows us that each spouse will pay $4,558 in taxes and fall slightly short of the income goal ($77/month shortfall each).

Option 2

In the second set of columns, we’ll zero out the RRIF income that was automatically copied over and enter $25,000 dividend income each. The calculator shows that neither spouse will have to pay any taxes on this income (the dividend tax credit offsets the taxes payable on the dividend income and the personal amounts offset any taxes on the OAS and CPP). In this scenario, the spouses have an excess of $303 per month each. This is a significant improvement over the RRIF scenario.

Option 3

In the third set of columns, we’ll zero out the dividend income that was carried over and enter $25,000 each in interest income. With this income, each spouse will have $4,909 to pay in taxes and show a shortfall of $106 per month. Clearly worse than the dividend option and worse than the RRIF option.

Option 4

In the last set of columns let’s look at a combination of income sources and the amounts needed to meet the income goals. With the retirement savings in a RRIF, a minimum amount will have to be withdrawn each year. Let’s assume that Jack needs to withdraw $10,000 from his RRIF. What other sources of income should be added—more RRIF, dividends, or interest? Well, since the dividend scenario seemed to be the better option, let’s add dividend income to each spouse until the income goal is reached. At $17,000 dividend income each (in addition to the $10,000 RRIF income), income taxes total $24 for the couple and they have $52 excess income monthly.

Summary

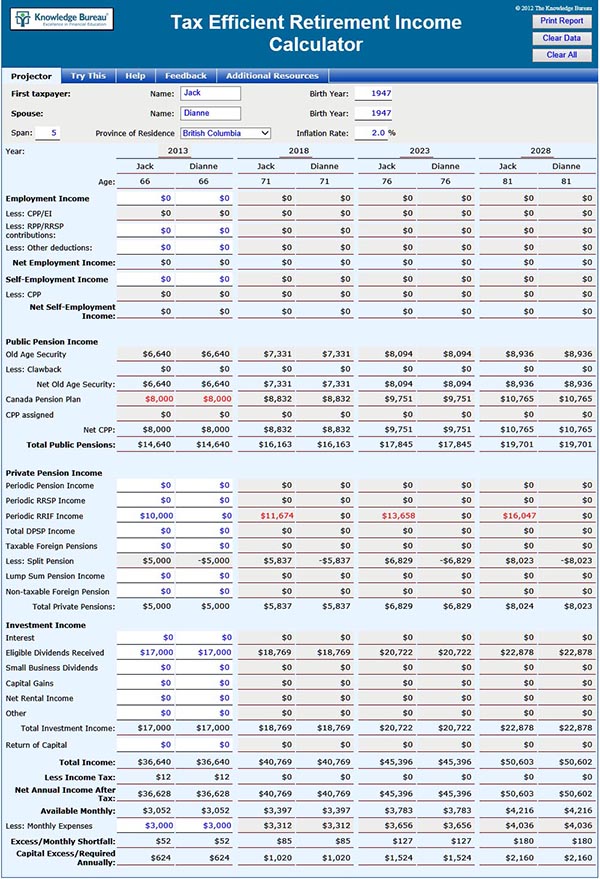

In the scenario above, we looked at options for one year. We did this by setting the span to 0 years, thus giving us four scenarios for 2013. If the span is set to a larger number, we can plan for a longer period—up to the entire retirement period if desired.

For example, using a span of 5 years, copying the income from the last column in our last example and allowing the calculator to project forward (using 2% inflation and adjusting RRIF income for minimum withdrawals), we see the following projection for income over the next twenty years.

Because the RRIF withdrawals exceed the inflation rate, the couple has a slightly higher excess each year.

This powerful calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.