Last updated: February 29 2024

Perplexing Tax Law: Denying Tax Deductions on Non-Compliant Short-Term Rentals

Evelyn Jacks

Short term rental ownership has doubled from 7% to 15% in the period 2017 to 2021. The federal government plans to deny tax deductions otherwise claimable to reduce income earned in the case of non-compliant short term rental owners starting in the 2024 tax year. This measure introduces significant complexity to an already perplexing tax regime for real estate owners and their accountants at a time when the outlook for growth in this market may be subsiding. Here’s what we know and why there may be a good argument for scrapping this tax entirely:

The Parliamentary Budget Officer (PBO) reported in February that he believes the new measures will generate an estimated $170 million in the next five years, but admits increases in the revenue outlook for short term rentals is poor going forward, given new restrictions, not just federally, but provincially and municipally as well.

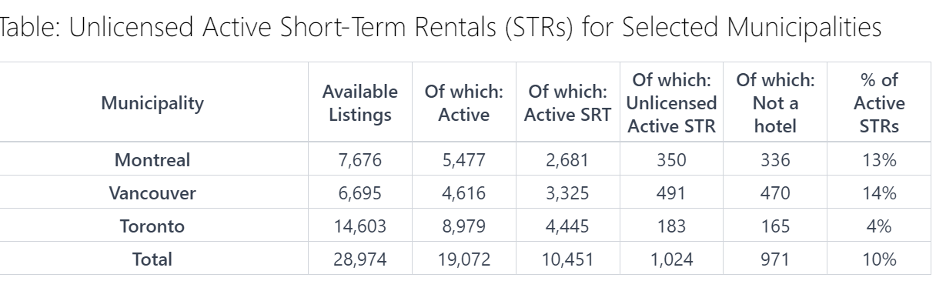

In addition, the information for the estimation of this revenue source is incomplete, by the PBO’s admission. They were only able to assess licensing status for AirBnB but no other platforms. Using data from this platform, it showed a 10% non-compliance factor in three cities as shown below.

The PBO assumed this same rate of non-compliance exists elsewhere in making the revenue estimates. It also relied on an interesting study from Statistics Canada on why and where the incidence of short term rentals has grown, and is particularly strong in tourist locations like Muskoka, Banff, Whistler or PEI.

However, the amount of expense deductions being taken could also not be accurately identified for the purposes of estimating tax revenue gains from the new tax measure, again due to lack of data. The PBO noted that any increase in tax revenues due to the new measures could also be much lower than anticipated if owners hadn’t previously reported income or if CRA could not accurately identify the short term rentals that are non-compliant.

And therein lies the problem: good tax law is certain, making it easy for taxpayers to comply and as important, want to comply because the tax is viewed as fair and equitable. This tax law is  neither certain, fair or equitable. Think about it: others who break the law renting out their properties for a variety of illegal purposes will continue to be able to write off their rental expenses.

neither certain, fair or equitable. Think about it: others who break the law renting out their properties for a variety of illegal purposes will continue to be able to write off their rental expenses.

Worse, though, is that this tax law that will potentially apply across the board to all rental property owners. Why? Because the burden of proof is on the taxpayer, not the CRA, to show they are compliant with their local laws.

Will the cost of audit activity wipe out the loosely estimated revenue gains projected by the PBO? Only time will tell.

In the meantime, all short term rental property owners need to shore up their documentation for potential tax audit down the line and of course that will include a copy of local licensing to make money from rentals that are less than 28 days.

That makes this tax a bad tax. Do you agree? This will be the subject of our March poll. Please weigh in next week on the following question: "Starting January 1 ,2024 there will be no expense deductibility from rental income earned by non-compliant short term rental owners. Do you think this is a good tax law?"