Payroll Deductions: A Tax on Labor

By definition, payroll remittances are mandatory statutory deductions withheld from an employee’s pay by an employer for the purposes of funding government programs. But are they a tax? The answer is yes, and this is why:

First, they are mandatory. Neither the employer nor the employee have a choice in the matter. Further, they are an important source of revenue for governments used to fund the Employment Insurance (EI) and the Canada Pension Plan (CPP).

Yet, neither of these income sources are guaranteed to be returned to the contributor or their survivors. This is contrary to private savings held in investment accounts, registered or non-registered, which can be passed to survivors. Consider these realities:

- Single workers who die before tapping into the CPP (retirement or disability benefits) will receive only the $2500 lump sum death benefit in their estate, nothing more.

- Married worker, two kids and a spouse. At age 60, kids are grown, the wife, a homemaker, has passed away. What will CPP pay when he dies? Only a $2500 lump sum – nothing more for his survivor pension after 40 years of working and paying more than $20,000 into the plan.

Payroll source remittances are also described as a tax by the OECD in their recent paper, Taxing Wages 2022. In it, the concept of a “tax wedge” and a “net average tax rate” are defined in conjunction with this; it is clear, payroll taxes are a tax on labor.

The Tax Wedge. The OECD describe taxes on labor (the tax wedge) to include taxes paid by both employer and employee as well as personal income taxes, less family benefits paid. They found in Canada:

For Single Workers

- The tax wedge for the average single worker increased by 0.6 percent from 30.9% to 31.5% in 2021. The average tax wedge in the OECD was 34.6%.

For workers with families (one earner, married, two children)

- Canada had a tax wedge of 20.4% in 2021, compared to the average of 24.6% in OECD member countries

Net Average Tax Rates. Canadian workers, however, pay a high net average tax which measure the net taxes paid directly by employees only (personal income taxes and employee payroll contributions less family benefits)

- For single workers: 25.1% compared with OECD average of 24.6%. The take home pay after tax and benefits was 74.9% of gross wages compared

with the OECD average of 75.4%

with the OECD average of 75.4%

- For average married workers with two children: The net average tax is 13%, which compares with 13.1% for the OECD average. This worker takes home 87.0% of gross wages compared to 86.9% for the OECD average.

When all taxes are considered, Canada has higher personal and corporate income profits and capital gains taxes, payroll taxes, and taxes on property than the OECD average.

This has economic consequences for both employers and employees. For employers, for example, the cost of the payroll taxes can affect the opportunity to provide increased wages or hire more staff, which can affect the opportunity to offer wage increases, inflation adjusting or even cause the reduction of staffing due to these new costs.

And there is a non-deductible penalty if they are remitted late: 3% if one to three days, 5% if four or five days, 7% if six or seven days and 10% if more than seven days late, or if no amount is remitted.

On the employee’s side, increasing statutory deductions shrinks take home pay. There is less money to pay for necessities that cost more due to inflation, to stay out of debt, and to save for the future.

Further, employees only get a partial tax reduction for their CPP costs and their EI costs. As both are fully taxable on receipt, it would seem fairer to allow a full deduction for the premiums in both cases.

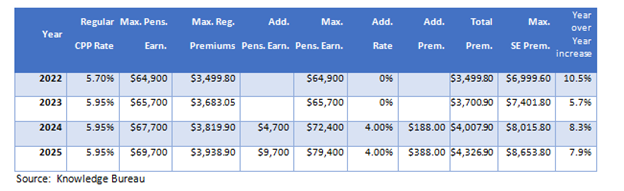

In the case of the CPP, premiums have been rising well above the cost of inflation for some time; and continue to rise (2024-2025 numbers are estimated):

The increased premiums will be used to fund an increase in benefits payable later in retirement, from one-quarter of pensionable earnings to one-third. The first enhanced benefits are expected to start in November 2022.

But it’s important to note the worker must contribute for 40 years to get the promised one third of their maximum pensionable earnings as a benefit. Those currently approaching retirement, therefore, will see little in return for their enhanced premiums.

Bottom Line: Statutory payroll deductions do provide some benefits to some people, but, these are taxable benefits and contributions are neither guaranteed nor do all premiums paid pass on to the family. Increasingly, rising statutory deductions remove dollars that could otherwise be invested in tax exempt or deferred plans, and with that, that time value of tax-advantaged savings. In retirement, the tax paid on the benefits received contributes to a loss in future purchasing power.

And that’s too bad, because most Canadians will not be able to count on the CPP to fully fund their retirement or the EI benefits to cover their cost of living. They will need to save more for both eventualities.

To learn more about these tax issues—consider: Advanced Payroll for Small Business. Advanced Payroll will help you become a more astute compliance manager that prepares accurate payroll, who understands the necessary requirements of an employer, federally and provincially, and who can meet the demands of an evolving digital workforce.

Additional Educational Resources:

CONTINUING EDUCATION

- November CE Summit Register by October 14 to save $50

- Check out the course Business Contracts: The Basics which covers basic contractual theory. You will learn the elements necessary for the formation or creation of a binding contract, the validity, and difficulties of a verbal contract and how a written one is always preferable, and how courts treat ambiguous language.

SPECIALIZED CREDENTIALS

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

WORKPLACE TRAINING

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

Evelyn Jacks is President of Knowledge Bureau, a national designated educational institute focused on World Class Financial Education. For information about certificate courses leading to specialized credentials see www. knowledgebureau.com or call 1-866-953-4769.

©Knowledge Bureau, Inc. All rights Reserved