Last updated: October 12 2022

Options? The Challenge of Rising Prices, and Cost-Push Inflation

Ian Wood, CFP, CIM, MFA-A

Inflation continues to be top of mind for most of us as we see prices increase at the grocery store, gas station, and pretty much everywhere else. Advisors and clients can build out defensive strategies with a better understanding of inflation in today’s context; the subject of this, the first of a three-part series.

In this article, we’ll discuss common measurements of inflation and major causes of inflation. In Part 2, next week, monetary and fiscal policies that are affecting inflation will provide more insight into what is to come. And, in Part 3, we will consider strategies to help alleviate some of the pain points from rising prices now and into 2023. Let’s get started!

Here’s an important first point: although inflation rates in Canada have started to come down (7.0% in August 2022 versus 8.1% in June 20221]), it’s important to remember that the rate at which prices are rising is slowing down; not necessarily that prices are necessarily falling to where they once were.

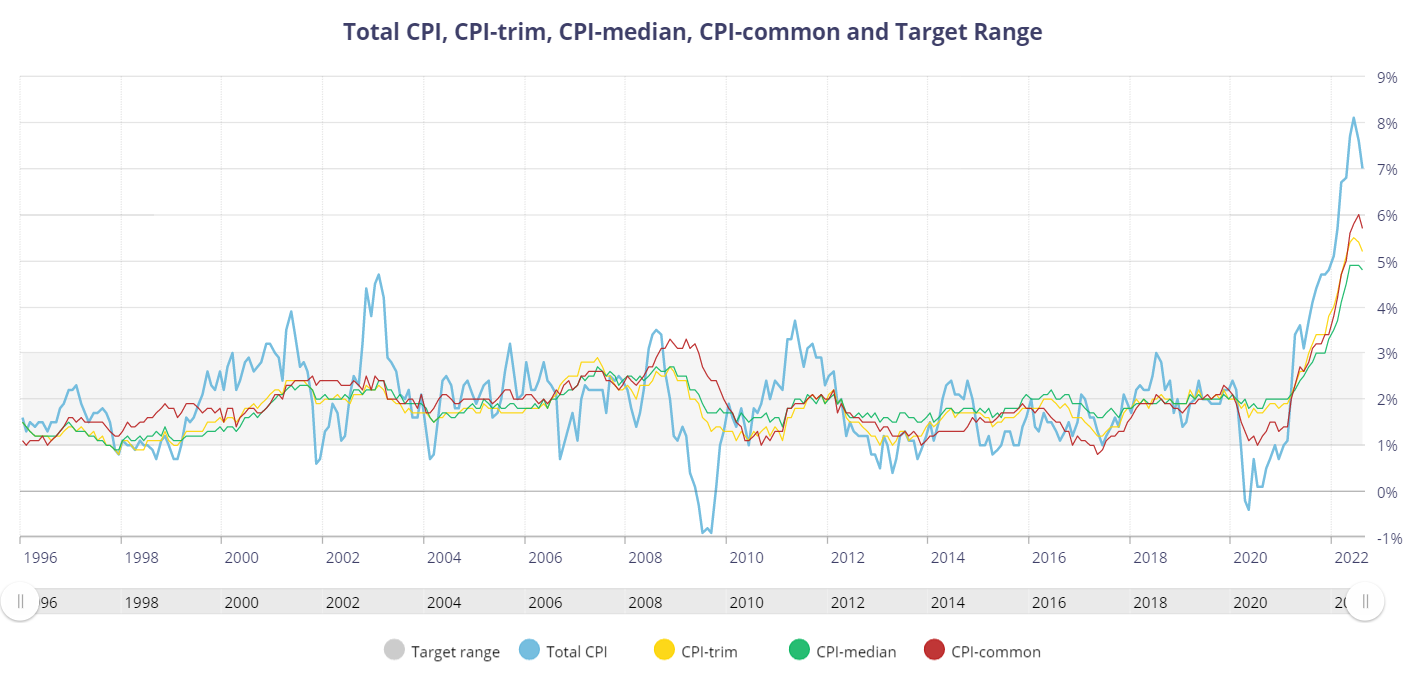

Prices are still rising much faster than they have for a long time and well outside the Bank of Canada’s target interest range (1-3%) as you can see in the chart below[2]. This is the difference between disinflation (the decrease in the rate of inflation we can see between June and August) and deflation (the decrease in prices, i.e., negative inflation last seen in May 2020).

The increase in prices can be broadly attributed to three main causes:

- The normal rise in prices the central banks target (1-3%)

- Cost-push inflation due to supply shortages

- Government spending increasing demand-pull inflation while also devaluing the currency by significantly increasing money supply and the Debt-to-GDP ratio.

Cost-push inflation is caused by the underlying costs of a business increasing. This could be a combination of rising costs due to commodities, supplies, labour, taxes, etc. Generally, cost-push inflation is undesired by consumers, but will generally work itself out over time as businesses and consumers adapt to the new environment and new efficiencies are discovered for production and transportation, which reduces to costs to businesses and therefore less costs pushed onto consumers.

As prices rise, employees demand higher pay to keep up with the cost of living. The phenomenon is logical and well recognized. In fact, we can go all the way back to Adam Smith’s The Wealth of Nations in which he discusses the difference between the value of labour and the value of money.

“A man must always live by his work, and his wages must at least be sufficient to maintain him.”[3]

Smith discusses the tighter correlation of the costs of sustenance with the costs of labour than the amount of money which was exchanged for the labour to purchase such sustenance. That is to say, wages tend to adjust with the cost of living.

Because labour costs are often a major expense for businesses, this causes prices to rise again due to cost-push inflation, and the cycle continues. Because labour generally only represents a portion of overall costs, the recursive impact of each iteration is decreased, so the cycle is not necessarily infinite; however, the cyclical nature of the increases in costs is proportional to the impact for the business and can be significant.

The recursive impact of each iteration is decreased, so the cycle is not necessarily infinite; however, the cyclical nature of the increases in costs is proportional to the impact for the business and that can be significant[4].

Bottom Line: Inflation is higher than what we’ve seen for decades, and one of the main causes for rising prices is cost-push inflation caused by shortages in commodities, labour, and supplies. That makes this a financially painful period for consumers, businesses and investors; one which requires a rethink of household and business budgeting, investment and retirement strategies.

Next time: The Government of Canada has been acting through fiscal and monetary policy to affect the rate of inflation. What have they done, and what possible motivations might they have to allow higher-than-normal inflation to stay in place?

[1] Statistics Canada (2022-09-20). Retrieved from Consumer Price Index: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1810000401&pickMembers%5B0%5D=1.2&cubeTimeFrame.startMonth=01&cubeTimeFrame.startYear=2021&cubeTimeFrame.endMonth=08&cubeTimeFrame.endYear=2022&referencePeriods=20210101%2C20220801

[2] Bank of Canada (2022-10). Retrieved from Key Inflation Indicators and the Target Range: https://www.bankofcanada.ca/rates/indicators/key-variables/key-inflation-indicators-and-the-target-range/

[3] Smith, A. (2013). The Wealth of Nations. Padstow: Wiley

[4] This recursion is one of the reasons that opponents of minimal wage increases argue the benefits will be less than implied by the proponents of such plans, but that’s a topic for another day

The Bank of Canada website provides definitions for the four versions of CPI (Consumer Price Index) illustrated in the chart, this article is referring exclusively to Total CPI.

Additional Educational Resources:

CONTINUING EDUCATION

- November CE Summit Register by October 14 and save $50.

- Check out the course Advanced Payroll for Small Business - this course takes the student through the completion of a full payroll cycle, compliance regulations and expectations, accounting for statutory and non-statutory deductions, taxable and non-taxable perks and benefits, and year-end preparation.

SPECIALIZED CREDENTIALS

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

WORKPLACE TRAINING

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

©Knowledge Bureau, Inc. All rights Reserved