Last updated: September 30 2013

Optimize Cash Flow

When family situations change—whether by design or happenstance—cash flows are often affected and adjustments must be made to either find new sources of cash or to make existing income sources more tax efficient thereby increasing after-tax cash flow.

The Cash Flow Calculator is designed to first analyze current and future cash flows and then plan how to increase after-tax income to maintain the family’s standard of living or to meet family goals. The process is best illustrated with an example; in it we’ll look at how to adjust income sources after a forced reduction in income to maintain after-tax cash flow.

Example

Jim Simpson lives in Ontario. He

- was recently told by his doctor that he had to decrease his duties at work to 50% of his current workload due to his accident at work;

- has a disability policy that will cover only 50% of the after-tax loss of income as this is what he will lose;

- had a gross annual income prior to his injury of $80,000;

- owns a rental property that brings in $1,000 net per year after expenses;

- currently has a $200,000 cashable GIC with a 1% annual return;

Jim wants to find a way to bring his after-tax cash flow after the accident up to its pre-accident level.

Jim had hoped that the rental property would increase in value but the recent poor housing market has caused the value of the property to stagnate. His equity in the rental property is currently $60,000.

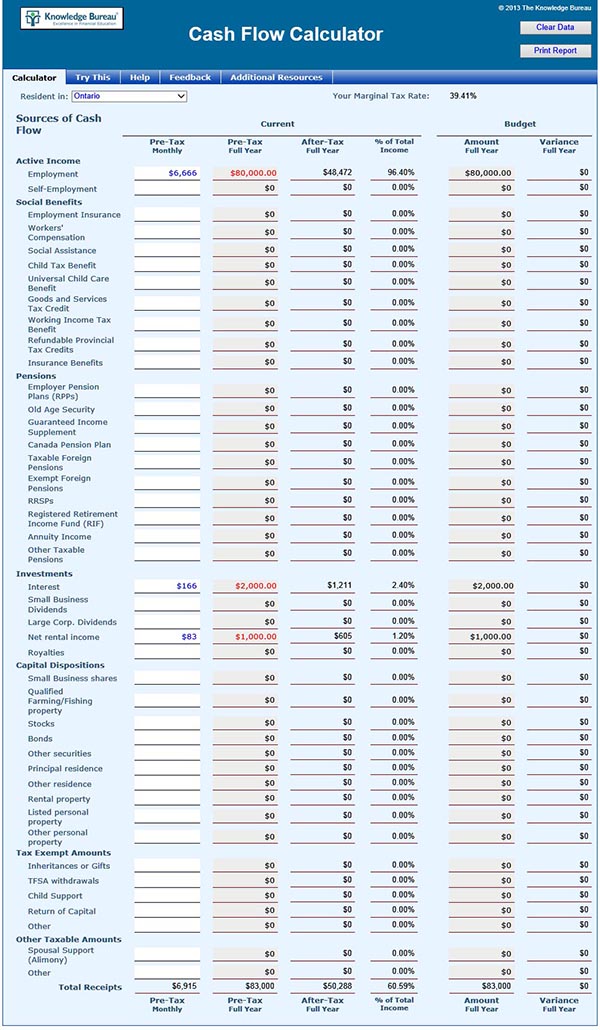

First, looking at his cash current cash flow, we see:

Jim’s gross annual income is $83,000 and after-tax, his annual after-tax cash flow is $50,288.

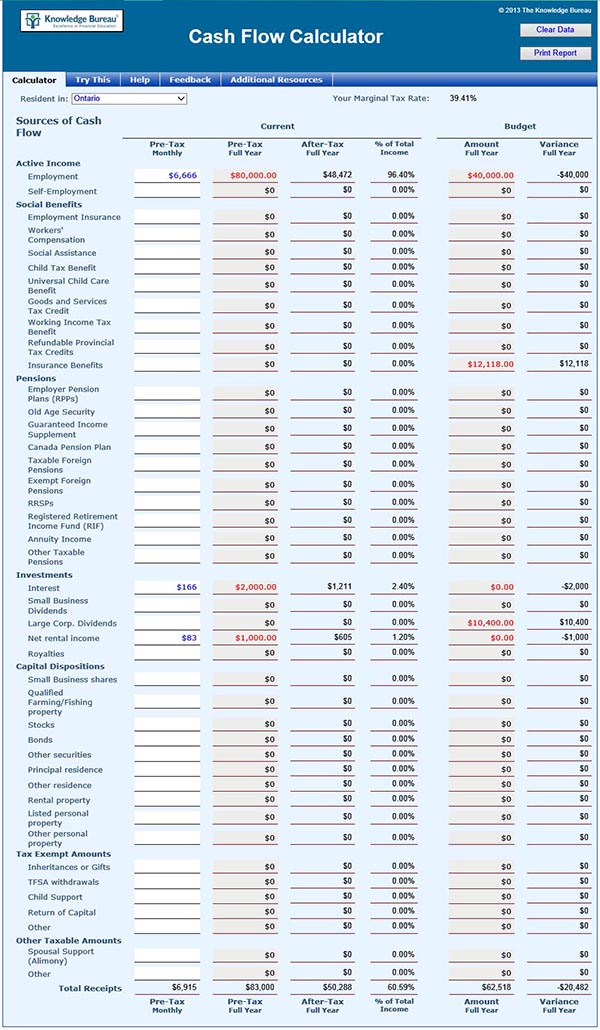

Once Jim goes on his disability his income sources (before adjustment) will consist of $40,000 employment income, $2,000 interest, $1,000 rental income plus non-taxable disability payments of $48,472 /2 x 50% = $12,118. He’ll save $7,882 in taxes but his gross income will still be shy about $12,000. Jim’s advisor suggests the following changes: Sell the rental property (it’s only netting 1.67% return on equity and the income is fully taxable) and cash in the GICs that are currently returning 1% fully-taxable income. The proceeds ($60,000 + $200,000) should be invested in a dividend fund that is currently returning 4%. His dividend income will be $10,400 and be taxed at a lower rate.

Putting the results of this plan into the Budget columns in the calculator shows:

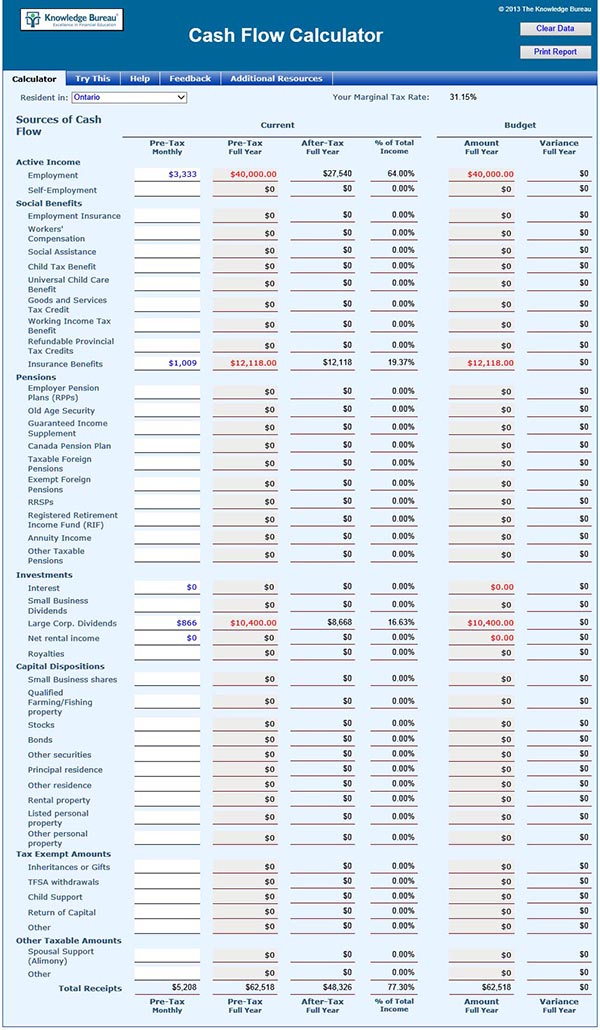

Despite the adjustments, his gross income still decreases by more than $20,000. However his new income sources are more tax efficient. To find out his after-tax cash flow, the income will have to be copied to the current columns. Doing so, we see:

Jim’s after-tax cash flow has decreased from $50,288 to $48,326. This decrease of $1,962 per year or $163.50 per month may well be offset by decreased personal expenses due to reduced work hours. If this reduction is not acceptable, the plan will have to be further amended to either find another source of income or choose an investment with greater returns (and likely greater risk).

The Cash Flow Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.