OECD: Canadian Taxes Are High, But Unemployment is a Bigger Issue

Evelyn Jacks

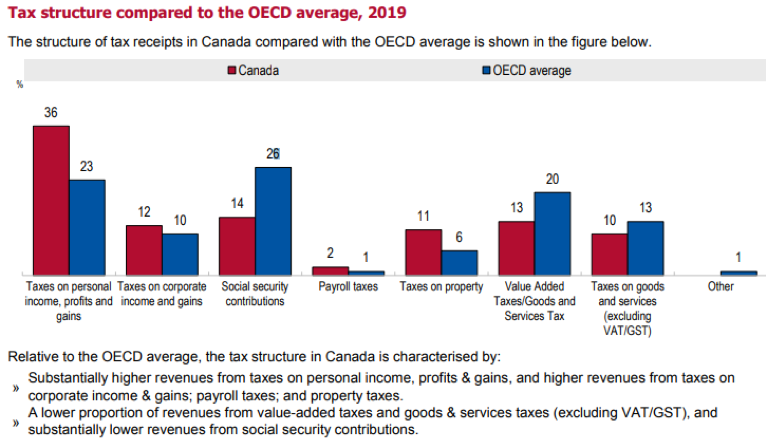

Canadian taxpayers pay substantially higher taxes on personal income, profits & gains, corporate income & gains, payroll taxes and property taxes than the Organization for Economic Cooperation and Development (OECD) average, based on 2019 statistics. Reflecting the environment prior to the pandemic, Canada’s economy was doing well and unemployment was at 5.7% - the lowest annual level on record at that time, according to Statistics Canada. Women and working boomers seem to have suffered the most fallout from the pandemic, but GenXers were not immune to the economic pain either.

First to the OECD Study: It’s important to bear in mind that the high gas prices recently experienced are not reflected here.

Now to the pandemic statistics. According to Statistics Canada’s July 2022 study, 69.6% of Canadians received employment income in 2020, down 0.4 percentage points from a year earlier. The median employment income was $37,200, which is down 2.1% from 2019.

Looking closer, however, the Stats Canada information sheds important light on individuals who have suffered more economic fallout:

- About 66% of Canadian women received employment income in 2020, down 0.5 percentage points from a year earlier. However, their median employment income fell 2.4% to $32,000

- Just under three-quarters (73.4%) of Canadian men received employment income, down 0.2 percentage points from a year earlier.Their median employment income fell 2.7% to $43,200. (This is $11,200 or 35% more than the median income made by women)

- In April 2022, Statistics Canada reported new data from the 2021 Census that highlighted the aging of Canada's workforce. In 2021, more than one in five (21.8%) Canadians of working age were aged 55 to 64, the highest share ever recorded in a Canadian census. But these workers were disproportionately affected by the pandemic. The share of 65-year-olds receiving employment income fell for both men and women by 4.4 per cent. The median income fell more significantly for men - 32.2% - and 23.8% for women.

- GenXers receiving employment income felt the pain as well.Employment income for those age 55 to 64 fell 2.9% for women and 2.0% for men from 2019 to 2020, while median income fell less for women - 5.2% - than for men – 6.6% in this age group.

But there was also good news for lower income earners: there was a 14.4% reduction in income inequality in the period 2015 to 2020 – the largest decline of any five-year period since 1976. This was largely due to increased government transfers which mostly benefited working age people. The Canada Child Benefit increases also helped.

Bottom Line: With both taxation and inflation at high levels, it is increasingly expensive to live and work in Canada. Coming out of the pandemic, several issues need to be addressed to manage financial fallout: the increasing costs of a large aging population which up to now has driven much of the tax revenues prior to their impending retirements, while at the same time, how a smaller taxpaying base can keep up the supports required to keep income inequality at bay.

Stepping up tax and economic education is certainly a part of that solution, as individuals responsible for their economic futures grapple with important financial decision-making in these changing times.

Additional educational resources:

Check out a modern new educational experience from Knowledge Bureau, designed to enhance your business skills at learn.knowledgebureau.com. This second Virtual Campus focuses on an expanded curriculum of short professional courses available by subscription, especially designed for entrepreneurial advisors in search of both technical and business education.

- The Amplify Series features short courses for pros, known as CE Savvy PD™. There are both verifiable and non-verifiable options. On the verifiable side, advisors can choose courses from wealth management topics, tax topics and digital advisory services. On the non-verifiable side, it is possible to enrol in a comprehensive tax research library, known as EverGreen Explanatory Notes, which features issues and answers of interest to advisors dealing with complex tax and financial planning issues. Also available are the Knowledge Bureau Discovery Calculators, which feature complex tax-efficient planning scenarios and explanations.

- The Accelerate Series features business know how for new entrepreneurs, those looking for ways to scale their existing enterprises or improve their business leadership skills. This series is also provides an ideal way to help clients with their financial literacy skills. Five new courses are added each month, making the subscription option especially valuable for those who want to continually improve their personal business skills.