November CE Summits - RSVP by October 31: A Significant Tax Filing Deadline

Investors in residential real estate – both non-residents and some Canadians - must file their first UHT return by October 31. Beyond this, a small but important window is available to prepare individuals, trusts and private businesses for new tax eroders before the end of 2023. For these reasons, Knowledge Bureau is presenting four important professional development days – November 1, January 17, 25 and 26, accompanied by new online micro-course collections. Details below.

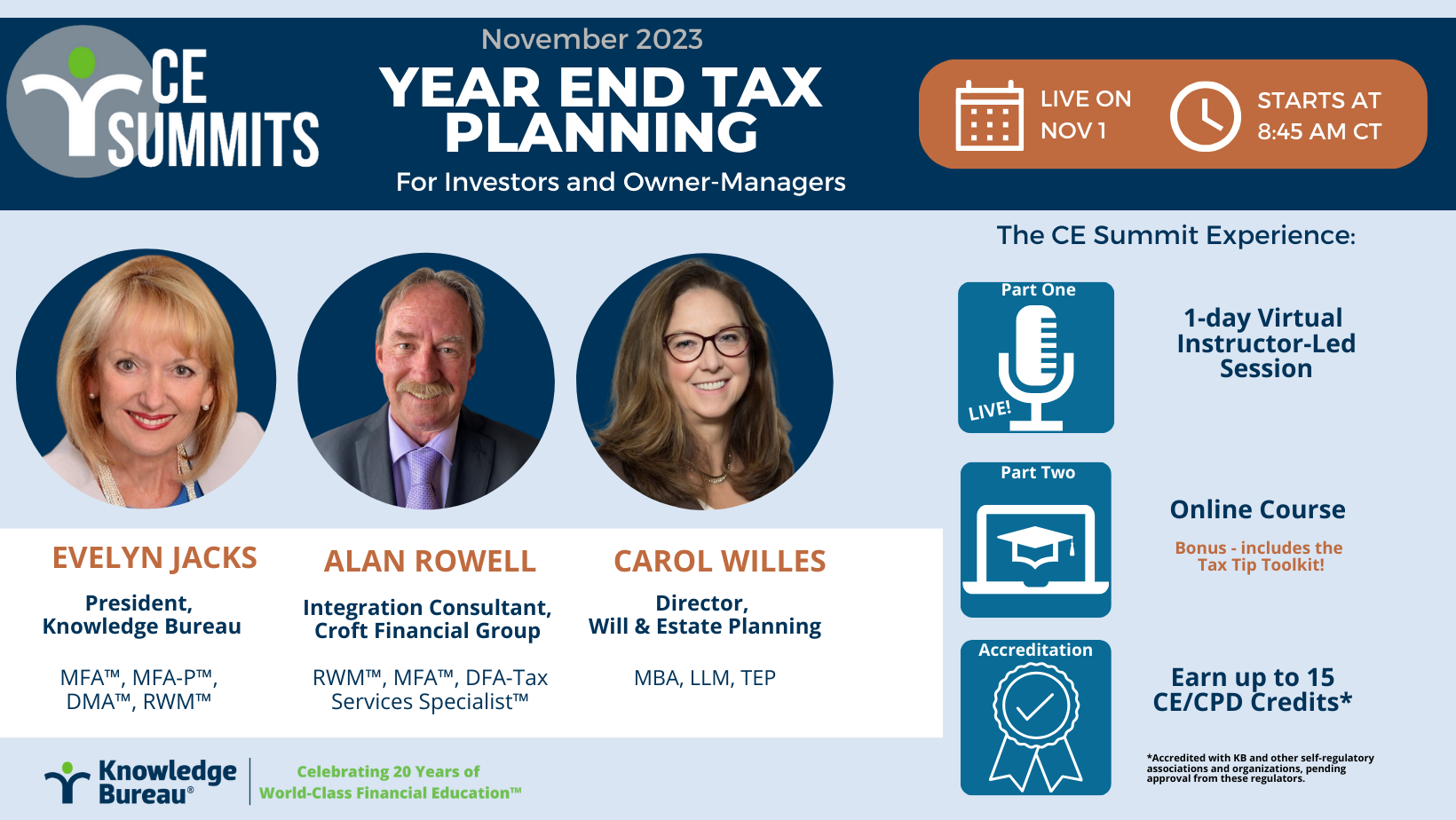

“We are pleased to bring a comprehensive overview of the significant new tax filing requirements starting with the November 1 Virtual CE Summit, which starts at 8:45 CT. The day features individual, business, retirement, and new trust filing news professionals need to discuss with clients well before year end,” says Mrs. Jacks. The day begins with an economic outlook for fall 2023 and follows with:

Year End Tips and Traps for Investors

- A new definition of Tax Planning

- Education Planning: RESPS & CESGS, Canada Learning Bond

- Planning for Disability: Registered Disability Savings Plan (RDSP)

- Emergencies: The Tax-Free First Home Savings Account (FHSA)

- Preserving Capital: Transfers of Income , Assets to Spouse

- Intergenerational RRSP Planning, Tax Credits and Benefits

- Rental Properties: Managing UHT obligations

Tips and Traps for Business Owner Clients:

- Don't rule out December 31:The fine details behind the CEBA loan extension

- Managing Tax Debt and final tax instalments

- Understanding Increases To Auto Expense Limits on Passenger Vehicles

- CCA – Accelerated Expensing, AIIP, Phase-outs

- Planning for the new Second Tier CPP Premiums in 2024

- Implementation of Genuine Inter-Generational Transfers

Next are the avoidance of penalties from auxiliary tax returns: the new UHT as well as returns to report excess contributions to registered accounts like the new FHSA, RRSP and TFSA accounts. A review of the rules using a “life of investment” approach, will provide guidelines for determining the ideal contributions and perhaps most importantly, detours around the over-contribution problems that can arise. Become acquainted with the RC243, RC727, T746 and T3012A forms. Find out what CRA does to update records and communicate on how these circumstances affect contribution room. In particular, what are the tax traps in the year a client turns 71 and 72? What are the proposed changes to RIF withdrawals to add tax intrigue to the equation? Learn the answers in this informative session.

January 1, 2024 marks an important date for tax hikes: CPP premiums go up with a second “enhancement” but in addition the new AMT is proposed to come into affect and this will impact the sale of many businesses or property, as well as making donations. In addition, there are new rules for intergenerational transfer for small business, farming and fishing operations. Does it make sense to trigger gains in 2023 to minimize AMT? Or with the indexed increases to the capital gains deduction for small business owners does it make sense to holdover the transaction until 2024?

Next up is a critical discussion about new trust tax filing compliance rules. Find out more and why so many of your clients may not be aware that they must file trust returns for the first time. Then review a new approach to philanthropic planning, especially for business owners and anyone who has experienced a tax event. You will learn to extend time to choose charitable recipients, gain flexibility to change charitable recipients, spread gifts over time, and receive annual donation receipts. Learn more about the importance of philanthropic client conversations, what strategic philanthropy means, the basic math of philanthropy, charitable donation timing and philanthropic structures including:

- Insurance

- Beneficiary designations

- RRIF deregistration

- Private foundations

- Donor Advised Funds

- Charitable testamentary trusts

- Charitable remainder trusts

This is followed by an interesting discussion on orchestrated estate outcomes. Understanding the importance of coordinated structuring will avoid the costly mistakes created by disjointed advice. Learn about the tax savings available for clients using the GRE designation and the pitfalls that are so easy to stumble into. Clients want to ensure their personal, family and business’ financial affairs will be efficiently handled on death and are sensitive to the amount of tax and probate payable on their death. Coordinated advance planning will facilitate the best results with proper liquidity planning, business agreements, identification of skilled executors, the use of agents and skilled will drafting. Learn more about how to:

- minimize exposure to professional liability

- structure comprehensively for optimal estate outcomes for business owners

- identify stakeholders and best practices to assist and protect them

- maximize the end-of-life net worth statement

- understand what is and what is not a Graduated Rate Estate (GRE) and how to use it to the best advantage for the deceased’s estate tax situation.

Finally, the Society of Real Wealth Managers will lead an important discussion on the effect of Artificial Intelligence on the future of your practice.

Don’t miss this important professional development day! Then be sure to reserve you seat at the January Advanced T1 Tax Update to be held virtually on January 17 and in person in Calgary and Toronto. Sign up your whole team..CE Summits are a tremendous value with everything included!

Take a duo of CE Summits with Knowledge Bureau this November and January and get the tools you need to help a variety of client profiles. Plus, you save on tuition with a Duo CE Summit Event Pass!

Check out the details for the November 1 Virtual CE Summit! You’ll Learn more from Evelyn Jacks and special guests Alan Rowell and Carol Willes at the November 1 Virtual CE Summits. A comprehensive full day virtual event, the CE Summit also includes access to a comprehensive new CE Savvy Collection Entitled New Issues in Year End Tax Planning and up to 15 CE Credits. Check out the agenda on the detailed event site and register now!