New T777 Employment Expense Statement Released

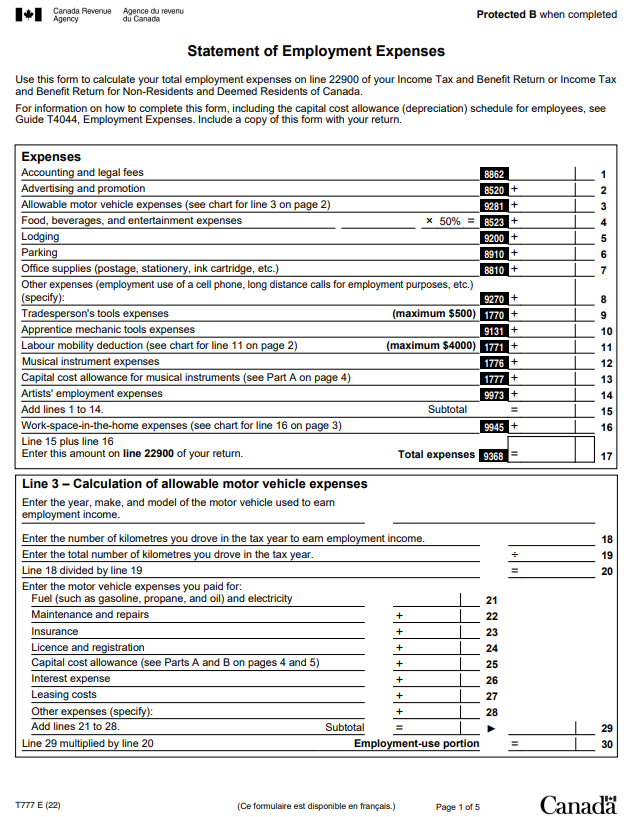

The 2022 version of Form T777 Statement of Employment Expenses is available and worth a detailed look. Employees who have a T2200 form signed by their employer may use this form to claim their home office and other expenses. In addition there is a new section for the claiming of the new labour mobility deduction for an eligible tradesperson. Following are tax tips you should take note of in 2022.

Employees who worked from home in 2022 due to the pandemic can still claim the home office expenses using the simplified method on Form T777S. But the claim may be higher under the detailed method – professional tax specialists will want to make sure they take the extra time to really dig for all the deductions possible.

Other than the increase in the maximum capital cost allowed for a new passenger vehicles and the increased limit for deductible leasing costs, by far, the biggest change for 2022 is the introduction of the new labour mobility deduction.

This new deduction is available to eligible tradespersons and apprentices working in the construction industry who have temporary relocation expenses because they had to live for at least 36 hours at a temporary location at least 150 km from their normal place of residence.

Eligible expenses include the following:

- Lodging expenses

- Transportation to and from the temporary location (one round trip)

- Meals consumed during the round trip (not limited to 50% and no simplified method)

Expense claims are limited to 50% of the income earned at each temporary location and to $4,000 for the year.

For 2022, expenses may be claimed for the following periods:

- 2021 – limited to 50% of employment income earned at that temporary location in 2022

- 2022

- January 2023

These rules may be confusing at first glance, but the government allows the claim for reasonable expenses occurred in the following periods:

- during the taxation year

- the previous taxation year or

- prior to February 1 of the following taxation year.

Where the taxpayer worked at multiple temporary locations in the claim period, the computation must be made separately for each temporary location, although the total claim for the year is limited to $4,000.

Where the taxpayer cannot claim all of their expenses because they do not have enough income at the temporary location in the year or eligible expenses exceed the annual $4,000 limit, those unclaimed expenses can be carried forward to be claimed in 2023.

Additional Educational Resources – stay up-to-date throughout the tax season on important tax changes, developments in tax news and tax and investment planning strategies with Evergreen Explantory Notes. Your annual subscription also qualifies for the required 15 non-verifiable CE Credits for the purposes of renewing your designations with Knowledge Bureau.

Register now for your Evergreen Explanatory Notes.

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

©Knowledge Bureau, Inc. All rights Reserved