Last updated: April 01 2013

More on Dividend Tax Hikes

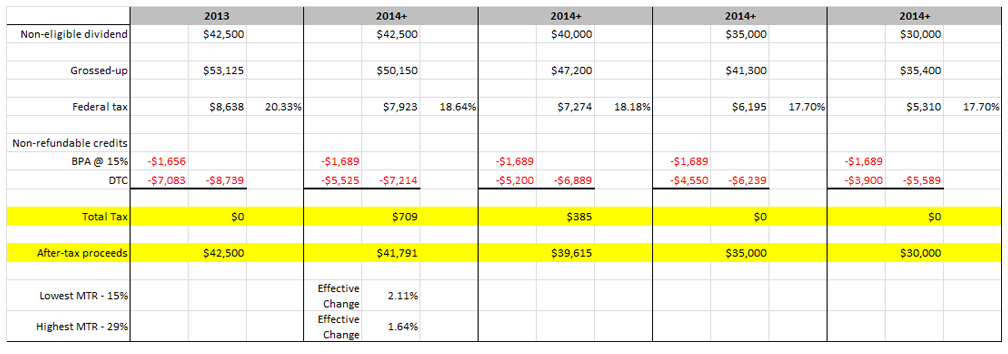

For owners of small businesses who pay themselves with dividends, the changes to the gross-up and dividend tax credit rates for 2013 will mean that the tax-free zone will decrease from its current level of about $42,500 for single taxpayers in 2013 to about $35,000 in 2014.

The following table shows the taxes on small business dividends in 2013 at $42,500 and in 2014 at various income levels. These changes represent a 17.5% decrease in the tax free zone. As dividend income rises above the tax-free zone, the changes will result in an effective tax increase of 1.64 to 2.11% depending on the taxpayer’s income level. (For a larger view, click on the image.)