Last updated: August 27 2013

Minimizing Tax on Asset Transfers

As we all know, “you can’t take it with you” so sooner or later, everyone has to transfer their assets to someone else.

The tax bite on such transfers depends on several factors:

- The accrued gains on the asset,

- The asset type,

- When the asset is transferred, and

- Who the asset is transferred to.

While most assets must be transferred at their fair market value, some transfers allow the transferee to determine the value at which the transfer takes place. The rules are complex, so designing a plan to minimize taxes on asset transfers can be difficult.

The Tax Efficient Asset Transfers Calculator from The Knowledge Bureau allows you to determine the tax consequences of transfers of all types of assets to a spouse, child, or charity either during the taxpayer’s lifetime or at death.

Example

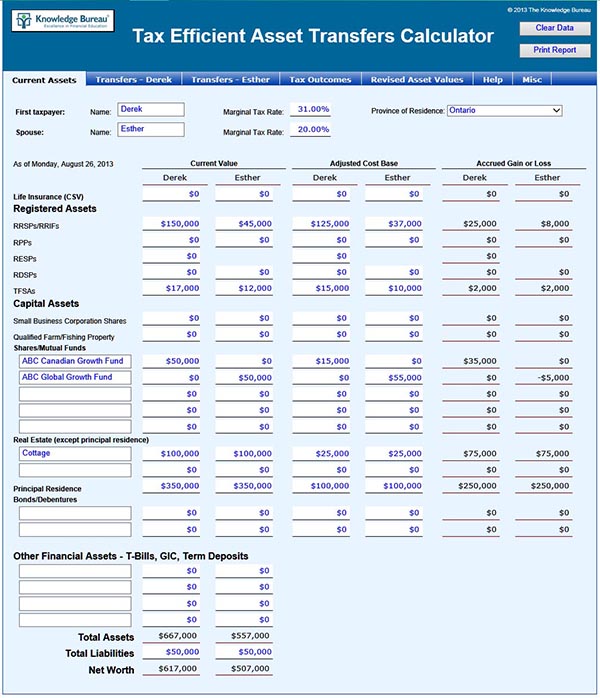

Derek and Esther are in their early 50s and would like to sit down with their financial advisor Dillon to review their assets prior to meeting with their lawyer to update their will. Although they are very active and healthy, they know that it is important to review as there is an opportunity to have their youngest daughter, Sally, (22 years old) involved in the next year or two.

- Derek has a 31% Marginal Tax Rate and Esther’s is at 20%. They live in Ontario.

- Derek has $150,000 (ACB $125,000) in RSPs and Esther has $45,000 (ACB $37,000).

- They also have TFSA balances of $17,000 (ACB $15,000) for Derek and $12,000 (ACB $10,000) for Esther.

- Derek has a market value of $50,000 ($15,000 ACB) in his ABC Canadian Growth Fund.

- Esther has a market value of $50,000 (ACB $55,000) in her ABC Global Growth Fund.

- They currently jointly own a cottage with a market value of $200,000 (ACB $50,000).

- Their primary residence is worth $700,000 (ACB $200,000) with a current mortgage of $100,000.

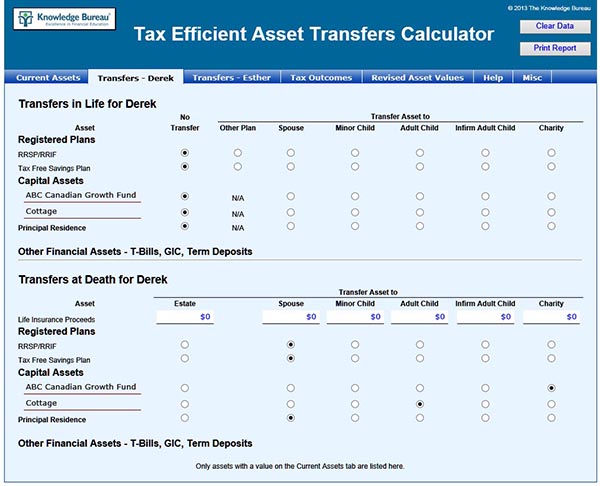

Derek and Esther would like to know the tax consequences of the following if Derek were to die first.

- Derek’s RSP would go to his wife Esther as will his TFSA.

- Their primary residence would go to Esther.

- The cottage would go to their daughter Sally.

- Derek’s non-registered investment portfolio would go to a registered charity of his choice.

Step 1: Record the Assets

The first step is to populate the “Current Assets “ tab.

The calculator determines any accrued gains or losses and the total assets and net worth for each of the spouses.

Step 2: Enter the Desired Transfers

On the second tab “Transfers – Derek”, select each of the transfers planned when Derek dies.

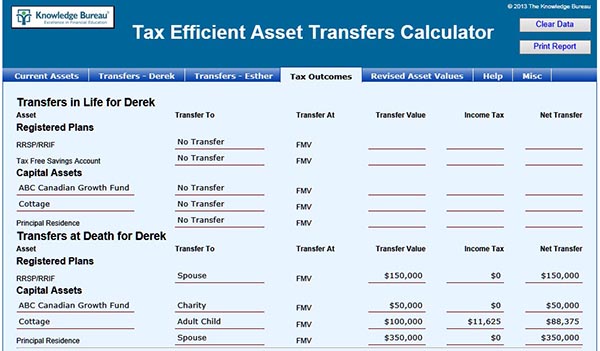

Step 3: View Tax Outcomes

The tax outcomes tab automatically determines any income tax consequences.

The transfers to Esther are all done on a tax-free basis. There will be capital gains tax if $11,625 on the transfer of the cottage to Sally. The transfer of the investment portfolio to charity will also be tax-free although a tax credit for the donation will be generated based on the fair market value of the assets—as seen in the next step.

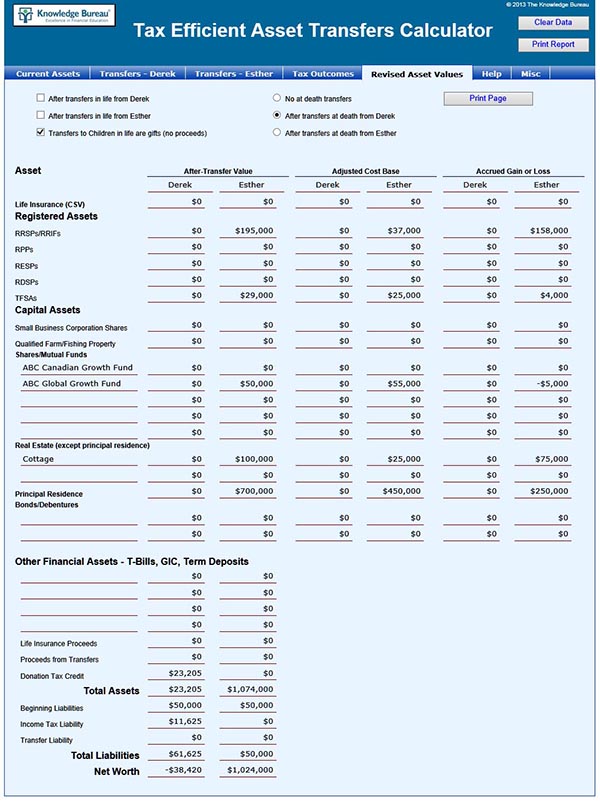

Step 4: View Revised Asset Values

The Revised Asset Values tab shows the couples asset values after transfers as well as any changes to liabilities.

We see after death, Derek has no assets remaining, but he does have a Donation Tax Credit of $23,205 and an income tax liability of $11,625. Esther’s assets now total $1,074,000 because of the transfer of Derek’s RRSP, TFSA, and Derek’s portion of the principal residence.

By looking at alternative transfer strategies, you can determine which strategy minimizes the tax consequences while meeting the goals of the individual. You’d also want to explore the best way to transfer Esther’s assets should she die before Derek.

The Tax Efficient Asset Transfers Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.