Last updated: August 16 2023

Mark Your Calendar: Fall Education & Tax Filing Milestones

It’s back to tax school time and that means shoring up on tax knowledge for the 2023-2024 tax filing seasons, but also to mark your calendar for important milestones to meet CRA fall filing requirements. To help, here are the Knowledge Bureau Report’s Fall Financial Calendar Checklist:

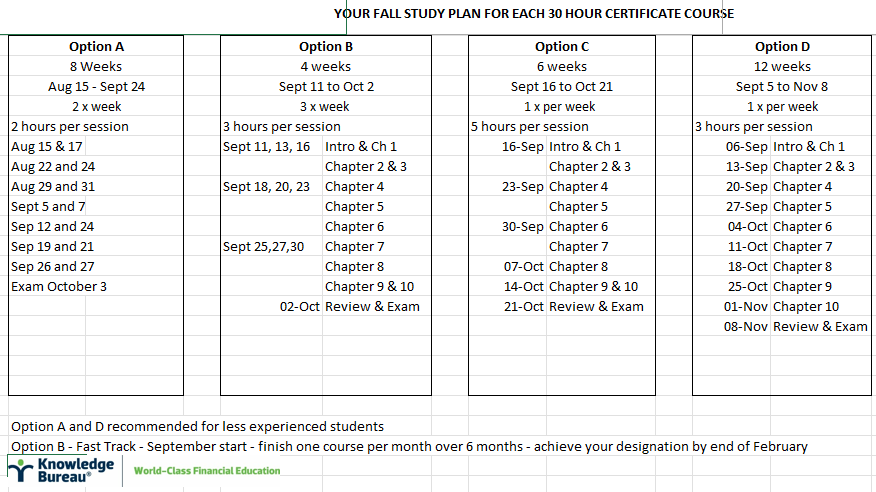

KNOWLEDGE BUREAU ONLINE COURSE STUDY PLANS – AUGUST/SEPTEMBER STARTS

Check out our new courses and educational calendar all leading down the pathway to Specialized Credentials and Continuing Education Credits. You can register now, start today and study from anywhere with convenient online training options including an opportunity to enrol in a DMA™ Designation Program and come to the September 20 Virtual CE Summit on Real Estate Audits for free when you sign up by September 15!

Check out the 2023-2024 Educational Calendar!

Remember, graduates of our designation programs qualify for generous affinity program tuition savings too. In addition, Knowledge Bureau programs qualify for the tuition fee credit and the Canada Training Credit.

KNOWLEDGE BUREAU FALL FINANCIAL CALENDAR CHECKLIST

Note acronym list appears below

|

August August 15-December 15 – Online Certificate course Study Periods begin (see Study Calendars below) Aug 18: CCB payment Aug 29: CPP, OAS, GIS benefits payment date Aug 30: Canada Veterans’ Disability Benefit payment date Back to school expense planning review Audit risk management: Correct tax-filing errors and omissions 2013-2022 September Sept 15: Quarterly tax instalment due Sept 16: KB Specialized Credentials - Fall Semester Begins Sept 20: CCB Payment Sept 20: KB CE Summit: Audit Defence Planning Sept 27: CPP, OAS, GIS benefits payment date Sept 28: Canada Veterans’ Disability Benefit payment date Review: Cash Flow & Debt Management Health Risk Management: Insurance needs review October Oct 1: Build or buy a home if Home Buyer Plan withdrawal made from RRSP last year Oct 5: GST/HST Credit payment, CWB advance Oct 13: Climate Action Incentive Payment Oct 15: US Tax filing (if Form 4868 extension of filing time has been filed) Oct 20: CCB Payment Oct 27: CPP, OAS, GIS benefits payment date Oct 30: Canada Veterans’ Disability Benefit payment date Oct 31: File 2023 UHT-2900 Tax form Family Review: Family income splitting, make a spousal RRSP contribution, review inter-spousal loans. RRSP Review: Post-doctoral income receipts qualify as RRSP earned income effective January 1, 2021. Retroactive adjustments allowed. Capital Gains Review: Tax-loss harvesting to offset capital gains income. Donations Plan: Review transfers of securities to charity to avoid capital gains tax, new AMT effective January 1, 2024. |

|

December Dec 13: CCB payment Dec 15: Final tax instalment remittances Dec 20: CPP, OAS, GIS benefits payment date Dec 21: Canada Veterans’ Disability Benefit payment date Dec 29: Final tax loss selling, transfer of shares to charity Dec 31: Farmers/fishers deadline for annual instalment remittance. Also: last day to contribute to own RRSP if age 71 and

Note: Election to stop or revoke the CPP election must be filed by June 15, 2024 |

|

Tax and Investment Acronym Glossary: AMT Alternative Minimum Tax CCB Canada Child Benefit CDB Canada Dental Benefit CHB Canada Housing Benefit CCPC Canadian-Controlled Private Corporation CERB Canada Emergency Response Benefit CESB Canada Emergency Student Benefit CEWS Canada Emergency Wage Subsidy CGE Capital Gains Exemption CRB Canada Recovery Benefit CRGP Canada Recovery Hiring Program CRCB Canada Recovery Caregiving Benefit CRSB Canada Recovery Sickness Benefit CPP Canada Pension Plan CWB Canada Workers Benefit FHSA Tax-Free First Home Savings Account GIS Guaranteed Income Supplement

|

GST/HST Credit Goods and Services Tax/Harmonized Sales Tax Credit HBP Home Buyers’ Plan (from RRSP) HHBRP Hardest-Hit Business Recovery Program* LLP Lifelong Learning Plan (from RRSP) OAS Old Age Security PAR Pension Adjustment Reversal RPP Registered Pension Plan PRPP Pooled Registered Pension Plan RDSP Registered Disability Savings Plan RESP Registered Education Savings Plan RRIF Registered Retirement Income Fund RRSP Registered Retirement Savings Plan TFSA Tax-Free Savings Account THRP Tourism and Hospitality Recovery Program* UHT Underused Housing Tax

*These programs included a rent subsidy |