Last updated: March 15 2023

March 28 Federal Budget: Will It Erode Wealth or Build It?

Will the March 28, 2023 Federal Budget further erode accumulated wealth with new taxes, alongside the continued inflationary and interest rate pressures which have already had a significant impact on businesses and investors? The answer is likely yes. What to watch for appears below.

Personal Taxes. No progress on these previously announced measures. Will they be included?

- Increase the CPP/QPP survivor’s benefit by 25%

- Increase Canada Child Benefit by 15% for children under one year of age

- Double Child Disability Benefits

- Make EI tax-exempt for maternity and parental benefits

- Revamp the EI system

- Health Care Workers to be able to deduct $15,000 for a new practice

- Canada Caregiver Credit to be refundable

- Career Extension Tax Credit for seniors who continue to work

- Surtax on excessive rent increases as a result of renovations

- Tax Credit for home appliance repairs

- Mandatory disclosure rules for tax years beginning after 2022

- Allow for free automatic tax return filings

- Implementation of new General Anti-Avoidance Rules - GAAR

- GIS payment for disabled people

Minimum Taxes. Details are expected to be announced on a new proposed 15% minimum tax on those earning more than income in the top tax bracket

Business Taxes. There are several issues under consideration:

- New rules to amend Bill C-208 enacted to enable tax-efficient Family Business Transfers, to ensure only “genuine” transfers qualify and prevent “surplus stripping”.

- The government intends to review the “rollover rules” for growing small businesses.

- Introduction of Employee Ownership Trusts to enable employees to purchase private businesses from owners

New Special Taxes. The government has indicated it is considering the following:

- A new 2% share buy-back tax, similar to one recently introduced in the US, levied on public companies

- A new wealth tax of 3% on net wealth over $10 million and 5% on net wealth over $20 million, payable over 5 years.As most of this wealth is tied to business ownership according to the PBO, this would amount to a special tax on entrepreneurship.

- Enhanced reporting requirements for RRSPs or RRIFs to include aggregate FMV (Fair Market Value) of all property held in the plan, as at the end of a year

- A review of SR&ED tax credits to potentially include intellectual property development

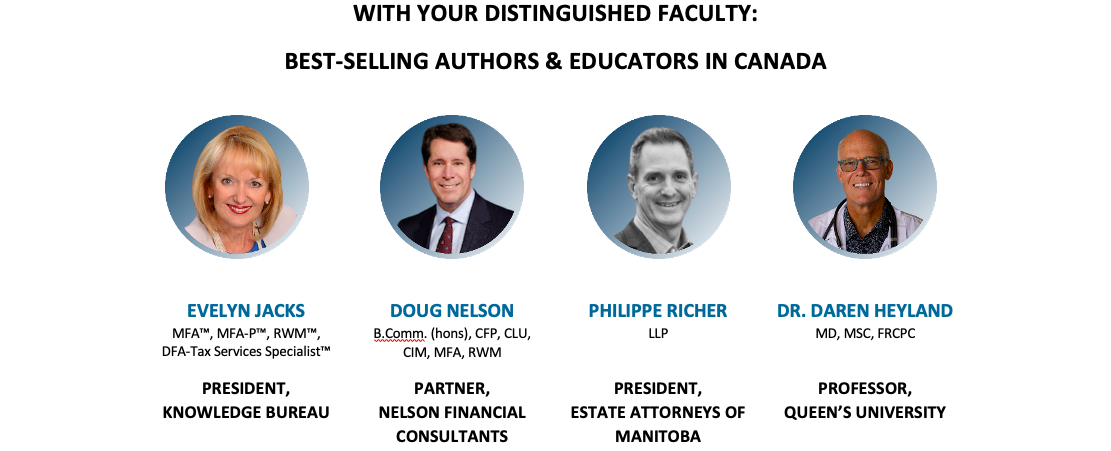

Knowledge Bureau will also provide detailed analysis in two special educational opportunities: The Knowledge Bureau Special Budget Report (please share subscription information with colleagues here) and the May 24 CE Summit which will feature presentations and analysis from an investment, retirement and estate planning view by expert instructors.

Click the image below to view the comprehensive agenda online.