Little Known Tax Facts: Ensuring Accuracy when Filing Tax Returns

Ruth Horst

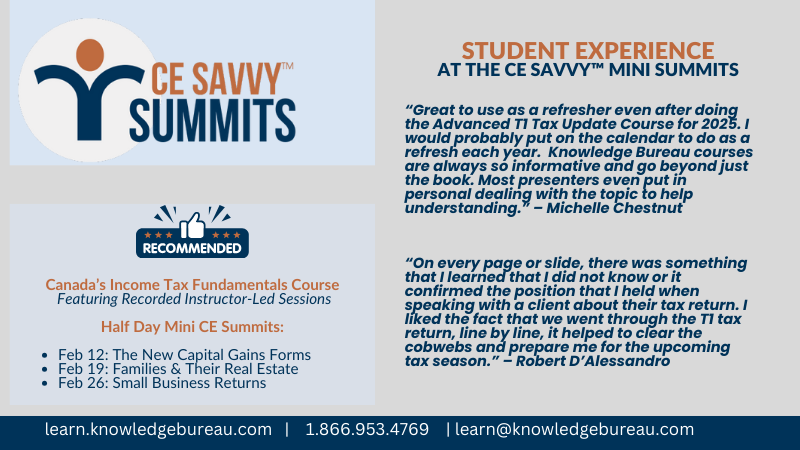

Knowledge Bureau hosted its first half-day Mini CE Summit which focused on Rookie Tax Training to bring Canada’s Income Tax Fundamentals course to life, and surprisingly, it was well attended by seasoned pros as well.

Now available with recorded sessions online, the event was enriched by a broad overview filing T1 returns for the 2024 tax year focused on the reporting of income, deductions and tax credits. The highlight, however was the great tax questions posed by the audience, ranging from foreign income verification to medical travel and moving expenses. The answers may be helpful to you, too:

Foreign Income Verification Statement: When individuals hold property outside of Canada with a cost of $100,000 CAD or more, a separate tax return (T1135) must be filed by the due date of the T1 (April 30). Some types of property are considered to be ‘specified foreign property’ which are reportable, and some are exempt from this reporting. A complete list is available on the CRA website.

Specified foreign property includes:

- tangible property situated outside Canada

- a share of the capital stock of a non-resident corporation

- an interest in a foreign insurance policy

- precious metals, gold certificates, and futures contracts held outside Canada

- shares of corporations resident in Canada held outside Canada

- an interest in a non-resident trust that was acquired for consideration

- an interest in a partnership that holds a specified foreign property unless the partnership is required to file Form T1135

- a property that is convertible into, exchangeable for, or confers a right to acquire a property that is specified foreign property

- a debt owed by a non-resident, including government and corporate bonds, debentures, mortgages, and notes receivable

Included in the not reportable list is:

- a personal-use property as defined in section 54

- a property used or held exclusively in carrying on an active business

- a share of the capital stock or indebtedness of a foreign affiliate

- an interest in a trust described in paragraph (a) or (b) of the definition of exempt trust in subsection 233.2(1)

- an interest in, or a right to acquire, any of the above-noted excluded foreign property

Important to note is that the T1135 is an informational return and will not generate any additional tax payable. However, failure to file and late filing will have significant penalties associated with it.

Foreign investments in a Canadian Financial Institution do need to be reported. These institutions usually provide their clients with an annual summary of foreign investments by country with the associated information that is required. The current cost amount of the investment or holding in CAD is always used.

It’s also important to understand the definition of two important aspects of this form:

- The cost amount to be used. This is defined in subsection 248(1) of the Income Tax Act and refers to the acquisition cost of the property. That could be different for different taxpayers. For example, for immigrants to Canada this is the fair market value of the property at the time of immigration. The same is true if the property was received as a gift or inheritance – use FMV at the time of the gift. Otherwise use the maximum cost of the property during the year, This can be based on the maximum month-end cost amount during the year.

- The currency conversion. The cost amounts described above must be converted to Canadian dollars. The T1135 suggests the exchange rate in effect at the time of the transaction (i.e. the time the income was received or the property was purchased) be used. It goes on to state that where income was received throughout the year, an average rate for the year is acceptable. Further:

- Maximum funds held during the year: use the average exchange rate for the year.

- Funds held at year end: use the exchange rate at the end of the year

- Maximum fair market value during the year: use the average exchange rate for the year

- Fair market value at year end: use the exchange rate at the end of the year

Most e-file approved software will have exchange rates available for the most common countries. If the exchange rate is not available in the software, the Bank of Canada exchange rates should be used and are available at: https://www.bankofcanada.ca/rates/exchange/annual-average-exchange-rates/

Medical Travel: Did you know that if you need to access a medical service that is greater than 40km (one way) from your home that you are able to claim public transit or mileage for your trips? Did you know that if the distance is 80km (or more) from your home that mileage, parking, meals and accommodation may be claimed for yourself as well as an attendant?

This is only possible if similar medical services are not available closer or the timeline for accessing the services is not readily available.

This is a highly audited deduction, so make sure that medical reports, doctor’s letter and your receipts are available.

Medical Moving Expenses: This is a very commonly over-looked medical deduction that allows reasonable moving expenses (up to $2,000) to be claimed to move a person, for medical reasons, to a facility or housing that is more accessible for the individual.

Bottom Line: There are so many factors that contribute to filing a tax return to the best advantage of the taxpayer. Learning to do taxes is definitely an exercise of continuous learning. Take advantage of the resources available and consider enrolling in the next 3 Mini CE Summits.

Congratulations to those who attended for their commitment to increasing their tax knowledge and to serving their clients better. In addition to the Mini CE Savvy Summit attendance, the registrants also have access to Canada’s Income Tax Fundamentals Course, which includes the recorded sessions.

Be sure to register to join us at the next 3 events in February:

February 12th – The New Capital Gains Forms February 19th – Families & Their Real Estate

February 26th – Filing Small Business Returns

Register at: CE Mini Summit Registration