The Dark Horses – Find them at the Advanced T1 Tax Update

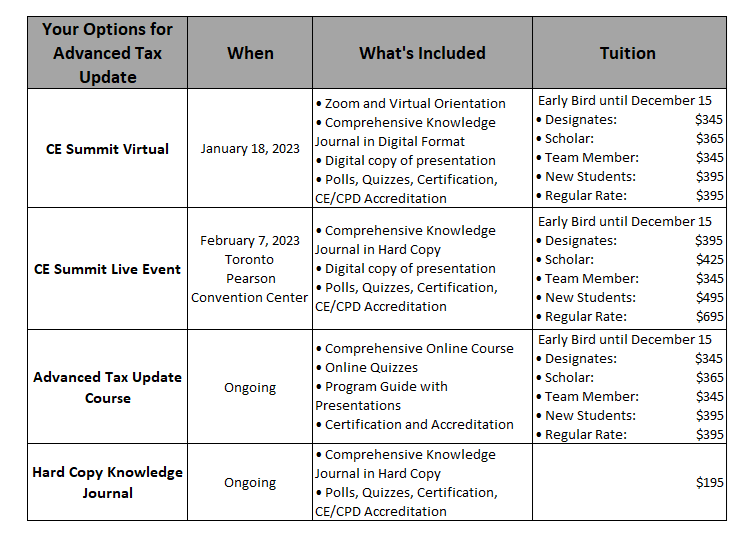

The Dark Horses are coming: little known tax facts and tips ordinary advisors never tell their clients about. It makes a big difference in the after-tax result! December 15 is the beginning of the Early Registration Deadlines for the Advanced T1 Tax Update, featuring three training options in 2023:

The CE Summit Event Only – January 18 (Virtual) or February 7 (Toronto – Pearson Convention Centre)

The CE Summit Event Only – January 18 (Virtual) or February 7 (Toronto – Pearson Convention Centre)

- To get your online event pass – click here for January 18 and click here for February 7

- To see the speakers and the agenda – click here

- The CE Summit Plus the Advanced T1 Updated Course

- A comprehensive online course filled with retention quizzes to test your knowledge of 2022 tax changes plus the recorded presentations. Completion deadline is February 28.

- Add this certificate course now for yourself or your team members – Each only $395. Enrol Here

- The Hard Copy – Advanced T1 Update Knowledge Journal

- A great desk-top resource in your office – Each only $195 Order here.

Final Registration for the virtual event, at regular pricing, is available after December 31. Or save up to 40% by registering in all the CE Summits for 2023. The Bundle includes the CE Summit Events, the Comprehensive Online Courses (one per event), certification (10 CE Credits for the event and 20 for the online course) and third party accreditation (IIROC/Insurance Councils).

- The Single: any one event: example, Advanced Tax Update Only (January 23, 2023)

- The Duo: Add the May Retirement and Estate Planning Summit (May 24, 2023)

- The Trio: Add the September Audit Defence Planning Summit (September 20, 2023)

- The Quad: Add the November Year End Tax Planning Update (November 1, 2023)

Quick Snapshot of New Agenda:

- Personal Tax Update: What's New in Personal Taxation?

- Focus on Employment Income, Deductions & Credits: Short Snappers!

- Focus on Pension Income: Tax Filing Tips and Traps

- Family Optimization Strategies

- Real Estate Transactions

- Focus on Income from Properties and Investments

- Focus on Business Owners - T2125 and Schedules

These highly informative sessions are led by industry leading experts including: Knowledge Bureau President, Evelyn Jacks, Alan Rowell, RWM™, MFA™, DFA-Tax Services Specialist, Larry Frostiak, FCPA, FCA, CFP, TEP, RWM™ and Dr. Dean Smith, PHD, CFP, TEP, CPA, CA, RWM™ .

©Knowledge Bureau, Inc. All rights Reserved