Last updated: May 31 2023

June & July: Tax Filing & Planning Milestones

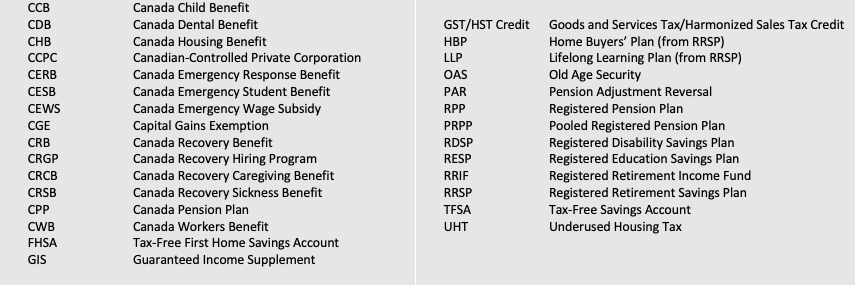

As we all enjoy family weddings and graduations, nurturing beautiful flowers and sharing long evenings admiring Canada’s summer splendor, there are important tax filing and planning milestones to observe, despite these compelling distractions. Make sure the Knowledge Bureau’s Summer Time Financial Checklist below is covered off before hitting the beach, or your favorite links, over the next 8 weeks. Plus check out the KB Glossary of Tax Terms and Acronyms to discuss with newcomers and new clients to increase their tax and financial literacy:

Summertime Financial Checklist

June

- June 15: T1 return for proprietorships - filing deadline

- Quarterly tax instalment remittance

- Closer Connection Exception Statement for Aliens (IRS Form 8840)

- Extension to file US tax return (IRS Form 4868)

- June 16:KB Specialized Credentials - Summer Semester Begins – Register by June 15

- June 20: CCB Payment

- June 28: CPP, OAS, GIS benefits payment date

- June 29: Canada Veterans’ Disability Benefit payment date

- June 30: Form RC243 TFSA Return and RC243-Schedule A – Excess TFSA Amounts

July

Note - Canada Worker’s Benefit Advance. Form RC201E for CWB advance no longer required starting July 2023. CWB advance to be automatically paid if qualified last year.

- July 5: CWB Advance, GST/HST Credit Payment, New Grocery Rebate Payment

- File missed prior filed returns to catch up on missed GST/HST Credit payments

- July 14: Climate Action Incentive Payment

- July 20: CCB payment

- July 27: CPP, OAS, GIS benefits payment date

- July 28: Canada Veterans’ Disability Benefit payment date

Summertime Planning Opportunities:

- Education Funding: Invest your child’s CCB into their RESP as you think “back to school”.

- Disability Funding: Invest in RDSP for qualifying disabled people in your circle of influence

- Income Estimation:Prepare a September/December Quarterly Instalment payment review

- Investors: Do a Portfolio Review

- Cottage Owners: Update Personal Net Worth Statements with a current valuation for the cottage; prepare cottage succession plan

- Businesses: business valuation, consider crystalizing CGE for farmers, CCPC shareholders

- Pre-Retirement: Consider postponement of OAS and CPP

- Retirees: Review RRSP meltdown strategies, RRIF income levels, OAS clawback review

- Valuations: Financial Assets, Cottage/Home/Rental Property/Business for asset transfer strategy

KB Glossary of Tax Terms and Acronyms

© Knowledge Bureau, Inc.