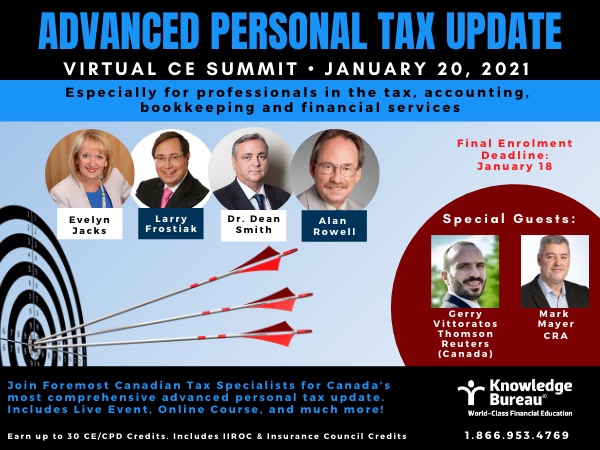

The January 20 CE Summit ‘Wow’ Factor

Esteemed Canadian tax experts delivered cutting edge personal tax filing information with a “wow” factor punctuated by huge audience participation at the Virtual CE Summit this week. Over 700 questions were received from an audience of over 350 professionals nation-wide – the largest one-day participation yet. Here’s what they said about the important tax and financial insights shared:

"I look forward to attending this CE Summit each year so that I start thinking about how best to serve my clients during tax time. I use the book constantly during my tax seasons. Best investment ever!" - Sandra Gibbs

"Very Valuable information!!!! So much to take in, and am very impressed with the information given. I now have answers for my clients. Thank You So Much!!!!!" - Cathy Losing

"I look forward to attending this CE Summit each year so that I start thinking about how best to serve my clients during tax time. I use the book constantly during my tax seasons. Best  investment ever!" - Tammie Gilbert

investment ever!" - Tammie Gilbert

Missed this important professional development event?

Take the Advanced Personal Tax Update online course, as featured in the Virtual CE Summit event. This includes access to the recorded presentations and up to 30 CE Credits, which can also be applied towards completion of a Designation Program.

Here's a look at the course content:

LESSON 1 INTRODUCTION TO T1 FILING AND PLANNING

LESSON 2: 2020 T1 TAX THEORY CHANGES

LESSON 3: UNIQUE TAXFILER PROFILES

LESSON 4: FAMILY FILING

LESSON 5: SIMPLE EMPLOYMENT PROFILES

LESSON 6: MORE COMPLEX EMPLOYMENT PROFILES

LESSON 7: SENIOR PROFILES

LESSON 8: INVESTOR PROFILES

LESSON 9: THE SELF-EMPLOYED

LESSON 10: PRINCIPAL RESIDENCES

All recordings from the live virtual event are included as well.