Last updated: November 22 2022

Is the CPP Sustainable: Pre-Retirees Will Soon Find Out

Is the Canada Pension Plan sustainable, and if so, are further premium rate increases required? The 31st Actuarial Report on the Canada Pension Plan (CPP)[1] is expected to be released before the end of December, 2022 and it should shed important light on how expensive these source deductions may yet become.

The Report is produced every three years, and this one will build on the results expected from both the enhanced and the base premium rates paid to support the benefits payable in the future. What’s different is the pandemic – will it affect the projections? The last report provided some interesting facts and commentary that may provide insight[2]:

- The number of CPP contributors were expected to grow from 14.5 million in 2019 to 18.4 million in 2050.

- Base contributions were expected to increase from $52 billion in 2019 to $165 billion in 2050.

- The additional contributions were expected to increase from $1.6 billion in 2019 to $43 billion in 2050.

- In the case of the base contributions, amounts paid are projected to be higher than expenditures up to the year 2021 inclusive.

- In the case of the additional contributions, amounts paid are projected to be higher than expenditures up to the year 2057 inclusive.

- The number of retirement beneficiaries receiving benefits from the base contribution was expected to increase from 5.6 million in 2019 to 9.9 million in 2050, and the distribution of their benefits was expected to grow from $49 billion in 2019 to $188 billion in 2050.

- The number of retirement beneficiaries receiving benefits from the additional contributions was expected to grow from 0.2 million in 2019 to 8.9 million in 2050. The distribution of their benefits was projected to grow from $0.1 billion in 2019 to $28 billion in 2050.

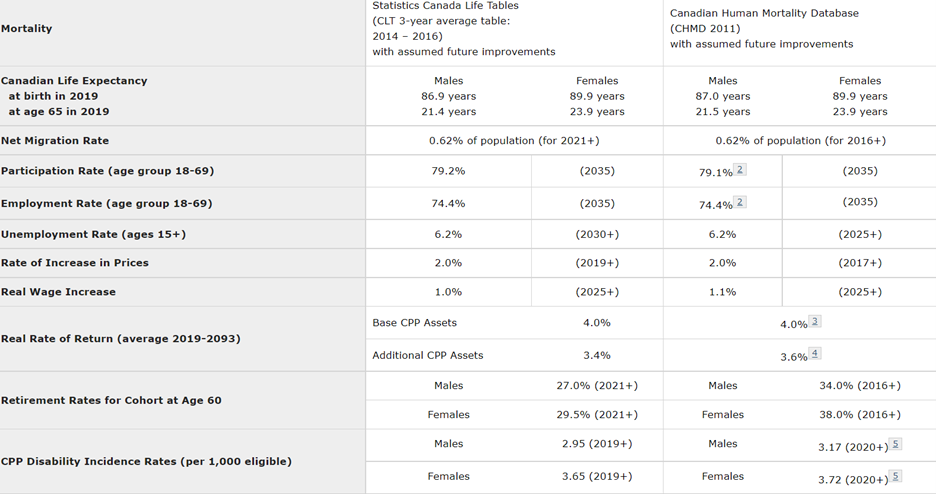

The report noted that three important factors will affect the CPP projections: Real rates of return on investments, the future evolution of mortality and future economic growth. Should those factors change, minimum legislated rates of premiums could rise.

Notably, the 30th CPP Actuarial Report assumed a nominal average 75-year rate of 5.95% for the base CPP and 5.38% for the additional CPP.

Here’s the bad news: A decrease of 1% in the assumed nominal average annual 75-year rate of return would result in a minimum contribution rate increase of the base premium to 10.62%, which the Report says is 9% higher than under the best-estimate assumptions.

There’s more: In the case of the additional premium for high income earners, the first additional rate would have to increase to 2.69% and the second additional minimum contribution rates would increase to 10.7% which is 36% higher than the best-estimate assumptions.

The assumptions in the 30th Report have relied on 2% increase in prices and Real Wage Increases or Rates of Return that may not accurately reflect current realities, as projected in the November 3 Economic Report:

Bottom Line: Canadian business and workers may have to brace for even higher CPP rates than currently anticipated. The 31st CPP Actuarial Report should be reviewed with interest by all stakeholders to the CPP.

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

Enrol by November 30th for major tuition reductions in our designation programs and also tuition savings up to $300 when you enrol in two courses. Click here to enrol.

[1]https://www.osfi-bsif.gc.ca/Eng/oca-bac/ipr-rip/Pages/epr31u.aspx#:~:text=The%20tabling%20of%20the%20Actuarial,opinion%20will%20be%20made%20public.

[2] https://www.osfi-bsif.gc.ca/Eng/oca-bac/ar-ra/cpp-rpc/Pages/cpp30.aspx#TOC-1.1

©Knowledge Bureau, Inc. All rights Reserved