Last updated: March 08 2023

Is Equality the Same as Equity for Women?

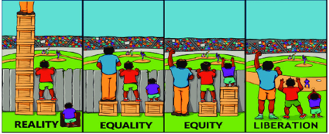

The theme of this year’s International Women’s Day on March 8th is #EmbraceEquity. It is an attempt to address the fact that Equality is not the same as Equity. Especially for women. Equality means each individual or group of people is given the same resources or opportunities. Equity recognizes that each person has different circumstances, and allocates resources and opportunities needed to reach an equal outcome.

So, what does this mean for your female clients? Do they have the appropriate knowledge, support and income available to reach the same financial outcome as their male counterparts? If not, how can you help level the playing field?

A terrific way to ramp up your knowledge on this subject is through Knowledge Bureau’s new CE Savvy PD™ Micro Course Collections Series. These collections of fully accredited micro-courses take a deep dive into curated and relevant tax and financial planning subjects that your clients need your help with. And you will earn valuable CE Credits while you take an hour a day to explore one planning concept at a time.

One collection that is becoming increasingly popular for advisors and those in the financial space is: CE SAVVY PD™ PRACTICE MANAGEMENT COLLECTION .

Why Enroll?

Courses in this collection are extremely timely, such as Women in Finance. While women still earn less than men in 95% of occupations, their approach to their education, careers, entrepreneurship, and investing is helping them build both income and wealth. A woman’s earnings in families now accounts for almost half of family income. Most importantly, women are expected to be responsible for a significant rise in their wealth holdings over the next decade. With increasing wealth, women will need to understand how to manage their wealth and learn to invest to grow their wealth. In this micro-course, you will learn about eight specific issues women face, and potential solutions women can explore with a financial advisor.

Other courses in this collection include:

Transitioning Clients to a New Advisor

Changing business models, firms or a succession/retirement requires sufficient planning by advisors to ensure minimum disruption in a client’s overall financial objectives including costs of investment, taxes and anticipated net returns. This micro-course will help you to consider ways to approach business transitions with your client towards an ultimate win-win for all stakeholders and provide perspective on the model in a post-pandemic world.

There are a variety of unique situations that could arise when dealing with senior clients including signs of incapacity, sudden incapacity, signs of fraud, Power of Attorney issues and just bad decisions. Protect yourself and your senior clients by knowing the special rules for dealing with senior investors and how to implement those special rules and guidelines.

High net worth clients, depending on portfolio size and portfolio structure, can benefit from fee-based services and tax-deductible investment counsel fees. By introducing the client to these potential advantages, the advisor can assist the client in making the most appropriate decision for him or her, for both the short term and longer term.

Powers of Attorney – Protecting Against Client Incapacity

The Public Health Agency of Canada estimates that more than 419,000 Canadians aged 65+ are living with diagnosed dementia. The average number of hours that a family or friend caregiver sends supporting a person with dementia is 26 hours. As baby boomers head into their seventies and eighties, the actual numbers of people who will experience cognitive issues will explode.

ENROL IN THE PRACTIVE MANAGEMENT COLLECTION NOW

Buy this collection before March 15th and get this collection for only $245! A savings of $50! Use code CE-PROMO when checking out to apply the discount.