Last updated: July 18 2019

Investment Options: Non-Registered vs RRSP Comparison Factsheet

Christine Steendam

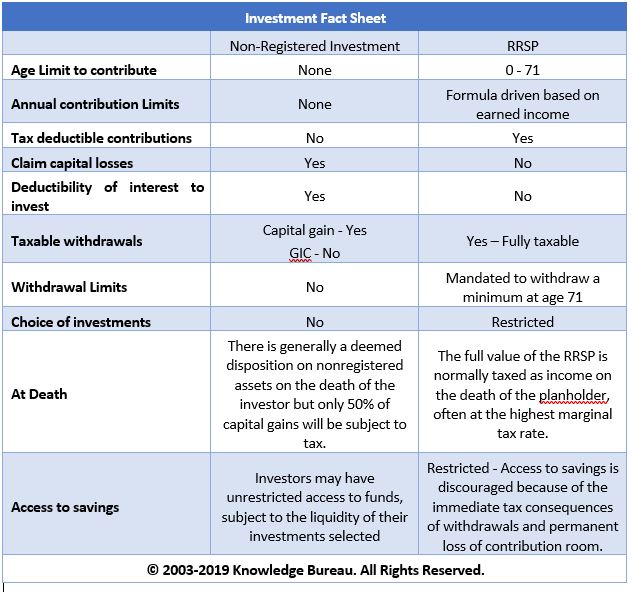

Sound retirement savings strategies typically involve investing in various non-registered investments such as Mutual Funds and ETFs and registered plans like RRSPs, PRPPs and RPPs. The options can be overwhelming for those looking to diversify their retirement savings. A simple fact sheet can help guide you through complicated financial conversations.

Providing your clients with an investment fact sheet can begin with some basic financial literacy. For example, an overview of the differences between registered and non-registered accounts through the four stages of Real Wealth Management™ – accumulation, growth, preservation and transition of wealth – can move financial decision-making along.

That’s because an educated client who understands how their retirement savings are being managed and what the tax consequences might be (now and later) will have greater trust in their advisory team. This includes both financial and tax professionals.

This educational approach can also open doors to a holistic approach to wealth management that not only looks at retirement (or semi-retirement as the case may be) in the client’s lifetime, but also looks at multi-generational wealth implications.

The following comparison table excerpted from the Tax Efficient Retirement Income Planning certificate course can be an important tool. Consider printing out the following fact sheet for your client the next time you sit down to talk about retirement savings and investments, using the permission and copyright line.

There are several scenarios where investing in a non-registered account makes sense:

1. To take advantage of the dividend tax credit

2. When clients are borrowing to invest

3. When clients have maxed-out their tax-sheltered accounts (RRSP, TFSA) and still have funds to invest

4. Emergencies

Additional Educational Resources: Retirement savings is often at the forefront of your clients’ minds, whether they are in the accumulation, growth, or preservation stages of their wealth. Earn your MFA ™ – Retirement & Succession Services Specialist designation and start custom-designing your clients’ tax-efficient retirement income plan, or supplement your education by taking individual certificate courses like Tax Strategies for Investors and Tax Efficient Retirement Income Planning . Or start with a Free Trial today.

COPYRIGHT OWNED BY KNOWLEDGE BUREAU INC., 2019.

UNAUTHORIZED REPRODUCTION, IN WHOLE OR IN PART, IS PROHIBITED.