Last updated: August 13 2013

Investment Income Planning

The Investment Income Calculator provides a step-by-step method for planning investment income for a single client or a couple over a four-year period. The calculator deals with TFSAs, registered investments (including RPPs, RRSPs, RESPs, and DPSPs) as well as non-registered investments.

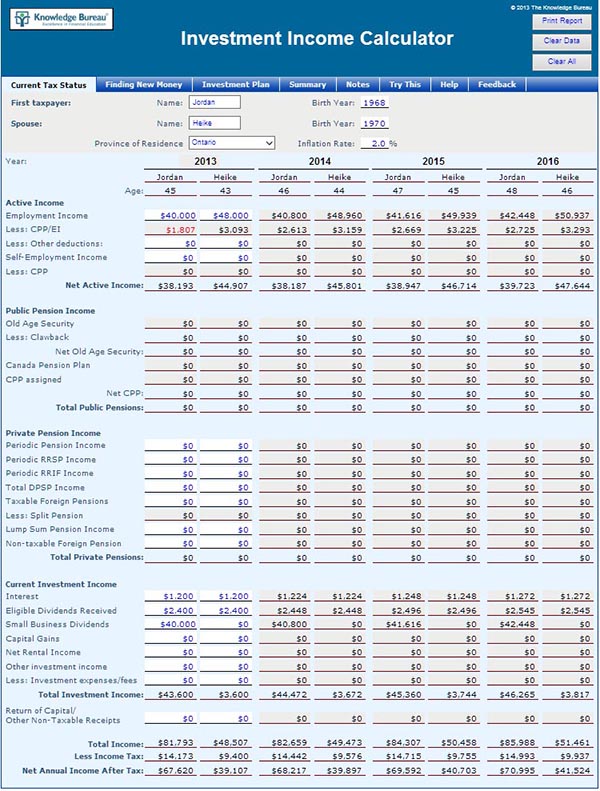

Current Tax Status

The first tab deals with the client’s current income situation and calculates the after-tax income that they generate, providing projections over the following three years.

Example:

Jordan and Heike are in their forties and live in Ontario. Jordan operates a small business and pays himself a salary as well as dividends. Heike is employed. They have some investment income as well as balances in their TFSAs and RRSPs. Heike has an RPP as well.

Here’s their current income situation as show on the first tab and projected forward using a 2% inflation rate.

After paying about $23,500 income tax between them, the couple has $106,727 income for 2013, which increases annually with inflation.

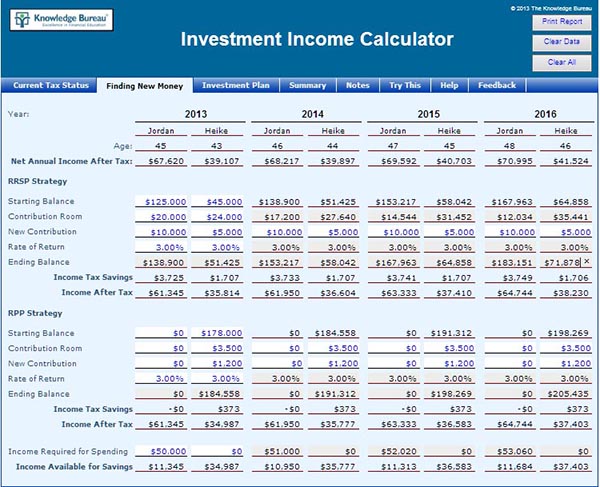

Finding New Money

The next tab deals with plans for investments in RRSPs or RPPs which generate tax deductions and therefore create additional capital for investment.

The graphic below shows our couple’s plan. Jordan will contribute $10,000 annually to his RRSP and Heike will contribute $5,000 to her RRSP plus $1,200 annually to her RPP.

Allocating the couple’s required annual spending of $50,000 to Jordan, we see that the couple now has $46,332 income available for savings in 2013. Expenses are allocated to Jordan so that Heike, who is in a lower tax bracket, can invest her income to take advantage of the lower tax rate on her investment income. For the purposes of this example, the default return rate of 3% is selected.

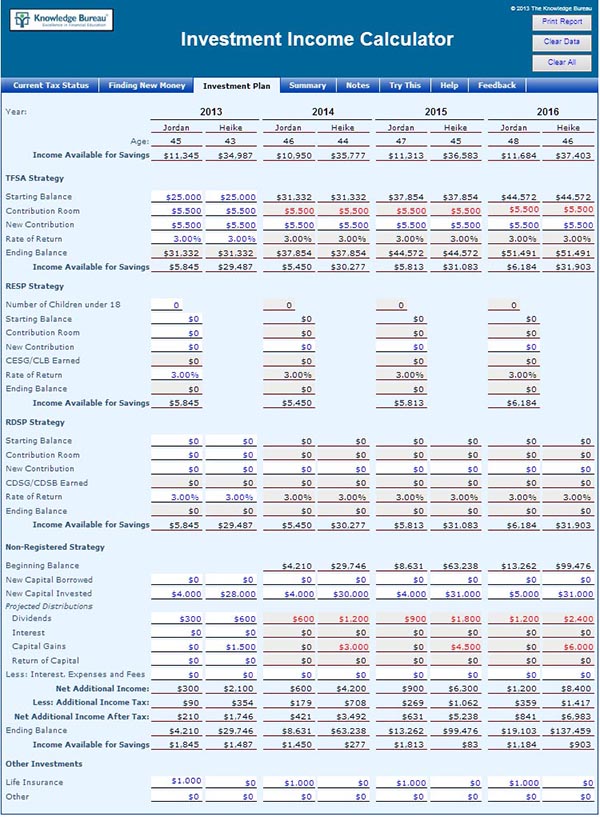

Investment Plan

Having established how much is available for investing after RRSP and RPP contributions, the next tab provides an allocation of these funds to TFSA, RESPS, RDSPs, and non-registered investments.

Our couple’s plan (as shown below) is to maximize TFSA contributions, but make no RESP or RDSP contributions as they have no dependants that need these plans. Jordan will spend $1,000 per year on life insurance and invest the remainder ($4,000 in 2013) in dividend-paying stock. Heike will invest $28,000 in non-registered mutual funds and expects to earn dividends and capital gains on those investments.

As you can see, by the end of the four-year plan, investment balances exceed $150,000.

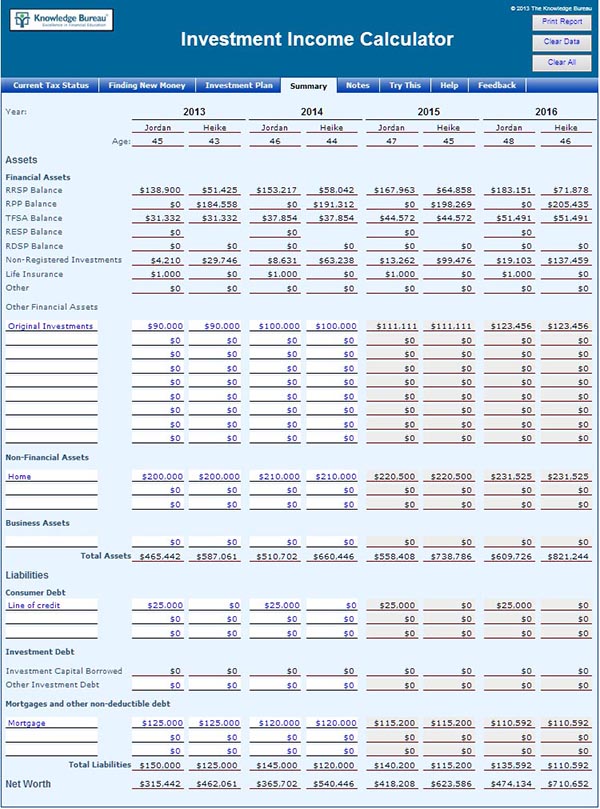

Summary

The next tab summarizes the couple’s net worth. All proposed investment balances are posted from the second and third tabs. Adding in the existing investment portfolio, their home, Jordan’s line of credit, and their home mortgage results in the following:

Over the four-year plan, the couple’s Net Worth increases from $777,503 to $1,184,786.

In reviewing this summary, it might make sense for Jordan to pay down his line of credit rather than investing in non-registered investments.

The Investment Income Calculator is one of fourteen calculators in the Knowledge Bureau Toolkit.