Last updated: October 05 2022

Inflation Fans: Payroll Taxes Increase in 2023

CRA has just announced increases in the CPP and EI premiums – statutory deductions – that will be payable by employers and employees in 2023. In the case of EI (Employment Insurance), the rates had been frozen for two years; but now, with both plans becoming more expensive, these taxes on labor will shrink both take home pay for workers and cash flow for employers in an inflationary winter.

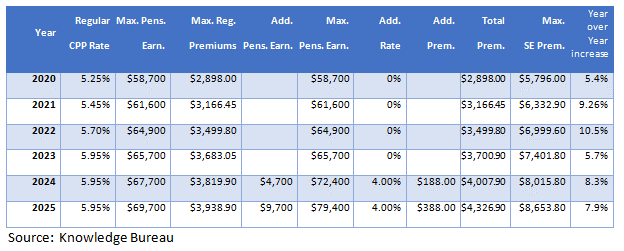

The CPP Premiums: A massive increase in premiums paid in 2022, reflecting wage spikes after the pandemic, now settles in at a 5.7% increase in 2023; rising to increases of about 8% over the next couple of years after that. By 2025 an employee earning just under 70,000 will pay just under $4000 in CPP premiums; while those with incomes just under $80,000 will pay over $4300 a year. The self-employed gig worker earning similar net income levels will pay double the amount – the employer and the employee’s share in this case:

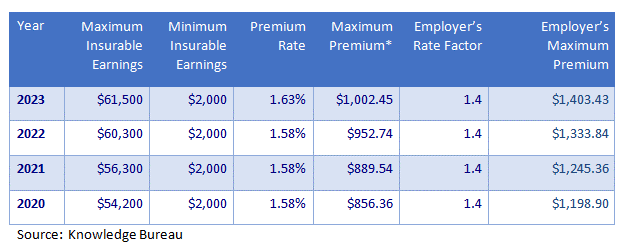

The EI Premiums: After a two - year freeze in EI premium rates, a massive 17% over 2020 amounts increase hits employees and employers in 2023, as both maximum insurable earnings and the premium rates increase.

Bottom Line: These payroll taxes will eat away at the purchasing power both employers and employees have in the marketplace in the new year. Best to shore up savings now, before these higher costs kick in.

Evelyn Jacks is President of Knowledge Bureau, a national designated educational institute focused on World Class Financial Education. For information about certificate courses leading to specialized credentials see www. knowledgebureau.com or call 1-866-953-4769.

Next Time: Why Payroll Deductions Are a Tax on Labor

Additional Educational Resources:

CONTINUING EDUCATION

- November CE Summit Register by October 14 and save $50.

- Check out the course Advanced Payroll for Small Business - this course takes the student through the completion of a full payroll cycle, compliance regulations and expectations, accounting for statutory and non-statutory deductions, taxable and non-taxable perks and benefits, and year-end preparation.

SPECIALIZED CREDENTIALS

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

WORKPLACE TRAINING

Register by October 31 for our Advanced Payroll for Small Business certificate course and save $100.

©Knowledge Bureau, Inc. All rights Reserved