Last updated: July 08 2021

Increasing the Present Value of Income

Evelyn Jacks

Why is tax efficiency so important in planning for future financial peace of mind? Because it increases the present value of income; which has the potential of earning more income and value over the longer savings horizon. Tax and investment advisors can provide invaluable assistance especially to those clients under age 45, who lag behind in their RRSP contributions.

The opportunity: invested earnings grow faster, sooner, when they are in a tax exempt, tax deferred or tax preferred investment account. But younger people are missing out, according to recent CRA statistics for the 2019 tax filing year:

|

Percentage of tax filers who contribute to a registered retirement savings plan by age group |

2019 |

|---|---|

|

% |

|

|

Total |

21.8 |

|

0 to 24 years |

5.4 |

|

25 to 34 years |

23.0 |

|

35 to 44 years |

32.6 |

|

45 to 54 years |

36.3 |

|

55 to 64 years |

30.7 |

|

65 years and over |

5.8 |

The rationale: The first priority in saving enough for retirement is to pay the least amount of tax on gross earnings along the way. In the absence of an employer-sponsored pension plan,  the best way to do this is to utilize RRSP contribution room. Higher income earners with RRSP contribution room should fund that room immediately, particularly because, unlike the TFSA, this contribution room does not enjoy inflation-adjusting.

the best way to do this is to utilize RRSP contribution room. Higher income earners with RRSP contribution room should fund that room immediately, particularly because, unlike the TFSA, this contribution room does not enjoy inflation-adjusting.

It is also important to make it a priority to minimize net family income along the way with an RRSP contribution, to get more of the first dollar earned back into taxpayer pockets and maximize available social benefits like the Canada Child Benefit. That is especially important for the under-45 group who are in their child bearing years.

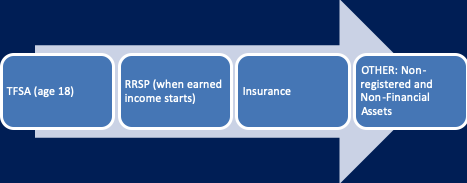

Positioning the Right Funds in the Right Accounts. By doing the right things early – maximizing the primary sources of retirement income through self-funded accumulations (RRSP, TFSA, non-registered accounts), it is possible to reduce taxes by timing the withdrawal of funds to plan for lower marginal tax rates throughout the retirement period.

The withdrawn funds need not be spent; rather they can be used to deposit into tax-exempt financial vehicles such as life insurance or tax preferred TFSA investments. This strategy will also enable growth of public benefits, such as the CPP and OAS, by deferring those benefits to age 70.

Bottom Line: Discuss a preferred order of investing in self-funded accumulations to get the best after-tax results early in life, maximize tax deferral and investment compounding time as well as the opportunity for re-investment in non-registered and non-financial assets (real estate or private business). But also anticipate a household’s after-tax withdrawal results to make sure the money is accumulating in the right accounts along the way to maximize income splitting opportunities and average down the marginal tax rates applied to income throughout the retirement period.

Evelyn Jacks is President of Knowledge Bureau and author of 55 tax filing, planning and wealth management books for consumers and their advisors. She tweets @evelynjacks

Additional educational resources: The Advanced Retirement and Estate Planning Course. The course features recordings of the instructor-led sessions from the May 20 Virtual CE Summit, and you’ll earn 30 CE credits and important new credentials that provides a full course credit towards the MFA™-Pension & Estate Services Specialist Designation Program.