How Popular is the Charitable Donation Extension

On January 23 , Finance Canada released draft legislation to confirm the extension of the charitable donation deadline for the 2024 tax year to February 28, 2025. However, this law won’t be passed until the House of Parliament returns from the prorogue.

It’s now clear that not all gifts will qualify for this extension, including gifts in kind. We received interesting feedback from Knowledge Bureau Report readers last month when we asked tax and financial professionals if they agreed with the extension for the purposes of reducing taxes on the 2024 tax return. Only 60% were in agreement. Here’s why:

“Understandably appreciated by some, but yet another administrative headache for others. When did we forget how to keep things simple?”- Daniel

“No. It creates more headaches than it solves, at least for small charities. And the law won’t be changed until Parliament can sit again, which won’t be until March. Anything postmarked by Dec 31/24 can be attributed to 2024 and there was plenty of time after Canada Post returned to operation to do that. Our supporters found many other ways to get donations to us by year end. Also, we send out one Official Tax Receipt for the whole year. Will we have to wait until after Feb 28/25 to do that? This was not well thought out and did not involve widespread consultation with Charities. Another knee jerk reaction to not taking useful action in the first place.” - Colleen G

“What will happen for future years? Will the charities be able to extend their fiscal year to bring these donations into their current fiscal year if their year end was December?” - Deborah Belden

“No. This is a headache for charities and there is no information right now to explain how this works now and in the future. The excuse that it’s because charities were affected by the postal strike sounds hollow to me. Donations are mostly done electronically with a tiny handful in cash. Rather, this strikes me more of political move to make people think they’ll get a bigger return. StatsCan shows that the average Canadian is not generous and does not make many, if any, charitable donations Extending the deadline won’t change that, especially when money is tight for many already. You’ve got to give money away to get money back.” - Cheryl Smith

“Most charities accept donations and provide electronic receipts. Donations can be carried forward for 5 years enabling 2024 donations to be deducted up to 2029. The mail strike should not be an adequate reason for this temporary tax change as there are alternatives to receiving receipts.” - Marilyn Sims

“I would say no because there are many ways besides mail to send donations to the charities of choice. There was enough coverage of the postal strike to let people know to find alternate ways to ensure their giving was on time. Also, most charities run on a calendar year so their record keeping would be much more complicated if they were to include receipts given after the year end.” - Robert

“The delay allows taxpayers to make last minute Donations, much as they would for RRSP.” Sidney

“100%, our charities took a major hit with donations, not only with the Postal strike but our economy in general. Canadians have been digging deep into their pockets for the last 18 months with high mortgage interest rates, high groceries and inflation over all. With some recovery on interest rate, more affordable groceries, and Canada Post back in service. Our charities have time to market, and catch up for lost revenue. Canadians are very generous, and will show their support with the additional time allowed.” - Ann Laurin

“The govt has until that date for RRSP so why not this?” - Marc Seguin

“Yes, only because of the mail strike. If they don’t give the credit for the 2024 tax year people won’t donate until later in 2025 and the charities will not reach their goals in 2024.” – John Bird

“Yes, Charities have suffered by not getting their annual mail request to their regular donors and cheques were not mailed to charities; I think it is fair for the charities to phone or email their regulars to get their normal end of year donations and fair to the taxpayer to make their end of year donations up to the end of February 2025.” - Anni

Thanks to those who weighed in on this topic. This month we’re asking:

In your view will the new U.S. tariffs affect your clients’ business and retirement plans?

Answer the poll!

Educational Resources:

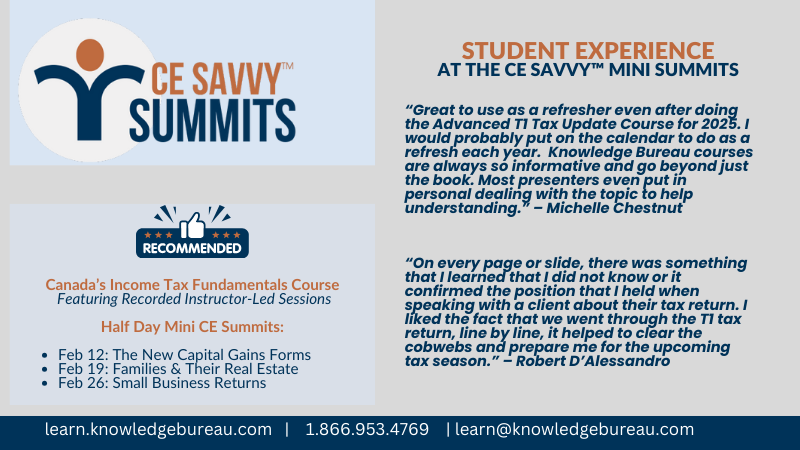

CE Savvy Summit Mini-events