Last updated: October 26 2022

Highest Indexation Rate in 40 Years: 6.3% for 2023 Personal Amounts

Walter Harder

Federal tax brackets and personal amounts are indexed annually based on changes to the consumer price index (CPI), but indexing lags inflation by nine months. So, although inflation is running near 7%, 2022 tax brackets and personal amount are 2.4%. However, 2023 brackets and personal amounts will be indexed at 6.3% based on the average CPI changes from October 2021 to September 2022. This is the highest indexation rate in 40 years.

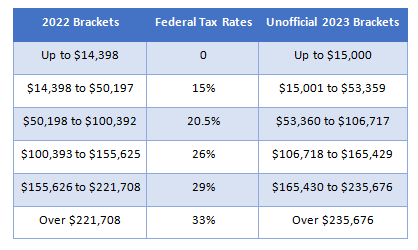

Here are the tax brackets for 2022 and the unofficial brackets expected for 2023:

Likewise, personal amounts, refundable tax credits, TFSA contribution room, and the capital gains exemption will be indexed by 6.3% for 2023. The basic pers onal amount for 2023 for lower-income claimants was set by legislation several years ago and increased less than the 6.3% applied to other personal amounts.

onal amount for 2023 for lower-income claimants was set by legislation several years ago and increased less than the 6.3% applied to other personal amounts.

New TFSA contribution room for 2023 will be $6,500 and, based on current inflation numbers, will almost certainly increase to $7,000 for 2024. The capital gains exemption for 2023 is expected to increase from $913,630 to $971,189.

Bottom Line: This news makes for some excellent tax planning opportunities before year end. When is the right time to generate discretionary income, capital gains or losses, or transfer assets? Find out more at the November 16 CE Summit. Click here to register.

Additional Educational Resources:

CONTINUING EDUCATION

Register for the upcoming November 16, 2022 Virtual CE Summit (Year-End Tax Planning: Investors & Owner-Managers)

SPECIALIZED CREDENTIALS

Register by October 31 and save $100 for the Year End Tax Planning for Corporate-Owner Managers certificate course where you learn how to advise private business owners and managers about the best ways to manage his or her compensation to maximize the amount of after-tax income available.

WORKPLACE TRAINING

Register for the upcoming November 16, 2022 Virtual CE Summit (Year-End Tax Planning: Investors & Owner-Managers)

©Knowledge Bureau, Inc. All rights Reserved