Last updated: December 06 2022

Give More, Tax Efficiently: Choosing Investments for a Charitable Donation Strategy

Ian Wood, CFP, CIM, MFA-A

Working with both financial advisors and tax specialists can help clients give more to their communities through charity before year end. But it’s critical for advisors to be proactive now, or time will run out to give more, tax efficiently.

One common issue I’ve come across is with clients who have a non-registered investment portfolio, but are writing cheques to charities for their annual giving.

You can spot this when you review their tax returns. Look for charitable receipts and T5s. If you don’t see evidence for securities gifted in-kind, then you can deduce your clients are making their gifts in cash.

It’s also important to review winners in the portfolio for the opportunity to transfer assets without having to report the capital gains as income. For a good summary of the benefits of gifting securities in-kind, review the CRA website for their pamphlet on Gifts and Income Tax[i]. According to the CRA:

“If you donated certain types of capital property to a registered charity or other qualified donee, (charitable organization that can issue a donation receipt) you may not have to include in your income any amount of capital gain realized on such gifts. You may be entitled to an inclusion rate of zero on any capital gain realized. . .”

There are various types of property eligible for the zero-inclusion rate, but we’ll focus on publicly-traded securities for the purpose of this article. Note also that tax rates and donation credits vary from province to province.

vary from province to province.

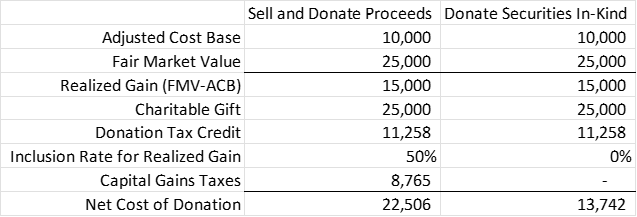

For illustration, we will base our assumption on a single Manitoba resident with $60,000 earned income and assume at least $200 of gifting has already occurred. The taxpayer has the option of selling securities and then donating the cash, and for the illustration below we’ll assume the full proceeds are donated and the client covers the tax bill on the capital gain separately.

Knowledge Bureau offers a Donation Savings Calculator as part of their Knowledge Bureau Calculator toolkit, which, by the way, is a complimentary benefit for members of the Society of Real Wealth Managers. This calculator can quickly estimate the tax savings from donating securities in-kind based on province and income. A free trial is available.

By avoiding taxes on capital gains, the donation of securities in-kind saved $8,675 of income taxes. So, how do we convert cash donors into in-kind donors? I use the following strategy:

First, we discuss the donation amount the client wishes to give[ii]. Then, we review their non-registered portfolio and look for the securities with the highest unrealized gains, in Canadian dollars, in terms of percentage. A good portfolio statement will provide these details. Next, we process the donation. We typically use a Donor Advised Fund to simplify the transaction[iii], especially if we’re dividing the donation between multiple charities.

Finally, I have the client deposit the amount they were donating into their non-registered portfolio and we repurchase the holdings just donated[iv]. This bumps up the cost base of the security donated, reducing the taxes in the future when the gain is realized.[v]

Note, there may be one advantage to selling securities rather than transferring securities. . . when a capital loss results. That loss can offset capital gains of the current year or the immediately preceding three years, to recover taxes paid on capital gains. In addition, the donation made with the proceeds of sale will produce more tax savings. Those tax savings can be used to fund the 2023 TFSA or donated again. . .truly a gift that keeps on giving. However, the repurchase strategy I mention above will be affected by the superficial loss rules if purchased within 30 days of the transaction.

Bottom Line: We can’t expect our clients to know the rules for capital gain inclusion on the donation of securities in-kind and the impact applicable to their unique situations. It is our job as advisors to look for the opportunity to initiate these conversations and allow our clients to give to the causes they support more tax efficiently. For most clients, giving more efficiently results in the ability to give more generously. The final day for the settlement of security transactions is December 29.

[i]Canada Revenue Agency (2022, 01 18). P113 - Gifts and Income Tax 2021. Retrieved from https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/p113/p113-gifts-income-tax.html#P266_35099.

[iii] Unless the charity in question has already established the ability to receive shares in-kind, a donor advised fund option can significantly simplify the transaction. It is also important for the donor to consider that due to market volatility, the exact dollar value of the donation is not certain until the charity has determined the fair market value for receipting.

[iv]Or another holding, depending on the portfolio.

[v] I often explain that it reduces the taxes to the estate because this is easier for clients to understand when we’re using long-term holdings that they had no intention of selling.

©Knowledge Bureau, Inc. All rights Reserved